Market

IDFC First Bank Q4 earnings preview: Analysts predict 25.2% surge in NII, 8% dip in PAT

2 Min Read

| Name | Index Value | Change | %Change | Open | High | Low |

|---|

Thank you, readers! That's all from CNBCTV18.com's live market coverage on March 28, 2024.

Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Market At Close | Expert View On Today's Session

“Indian equities closed the day and fiscal year on an optimistic note, with volatility by the end of the session, as buying by retails, DIIs, and FIIs surged across categories. The mid- and small-cap stocks have emerged as frontrunners, rebounding from the initial sell-off earlier in the month. An upgrade in the domestic economy forecast hints at an encouraging outlook for the stock market in FY25. However, the emphasis is on large-cap due to the persisting premium valuations of mid-cap stocks, which could pose a concern on the broad market in the short to medium term,” says Vinod Nair, Head of Research, Geojit Financial Services.

Market In FY24 | Nifty Rises 30% In FY24 To Post Biggest Returns (Ex-COVID Yr) Since 2010

All Sectoral Indices Rise In FY24, Realty, PSU, Power & Auto Gain The Most

48 Of 50 Nifty Stocks Give +ve Returns In FY24, 5 Of Them Have Doubled

Bajaj Auto, Tata Motors, Adani Ports, Coal India & Hero Rise Over 100% Each

11 Nifty Stocks Gain In The Range Of 60-90% In This Fiscal

Only 2 Nifty Stocks (HDFC Bank & HUL) Give Negative Returns In FY24

In Midcap Space, PSU Cos Register Biggest Gains, REC, BHEL, PFC, NBCC Top Gainers

REC (GU)300%, BHEL (GU)254%, NBCC (GU)236%, PFC (GU)222%

Hind Copper (GU)190%, Trent (GU)187%, Birlasoft (GU)186%

PNB (GU)168%, DLF (GU)152%, Lupin (GU)150%, HAL (GU)144%

Market This Series | Nifty & Nifty Bank Register Gains Over Over 2% For Two Straight Series

31 Nifty Stocks Give Positive Returns, HDFC Life, L&T, Eicher Top Gainers

Hero, Kotak Bank, ITC, IndusInd & Titan Too Are Amongst Top Nifty Gainers

TCS, Dr Reddy’s, Shriram Fin & SBI Life Are Top Nifty Losers

ABB, Tata Chem, ICICI Pru, Indus Twrs & IndiGo Are Top Midcap Gainers

Zee Ent, NMDC, Apollo Tyres & CONCOR Amongst Top Midcap Losers

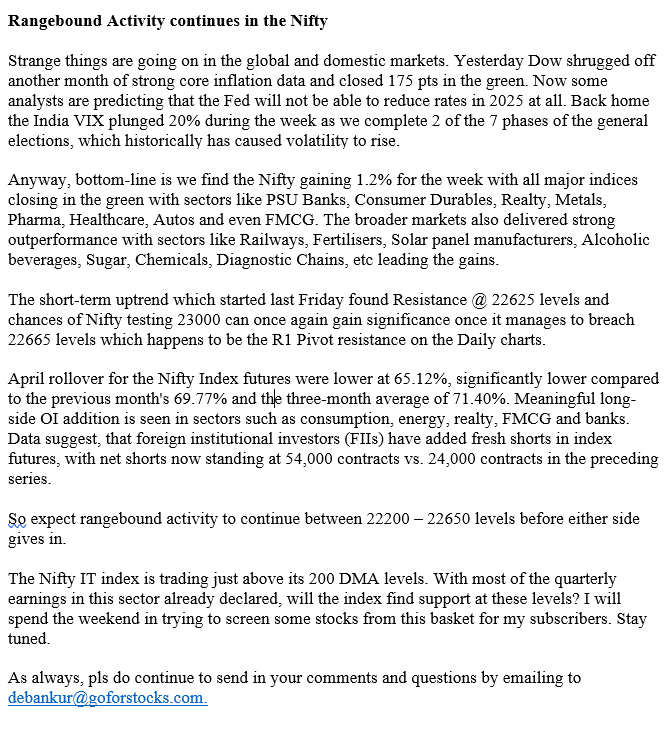

Market This Week | Market Posts Biggest Weekly Gain In 2 Months, Sensex & Nifty Up 2%

Midcap Index Sees A Move In-line With Benchmarks, Rises 2%

Nifty Bank Gives Positive Returns But Relatively Underperforms, Up 1%

Except Media & IT, All Sectoral Indices Record Gains This Week

Realty, Oil & Gas, Infra & Auto Are Top Gaining Indices

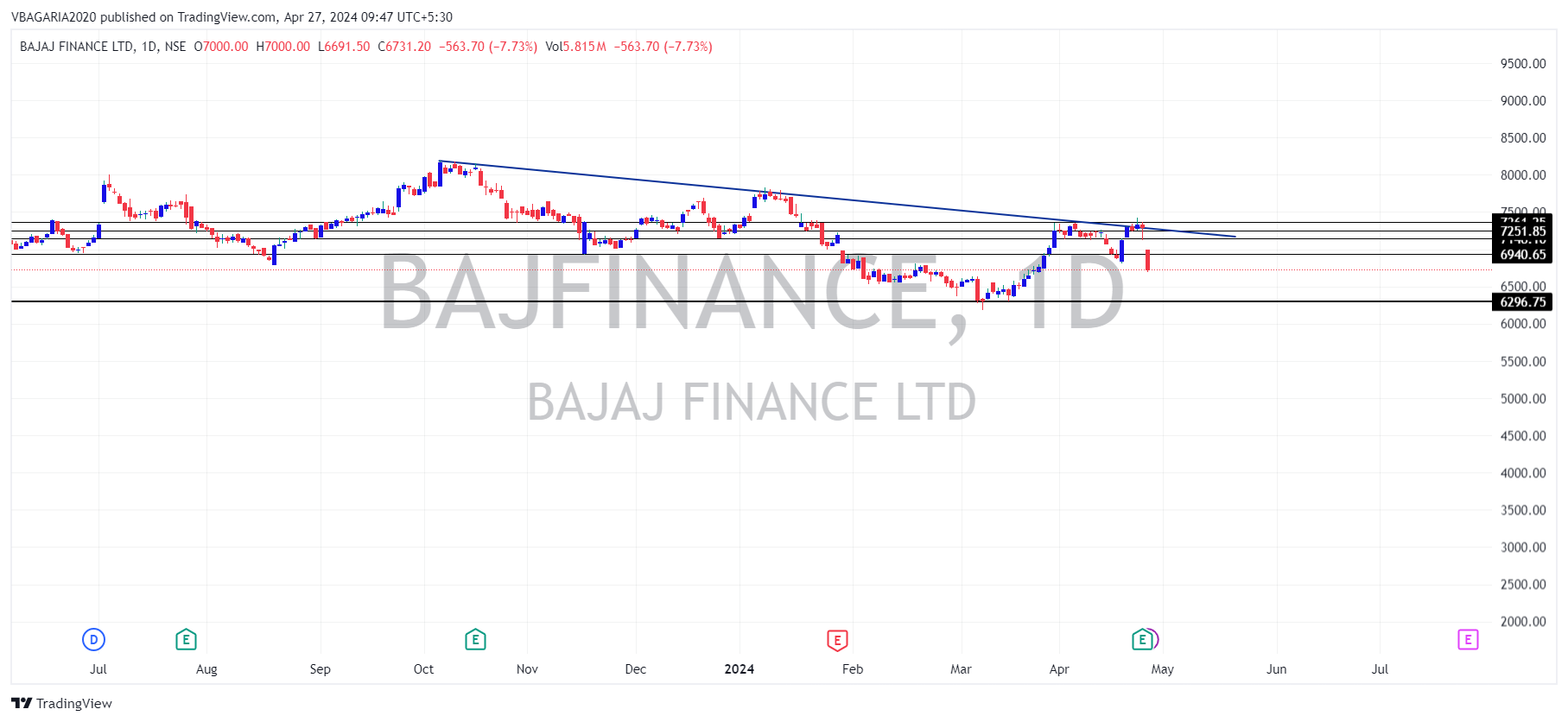

40 Nifty Stocks Give +ve Returns, Bajaj Fin, L&T, Bajaj Finserv Top Gainers

Metropolis, Siemens, IndiGo, Dr Lal, Chola Invst Are Top Midcap Gainers

| Currency | Price | Change | %Change |

|---|

| Currency | Price | Change | %Change |

|---|