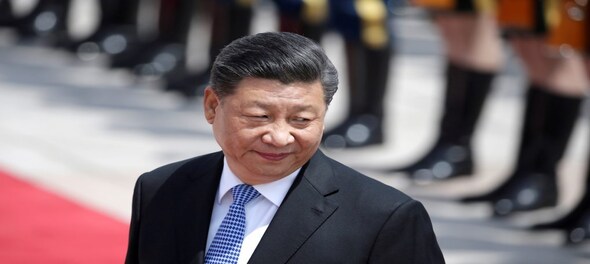

Chinese President Xi Jinping stepped up support for the world’s second-biggest economy, issuing additional sovereign debt, raising the budget deficit ratio and even making an unprecedented visit to the central bank.

The nation’s legislature approved a plan to raise the fiscal deficit ratio for 2023 to about 3.8% of gross domestic product, the official Xinhua News Agency said Tuesday — well above the 3% set in March which the government has generally considered a limit for the nation. The plan includes issuing additional sovereign debt worth 1 trillion yuan ($137 billion) in the fourth quarter to support disaster relief and construction.

China has rarely adjusted the budget mid-year, having previously done so in periods including 2008, in the aftermath of the Sichuan earthquake and in the wake of the Asian financial crisis in the late 1990s.

“The additional fiscal support approved today is the intervention we had been expecting and that was needed to prevent an abrupt fiscal tightening in China in the closing weeks of the year,” said Mark Williams, chief Asia economist at Capital Economics Ltd.

The budget changes came during a flurry of announcements from the Standing Committee of the National People’s Congress, the Communist Party-controlled parliament that oversees government borrowing.

The legislature on Tuesday wrapped a days-long meeting where it also ousted Li Shangfu as defense minister two months after he disappeared from public view, and stripped former foreign minister Qin Gang of his remaining role as State Councilor. Adding to the series of high-profile reshuffles, the Standing Committee named Lan Fo’an as finance minister to replace Liu Kun, a widely expected move.

The budget revision underlined concerns among top leadership about the economy’s outlook into next year and the government’s increased focus on shoring up the economy and financial markets. Earlier in the day, Xi himself made his first known visit to the nation’s central bank since he became Chinese president a decade ago.

Bloomberg News reported earlier this month that Chinese policymakers were considering raising this year’s budget deficit and issuing additional sovereign debt, part of a push to help the nation’s reach an official government growth goal of about 5% for 2023. Citigroup Inc. economists at the time said a move beyond the usual debt-to-GDP target “could show a greater sense of urgency of the policymakers” as they push to reach that growth goal.

Since then, stronger-than-expected data for the third quarter has led authorities to say they are “very confident” in the economy’s ability to hit that target this year. Several challenges are likely to persist into 2024 though, including problems stemming from ongoing property market turmoil and deflationary pressures. Economists expect growth to slow to 4.5% next year.

“Relevant authorities should make preparations for the sovereign bond issuance and projects in an active and orderly manner to ensure every penny is managed and used appropriately,” said Zhao Leji, chairman of the Standing Committee.

The 1 trillion yuan worth of special bond issuance to fund post-disaster reconstruction amounts to additional fiscal stimulus of about 0.8% of GDP, according to Duncan Wrigley, chief China economist at Pantheon Macroeconomics Ltd. He said the aim is to prop up China’s recovery going into 2024 against headwinds from falling property construction and exports.

Financing infrastructure investment through sovereign bond issuance may also reflect a shift in policy thinking by putting more of the fiscal burden on the central government, rather than local authorities who are running out of room to leverage up. The central govt will transfer funds from the additional borrowing to local authorities to use in projects this year and next, according to Tuesday’s announcement.

Legislators also renewed through 2027 an authorization for the State Council, China’s cabinet, to front-load some of next year’s local bond quota. Zhao urged for an acceleration in the issuance new local government notes and the use of the funds raised.

Beijing has shown increasing resolve to aid local governments with fiscal problems: Last month, it kicked off a program to allow struggling regional authorities to swap high-interest off-balance-sheet borrowing for lower-interest bonds.

Concerns also remain within the nation’s beleaguered private sector, leading authorities to take measures to help remove barriers for them. The State Council, China’s cabinet, is asking the public to help find cases where government agencies are imposing arbitrary fines or favoring state-owned enterprises over private ones, Caixin Global reported Tuesday.

Separately, Xi reiterated support for the private sector in a letter to the All-China Federation of Industry and Commerce that called for called for rallying private entrepreneurs around the Party more closely, according to the People’s Daily.

In a report to the Standing Committee over the weekend, People’s Bank of China Governor Pan Gongsheng vowed to make policy “more” targeted and forceful. Pan also underscored a longer-term view on the economy while indicating easing is still on the cards, saying that policy would make good counter-cyclical and cross-cyclical adjustments.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna Sexual Assault Case: Activist raises concerns over political interference, delayed investigation in the matter

Apr 30, 2024 10:17 PM

Lok Sabha Election 2024: Baramati election outcome will decide the future of Pawar dynasty, says expert

Apr 30, 2024 10:08 PM

Lok Sabha elections 2024: Baramati to Mainpuri, key battles in phase 3

Apr 30, 2024 7:01 PM