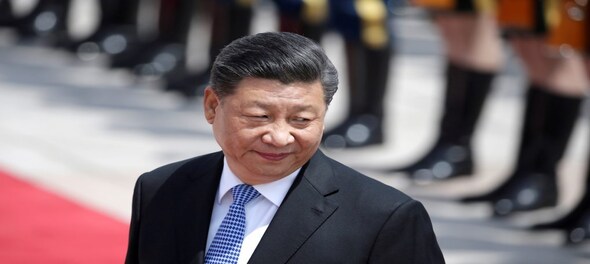

Chinese President Xi Jinping is set to receive a briefing from Chinese regulators on financial markets, according to people with knowledge of the matter, underscoring an urgency in Beijing to prop up the country’s plunging stocks.

Regulators led by the China Securities Regulatory Commission plan to update the top leadership on market conditions and the latest policy initiatives as soon as Tuesday, said the people, asking not to be identified as the matter is private. The timing is subject to change, the people said. It’s unclear whether any new support measures will come out of the meeting.

The move highlights mounting pressure on Chinese authorities to put a stop to a slump in stocks after piecemeal measures over the past few months failed to lift investor sentiment. About $7 trillion of value had been wiped off China and Hong Kong equities since their peaks in 2021.

Authorities issued a flurry of supportive announcements on Tuesday, including a vow by Central Huijin Investment Ltd., the unit that holds Chinese government stakes in big financial institutions, to buy more exchange-traded funds to maintain the smooth operation of the capital market. Every effort will be made to maintain stable market operations, the CSRC said in a follow-up comment.

Xi has shown signs of becoming increasingly involved in the nation’s financial and economy policies, including making an unprecedented visit to the central bank late last year.

Authorities have been working around the clock over the past few months to come up with market rescue measures, the people familiar said. The securities regulator has worked weekends and the National Financial Regulatory Administration has called at least a dozen meetings over the past two months on stabilizing capital markets, according to the people.

The CSRC and NFRA didn’t immediately respond to Bloomberg requests for comment.

Officials this week tightened trading restrictions, banning some quantitative hedge funds from placing sell orders and others from cutting stock positions in their leveraged market-neutral funds, in an effort to stem losses in stocks. The securities regulator also said Monday it will guide brokerages to adjust their margin call levels and maintain “flexible” liquidation lines to limit forced liquidations.

Earlier efforts have included curbs on short selling as well as state buying of shares in the nation’s largest banks, while a $278 billion stock stabilization fund had also been contemplated.

The measures have shown little success in restoring investor confidence, which has been hurt in recent years by an economic slowdown as well as Xi’s growing control over private enterprise and sweeping crackdowns.

The nation’s small-cap shares sank more than 6% Monday to the lowest since 2018, while the benchmark CSI 300 Index dropped to a five-year low earlier this month. Investors could be bracing for more losses before a weeklong Lunar New Year holiday, as traders reduce positions out of concern that risks ranging from geopolitical tensions and sluggish consumption may deepen the market’s freefall once trading resumes.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: What rural Delhi wants

May 16, 2024 10:10 PM

Over 50 onion farmers detained in Nashik ahead of PM Modi's visit

May 16, 2024 11:14 AM

Why Google CEO is cautiously optimistic about the election year

May 16, 2024 9:51 AM

Mark Mobius reveals how markets will react if NDA wins 400+ Lok Sabha seats

May 15, 2024 8:09 PM