China has come down heavily on its internet giants over the last 11 months. Companies like Tencent, Alibaba Group, Ant Group, Didi and more have had to deal with increased regulatory pressure as China starts to muzzle its tech billionaires. The adversarial stance taken by the Chinese authorities has seen the biggest wealth drop in the world. Nearly three-quarters of a trillion dollars have already been wiped off from Chinese stock markets.

With the wealth of billionaires mostly coming directly through their equity holdings in their own companies, as is the case with the world’s richest individuals, the massive wealth drop has resulted in many billionaires seeing their wealth shrink by significant margins.

Also read: Wolf in Cashmere: Bernard Arnault, the centibillionaire who mixes luxury with ruthless acumen

Colin Huang, the founder of Chinese e-commerce platform Pinduoduo Inc (PDD), in particular, has the dubious position of being the man who lost the most wealth this year, reported Bloomberg.

Huang has seen a decrease of $27 billion or RMB 174 billion in his wealth, according to Bloomberg’s Billionaire Index. The reason behind the unprecedented drop is a free fall in Pinduoduo’s stocks after CCP’s crackdown on internet giants. Huang’s precipitous drop is the highest recorded of all the individuals on the index. In comparison, Hui Ka Yan, Chairman of Evergrande, which is one of China’s largest real estate developers and in a steep debt crisis, only lost $16 billion.

Other Chinese billionaires whose net worth took a beating include bottled water company Nongfu Spring Co Chairman Hong Shanshan, losing $18 billion, and Tencent's owner Pony Ma, who lost $10 billion; and the billionaire who started the crackdown, Alibaba’s Jack Ma losing $6.9 billion. In all, six out of the 10 billionaires in the Bloomberg Index with the biggest declines in net worth this year are from China.

PDD shares and American depositary receipts have fallen by a significant margin, more than even Tencent and Alibaba. The reason for this disparity is simple -- PDD had only posted its first profitable quarter last month while Tencent and Alibaba have had much longer to establish their business and have profitable business models. For PDD, which overtook Alibaba’s online marketplaces in terms of active users in December, the crackdowns have come at a time when the company was finally transitioning from a growth stage to a profit-earning stage.

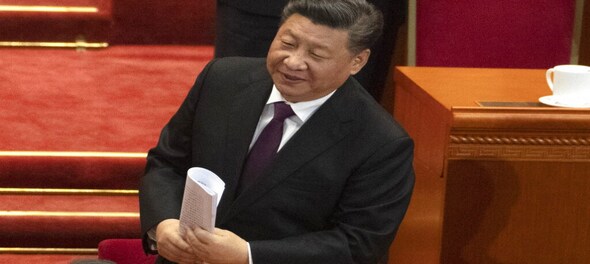

Huang, who painstakingly built the company in 2015, has now paid the price for China’s draconian moves. Huang has already left his responsibilities as chairman and CEO of the company, even as PDD has bought into Xi Jinping’s vision of ‘common prosperity.’ The company has already pledged to give $1.5 billion from its earnings for agricultural development in China.

While Huang may be the biggest ‘loser’ in China’s regulatory race, he is not the only one to feel the aftershocks of the tech clampdown. Companies like Didi and ByteDance may even see the government hold an important stake in them as a result.

(Edited by : Shoma Bhattacharjee)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Phase five Lok Sabha polls: Rae Bareli, Amethi among 14 UP seats going to polls on Monday

May 19, 2024 1:03 PM

AAP protest walk: Arvind Kejriwal challenges BJP to arrest entire party, Delhi Police imposes Section 144

May 19, 2024 12:26 PM

Terror attacks in Kashmir raise concerns ahead of May 20 and May 25 election

May 19, 2024 12:15 PM