The stock market seems to have mostly ‘recovered’ from the shock given by the finance minister by announcing massive restructuring in the corporate tax rates. More than 80 percent of the stocks are now trading at a price lower than the price prevailing before the September 20, 2019 press conference.

The short sellers were totally squeezed out of their blood by the manner in which the tax rate cuts were announced. The move was presented as a ‘major reform’. Most industry captains and market commentators also hailed it as a game-changer. I have no doubts that from a long-term viewpoint it is a structural improvement that was long-awaited. The first draft of the Direct Tax Code presented more than a decade ago contained these proposals.

Caught off guard

The equity research analysts and strategists were also caught off guard by the finance minister's move. A large majority of them scrambled to change their price targets for stocks covered by them as well as the benchmark indices. Many large brokerages changed their stance on Indian equities to positive from neutral or negative. The celebrations continued for at least three days, when it was officially announced that the fiscal deficit targets presented in the budget will not be changed despite the potential Rs1.45 trillion shortfall in corporate tax collection due to rate cuts. The government exuded confidence that the shortfall would be met from the disinvestment of PSUs, better tax compliance and other savings.

First, the bond markets refused to believe the government's fiscal confidence and borrowing programme. The bond yields climbed despite growth downgrades and the widely expected RBI repo rate cut.

Subsequent clarifications by CBDT on deferred tax assets and outstanding MAT credits dampened the sentiments in equity markets also. The investors realised that the benefit of tax cuts is much smaller and narrower than what appeared at first instance.

The numbers don't tally

A back of the envelop calculations about the impact of tax rate cuts announced indicates that the impact might be even smaller and narrower than the presently anticipated.

For example, consider the following data points:

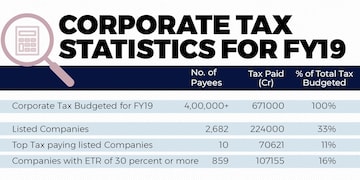

(i) The total corporate tax collection budgeted for FY19 was Rs 6.71 trillion.

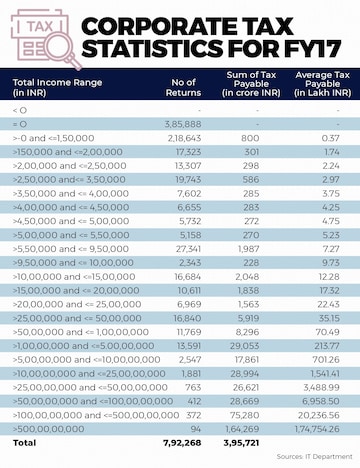

(ii) As per the latest data available from the Income Tax department, in FY17 about 4.06 lakh companies had paid tax. Out of these, the top 94 companies accounted for about 41 percent of the total corporate tax collected. Top 3522 companies accounted for 82 percent of the total corporate tax collection.

(iii) In FY19, more than 400,000 companies may have paid corporate taxes. Around 2,700 listed companies paid Rs 2.24 trillion or 33 percent of the total corporate tax budgeted. The top 10 listed companies accounted for Rs 70,621 crore or 11 percent of the total corporate tax budgeted. Only 850 odd listed companies had an effective tax rate (ETR) of more than 30 percent, and these companies accounted for merely 16 percent of the total corporate tax budgeted.

(iv) Of the top 10 listed companies only four had an ETR of 30 percent or more, out of which two (Tata Steel and ICICI Bank) may be due to extraordinary items. Based on FY19 profit and tax numbers, the total impact of the corporate tax rate cut on the top 10 companies may not be more than Rs 2,000 crore in FY20.

If we extrapolate this reasonable assumption, it is highly likely that the total impact of the tax rate cuts announced by the finance minister may not be more than Rs 25,000 crore.

These are just broad calculations based on the data available publically. The finance ministry may want to furnish details to show they are neither misled nor trying to mislead the financial markets.

In my view, such an exercise by the finance ministry is highly desirable to support the confidence of the participants in the financial markets.

Vijay Kumar Gaba explores the treasure you know as India, and shares his experiences and observations about social, economic and cultural events and conditions. He contributes his pennies to the society as Director, Equal India Foundation.

Read his columns here.

First Published: Oct 8, 2019 6:00 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi confident of BJP sweeping Bihar and UP, banks on 'sympathy' in Maharashtra

Apr 29, 2024 9:38 PM

Exclusive: Can't fix elections in India, not even for a municipality, says PM Modi on Opposition charges

Apr 29, 2024 9:25 PM

Supreme Court dismisses plea seeking postponement of CA exams; details here

Apr 29, 2024 2:29 PM

Just 8% women candidates contested first two phases of Lok Sabha polls

Apr 29, 2024 12:00 PM