Cycle on Steroids: Rate hike/cut cycle may be separated just by a Year!

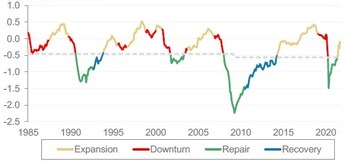

If this statement was made prior to 2020 Covid crash, it would have been slammed. But as we have experienced in this central bank engineered recovery, this cycle is on “Steroids”. Aggressive fiscal and monetary policy has ensured that the economic cycle quickly moves out from a painful economic slump (seen between 2Q2020 to 4Q2020) to a stable recovery path to pre covid levels (1Q2021 to 3Q2021). In fact, looking at the current macro indicators in the US and globally, the economic cycle has already transitioned or is transitioning into mid-cycle.

Economic Cycle indicates, US is already in mid-cycle transition (Source: Morgan Stanley)

Economic Cycle indicates, US is already in mid-cycle transition (Source: Morgan Stanley)This has triggered, dialling back of easy liquidity and emergency policies that were needed to emerge from the covid pandemic (these policies are becoming inflationary and causing excesses in parts of financial markets). Hence the market has been price for higher rates (in last months) and Fed now seems to be following the same.

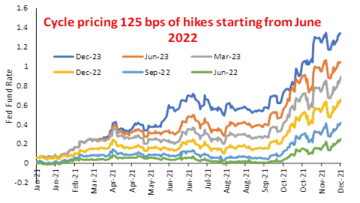

Markets guiding the Fed on rate hike trajectory

As per the rates market (Fed Fund Futures), the rate hike cycle could be sharp and swift (as inflation continues to show resilience and suggests that the policymakers are behind the curve in raising rates). As per the Fed Funds Futures contracts, there is likely to be 125bps of rate hikes till late 2023 (3 in 2022 and 2 in 2023).

(Source: Bloomberg, LIC MF PMS)

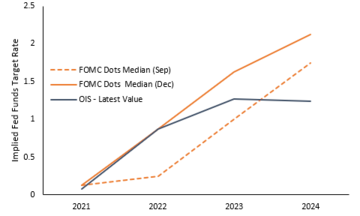

(Source: Bloomberg, LIC MF PMS)Following suit in its latest FOMC meeting, the Fed has also caved into “non-transient” inflationary impulse and quickly aiming to tighten the chords before runaway inflation derails the growth momentum. In its latest FOMC, Feds dot plot moved 63bps higher for 2022 and 2023 (meaning the fed is now pricing a steeper rate hike cycle than market-implied pricing as well).

(Source : Bloomberg, LIC MF PMS)

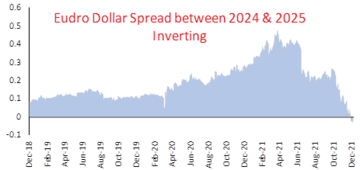

(Source : Bloomberg, LIC MF PMS)Parallelly Markets also pricing rate cut by 2024-2025

However, this hawkishness is likely to quickly unwind in 2024-2025. The Euro Dollar Future Spread has inverted with negative spread (Euro Dollar 2024 contract – Euro Dollar 2025 contract). This suggests a rate cut in in 2025 (historically these cuts in interest rates have been triggered by marked economic slowdowns).

(Source: Bloomberg, LIC MF PMS)

(Source: Bloomberg, LIC MF PMS)Also Read | Is India on the path to capex recovery?

Conclusion

Unlike the last 18 months, where the pain was sedated by aggressive fiscal and monetary policy, the cross-asset volatility is likely to move higher. While the return generation engine for equities will continue to remain strong but the volatility is likely to increase and hence warrant active asset allocation strategies and focusing on the fundamentally strong bets rather than just following high beta and/or momentum plays.

(The author, Azeem Ahmad, is Head of Portfolio Management Services and Principal Officer at LIC AMC and is managing over Rs 1,750 crore belonging to institutional investors and high net worth individuals. Views expressed are personal.)

(Edited by : Dipti Sharma)

First Published: Dec 29, 2021 11:34 AM IST

Note To Readers

(Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!