In an earlier note, we had explored banking liquidity and credit creation from the perspective of the banking system.

We now explore questions relating to the Reserve Bank of India (RBI). Does a Cash Reserve Ratio (CRR) requirement control money creation? How do Basel liquidity and capital stipulations impact economic activity? Does the RBI need to regularly inject liquidity to support credit creation and economic growth? What tools does the RBI have to modulate banking liquidity, and what constitutes ‘deficit monetisation’?

A recap

Let’s start with a quick recap of the arguments of the previous article.

The banking system needs neither liquidity surpluses nor deposits to fund fresh loans. Loans create deposits that increase the system-wide requirement of statutory reserves. This can be met as long as the government is borrowing adequately.

Banking liquidity is altered by government flows, the demand for physical currency, RBI bond and currency market interventions, and statutory reserve limits set by the RBI. These are all largely outside of banking control.

Therefore, the banking system cannot “lend away” liquidity surpluses, nor can it actively source deposits to reduce any liquidity deficits. Characterising daily banking liquidity operations with the RBI as “lazy banking” is a misnomer.

Indirectly, however, persistent banking liquidity surpluses reduce short term rates, and can, therefore, nudge fresh client lending. Conversely, persistent banking liquidity deficits have the opposite impact.

The RBI balance sheet

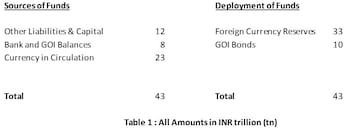

The table below gives a snapshot of the RBI balance sheet at the beginning of the day, aligned with the banking system balance sheet used in the previous article.

The RBI has assets of Rs 43 trillion, in the form of foreign exchange reserves (Rs 33 trillion) and GOI bonds (Rs 10 trillion). These are funded by Rs 8 trillion of banking CRR and government balances, Rs 23 trillion of currency in circulation, and Rs 12 trillion of other liabilities and capital (some of which has been eyed by governments as extractable surpluses).

As described previously, through its daily Liquidity Adjustment Facility (LAF) repo and reverse repo operations, the RBI helps the banking system convert its surplus Statutory Liquidity Ratio (SLR)/ High Quality Liquid Assets (HQLA) into CRR and vice versa.

The CRR myth

Textbooks have taught us that a minimum CRR requirement helps contain the extent of credit creation through a “money multiplier”. This is how it’s supposed to work. Loans create fresh deposits. However, a part of these new deposits (currently 4 percent) need to be set aside as CRR, leaving less of the new deposit to fund fresh loans. The spiral of credit and deposits, therefore, narrows, restricting the growth in loans and deposits to a finite limit.

This is flawed reasoning, starting with the flawed premise that deposits are needed for the funding of loans. Here is a better way to approach this concept.

Loans are self-funded by the deposits they create, but the deposits so created increase banking statutory reserve requirements. Statutory reserve requirements are currently at about 23 percent of deposits for SLR/ HQLA, and 4 percent of deposits for CRR, for a total of about 27 percent of deposits.

The RBI LAF window allows for the fungibility across excess SLR/ HQLA and CRR. Therefore, all of bank reserve requirements can be met purely by adding adequate SLR/HQLA. In fact, banks cannot create CRR balances by themselves.

As long there is adequate SLR/ HQLA debt issuance, there is no constraint on the creation of reserve assets. For every Rs 100 of a standard loan, therefore, banks just need to lend Rs 37 to the government. Collectively, this would create Rs 137 of deposits, and the 27 percent of reserve requirement on these deposits would be met by the Rs 37 of fresh reserve assets.

In other words, CRR is not a limiting factor for credit and money creation in India at all. Indeed, countries such as the UK, Canada, Australia, New Zealand, Sweden and Hong Kong have zero CRR requirement. The real constraints to credit and money creation are Basel stipulations of capital and liquidity, besides the availability of adequate SLR/ HQLA assets.

However, persistent liquidity surpluses do bring down money market rates, and hence can push the banking system to lend more. Persistent liquidity deficits would have the opposite effect. The impact is subtle, rather than direct.

A corollary – The RBI liquidity injection myth

A corollary myth is that the RBI balance sheet must expand by some number – usually argued as at least the nominal GDP rate -- to allow the banking system to grow.

This is just not true. Consider the current situation, where banking loans are at Rs 100 trillion. Assume that client loans were to grow by a very healthy 20 percent (Rs 20 trillion) over the year. If banks were already at the brink of reserve requirements, they would need to additionally lend 37 percent (or Rs 7.4 trillion) to the government, to meet overall statutory reserve requirements. In all, this would create banking deposits of Rs 27.4 trillion, increasing the RBI CRR requirement by an additional 4 percent (or Rs 1.1 trillion). Reflecting this, other things being equal, the RBI balance sheet would only need to expand by Rs 1.1 trillion, just 2.5 percent of the Rs 43 trillion RBI balance sheet.

Given reserve creation is between banks and the issuer of SLR/ HQLA, other things being equal, the impact on the RBI balance sheet can be minimal.

The real constraints – Basel capital and liquidity

While statutory reserves offer little constraints to credit growth, the requirement for Basel capital and liquidity do place balance sheet limits on banking credit and money creation.

While the capital restriction is fairly obvious, the Basel liquidity restriction needs some explanation. To meet short-term Liquidity Coverage Ratio (LCR) and long-term Net Stable Funding Ratio (NSFR) requirements, Basel nudges individual banks to fund assets with deposits that are behaviorally or contractually long term.

This hunt for stable term deposits can push up term interest rates. In addition, locking up deposits for longer terms reduces the circulation of money and hence economic activity.

Overall, Basel safety stipulations on bank capital and liquidity naturally constrain credit growth and economic activity, particularly key for emerging markets such as India.

Of course, besides Basel capital and liquidity, several other issues come into play around credit creation – the extent of investment opportunities available, the trust within the ecosystem, and the incentive structure for bankers and borrowers.

RBI and liquidity management

Banks have the primary responsibility of maintaining overall statutory reserves. Within that, only the RBI can ensure that banks maintain requisite CRR balances.

First, the external changes to CRR balances. Currency withdrawals reduce both banking deposits and CRR balances, whereas currency deposits increase both. Payments to the government reduce both bank deposits and CRR balances, while government spending increases both.

Thereafter, if the CRR balances are short of statutory requirements, the RBI has to create them, with outright purchases of foreign currency, outright purchase of SLR/ HQLA bonds, or the first purchase leg of foreign exchange swaps or bond repos. If CRR balances were in excess of statutory requirements, the RBI would need to sell bonds or currency instead.

Any RBI action in foreign exchange or bond markets would naturally impact market prices. In the fiscal year 2018-19, for instance, the RBI purchased Rs 3 trillion of GOI bonds in a bid to inject rupee liquidity. This amounted to 67 percent of the net GOI issuance for the year. Similarly, in the wake of foreign currency inflows during the fiscal year 2018-19, forward purchases of US dollar by the RBI avoided immediate rupee liquidity injection. However, such intervention pushed up forward premia, and actually encouraged even more reversible foreign currency inflows.

The central bank has to be conscious of the market fallout from their choice of liquidity management tools. Blinkered approaches of only considering the liquidity objective while ignoring the fallout in markets cannot make for sensible policy.

RBI and deficit monetisation

Central bank purchase of government bonds in the primary market is often characterised as “print and spend” monetisation of government deficits. Such purchases would increase the RBI’s GOI bond assets, against a like increase in the RBI’s government balance liabilities. As the government then spends this money, the banking system would see a balance sheet expansion, with an increase in banking deposits and a like increase in banking CRR balances.

Exactly the same banking impact is achieved both by the transfer of RBI surpluses to the government and by RBI purchases of government bonds in secondary markets.

A transfer of RBI surplus to the government would reduce the RBI’s “other liabilities and capital” and increase the government’s balance with the RBI by a like amount. As the government then spends this money, funds would move into the banking system, increasing banking deposits, banking CRR balances and hence the overall size of the banking balance sheet.

Likewise, across the purchase of government bonds by banks in the primary market, the subsequent purchase of bonds in the secondary market by the RBI, and government spending, the net impact on the banking system would be balance sheet expansion, with an increase in deposits against an increase in bank CRR balances.

While academics generally treat RBI purchases of bonds in the primary market as distinct from RBI secondary market bond purchases or RBI surplus transfers to the government, the net impact of the three on banking balance sheets is exactly the same – net creation of bank deposits, increase in bank CRR balances, and expansion of banking balance sheet.

In other words, as judged by the impact on the banking system, RBI OMO bond purchases and surplus transfers to the government are tantamount to deficit monetisation.

Summary

The notion of CRR capping money creation through a money multiplier is flawed, and CRR can well be done away with. However, persistent banking liquidity surpluses push money market rates lower and hence nudge increased credit growth. The converse works with persistent liquidity deficits.

Further, the notion that the RBI has to expand its balance sheet by the nominal rate of GDP growth to facilitate adequate growth in banking credit is questionable.

Basel requirements on bank capital and liquidity restrict credit growth and economic activity.

While banks maintain overall statutory requirements, the maintenance of banking CRR is in the hands of the RBI. Besides tweaking regulatory limits, the RBI can intervene in foreign currency and bond markets to manage bank CRR balances. These interventions impact market prices. Only focusing on the liquidity objective while ignoring the impact on markets cannot make for sensible policy.

In terms of impact, RBI surplus transfers and secondary market bond purchases constitute as much deficit monetisation as does any RBI bond purchases in primary markets.

Ananth Narayan is Associate Professor-Finance at SPJIMR. Read his columns here.

First Published: Feb 19, 2020 2:12 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna Sexual Assault Case: Activist raises concerns over political interference, delayed investigation in the matter

Apr 30, 2024 10:17 PM

Lok Sabha Election 2024: Baramati election outcome will decide the future of Pawar dynasty, says expert

Apr 30, 2024 10:08 PM

Lok Sabha elections 2024: Baramati to Mainpuri, key battles in phase 3

Apr 30, 2024 7:01 PM