Two sets of data by private research companies are casting doubts about the pace of economic growth in the April-June quarter. Data from the jobs and staffing companies show that hiring slackened in April and May, while consumer durable companies and market research companies report a contraction in demand for consumer goods in these two months.

However, macro data like import growth show the economy is in fine fettle and is consuming a large quantity of capital goods imports while the Centre for Monitoring Indian Economy (CMIE)’s employment index indicates that a record 4.1 million jobs were created from May 2022 to May 2023.

How does one reconcile these directionally opposite trends is the tough question. But before we get to that question let's look at the data in detail.

EMPLOYMENT TRENDS

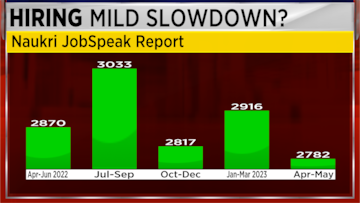

First up the hiring data: The Naukri JobSpeak index, in April and May, is standing at 2782 down five percent from the Jan-March average reading.

Naukri JobSpeak Report (May 2023)

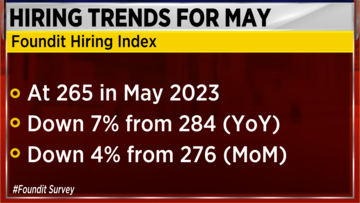

Another job index collated by Foundit (erstwhile monster.com and now a subsidiary of Quess) also came in four percent lower in May 2023 versus April and down seven percent from May 2022.

FOUNDIT SURVEY

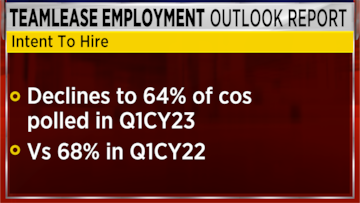

Teamlease, the other listed staffing company, in their Jan-March survey, found a four percent drop in the number of companies with the intent to hire. All three hiring companies said that the big fall in hiring came from IT companies, but they weren’t the only ones hiring less.

Naukri’s index showed that the insurance, education and retail sectors also hired less year-on-year; while Foundit’s data showed that big sectors like BFSI, engineering and construction, BPO/ITES and manufacturing also hired less in May 2023, versus both April 2023 and May 2022, indicating that this isn’t a seasonal issue.

NAUKRI JOBSPEAK REPORT (May 2023)

| LOW HIRING SECTORS | (% YoY) |

| Insurance | 15 |

| Education | 16 |

| Retail | 21 |

| IT, Software | 23 |

HIRING TRENDS FOR MAY: FOUNDIT SURVEY

| INDUSTRY | WORST (YoY) |

| IT | 20 |

| Manufacturing | 16 |

| BPO/ITES | 17 |

| Engg, Construction | 14 |

| Auto, Ancillary | 11 |

| BFSI | 10 |

CONSUMPTION TRENDS

Coming to consumption trends, data from market research company Bizom shows that consumption in April fell by 17.9 percent from year-ago levels while in May it fell by 12.1 percent for a broad swathe of FMCG and consumer goods.

CONSUMER DURABLES SECTOR

> BIZOM MARKET RESEARCH

| Month | SALES GROWTH (% YOY) |

| Jan-March | 11.8 |

| April | 17.9 |

| May | 12.1 |

The Chairman of TTK Prestige, TT Jagannathan and the CEO of Bajaj Electricals, Anuj Podar both corroborated this data from their own experience while speaking on CNBC-TV18. Rural demand didn't pick up, Jagannathan said, while Poddar said that the unseasonal rains may have led to less demand for fans and air coolers. He added that the delayed monsoon may have led to better buying of fans and air coolers in June, but data is awaited for this month.

Thus, the hiring and consumption trends of India Inc were clearly subpar in April and May

MACRO DATA INSPIRING

However, macro data is inspiring. Imports in May were 16 percent higher than in April through April-May together was flat versus Jan-March imports. Imports for all months of 2023 were lower than for 2022, but that was mostly due to lower prices of commodities.

INDIA's MONTHLY IMPORTS IN 2023

| Month | ($bn) | % YoY |

| May | 57.1 | 5.9 |

| April | 49.9 | 14.3 |

| March | 58.11 | 1.7 |

| February | 51.31 | 7.5 |

| January | 50.66 | 2.6 |

Goods export data for all five months of 2023 ranged between $33-$38 billion indicating no pronounced slowdown, but no growth either. Services exports fell perceptibly in May to $25 billion, down nearly 20 percent from around $30 billion average exports in the previous four months from Jan-April, but May could be a one-off.

Coming to employment data, the CMIE employment index in May recorded a significant jump over the past year, with the addition of around 4.1 million jobs in the country. The workforce comprised almost 408 million people in May 2023, while there were 403.9 million employed persons in May 2022, CMIE said. Likewise, the unemployment rate in the country for people aged 15 years and above fell to 7.7 percent in May from 8.5 percent in April, data from CMIE shows.

RECONCILING INDIA INC TRENDS WITH MACRO DATA

So how does one reconcile the macro data which shows good growth in the economy with the hiring and consumption trends from India Inc which show weakness?

The explanation could be that the informal economy is probably doing better than the formal economy, which may have reached some saturation after a strong past 12 months.

This squares with the fact that the jobs data from Naukri and Foundit show that Tier 2 cities saw more hiring than Tier 1 cities. (See Naukri findings below). The Foundit Index too fell five percent in metros but was up one percent in Tier 2 cities.

Naukri JobSpeak Report (May 2023)

> Geographical break up: Metros (%YoY)

| Delhi | 5 |

| Mumbai | 5 |

| Kolkata | -6 |

| Chennai | -8 |

| Pune | -11 |

| Hyderabad | -13 |

| Bengaluru | -13 |

> Geographical break up: Non-Metros (%YoY)

| Ahmedabad | 27 |

| Vadodara | 22 |

| Jaipur | 17 |

| Chandigarh | -8 |

| Coimbatore | -6 |

| Kochi | -1 |

If the economy as a whole is doing well and India Inc is seeing some softness that’s a welcome change from the K-shaped recovery one has seen since the outbreak of Covid. But, some caution about the pace of growth is merited. Exports and imports, while not falling, aren’t growing either. Subpar rains and a slowing global economy may spell more headwinds.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | What does a low voter turnout indicate for NDA and I.N.D.I.A Bloc

Apr 29, 2024 5:48 AM

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM