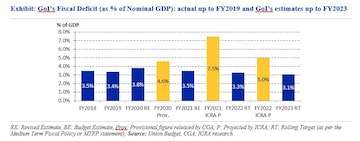

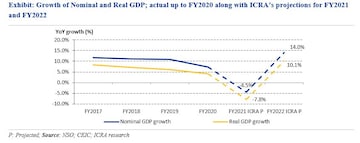

The revenue shock provoked by the COVID-19 pandemic is expected to bloat the government of India’s fiscal deficit to a massive Rs 14.5 trillion in FY2021 or 7.5 percent of GDP, from the budgeted level of Rs 8.0 trillion. As the economy bounces back from the contraction underway in FY2021, the level of the fiscal deficit that is appropriate for FY2022 and beyond poses an interesting policy question.

The rolling target included in the Union Budget for 2020-21, had placed the fiscal deficit for FY2022 at 3.3 percent of GDP. Revenue normalisation would anyway correct the size of the fiscal deficit to a large extent in the coming fiscal. Therefore, sharp fiscal tightening should be avoided, in our view, as it would counteract the economic recovery expected in FY2022.

A revenue deficit of 3.5 percent of GDP and a fiscal deficit of around 5 percent of GDP for the government in the coming fiscal, may allow enough space for prioritising health expenditure, vaccine rollout as well as capital spending, given the revenue rebound that is widely expected.

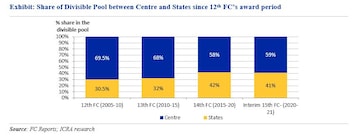

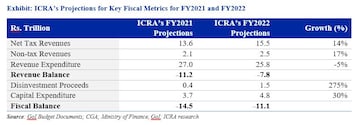

We project gross tax revenues to expand by 14 percent in FY2022, similar to the anticipated nominal GDP growth. In terms of the likely net tax revenues, the split of Central tax collections that the Fifteenth Finance Commission (15th FC) has suggested for its award period of FY2022 to FY2026, is not available in the public domain as of now. We have assumed a broad status quo to inform our analysis and forecasts for the coming fiscal. Based on this, we have forecast the GoI’s net tax revenues at Rs 15.5 trillion for FY2022.

In our view, the timing may not be appropriate to consider lowering the direct tax rates, to avoid having to impose curbs on spending later, if the expected revenue buoyancy does not end up being realised. Moreover, any modifications to the GST rates are in the domain of the GST Council.

The government's non-tax revenues are likely to record a muted rise in FY2022. After the spectrum auctions that are planned to be conducted in Q4 FY2021, the inflows of the government from the telecom sector are expected to be subdued in FY2022. Additionally, the surplus transferred by the RBI is unlikely to rise sharply in the coming year, given the significant reserve repo operations conducted in FY2021 to absorb the surplus systemic liquidity.

While the pandemic will result in a large miss related to the disinvestment target set by the government for FY2021, the pipeline for FY2022 is healthy. In our view, PSU disinvestment offers a viable avenue to raise revenues and create fiscal space to boost spending. In aggregate, we project the government non-tax revenues and disinvestment inflows at Rs 4.0 trillion in FY2022.

In terms of expenditure, priority should be accorded to capital expenditure and infrastructure spending especially projects that had already been identified in the National Infrastructure Pipeline, and where the plans are at an advanced stage. This will help to create a multiplier effect and boost economic revival.

In addition to the specific outlay for the COVID-19 vaccination drive, the allocation towards the health sector should be enhanced appreciably, in our view, relative to the recent trend.

Additionally, an urban equivalent of the Mahatma Gandhi National Rural Employment Guarantee Program (MGNREGP) and an adequate allocation for the existing rural-focussed MGNREGP would aid in sustained consumption demand. Further, the Budget may unveil some new schemes to support the agricultural and rural economy, the MSMEs, and to support job creation.

Assuming a revenue deficit of 3.5 percent of GDP (approximately Rs. 7.8 trillion, based on our estimate of nominal GDP) and a fiscal deficit of around 5 percent of GDP (approximately Rs. 11.1 trillion) would mean space for revenue expenditure of Rs 25.8 trillion and a substantial step-up in capital expenditure to Rs 4.8 trillion. A small contraction in revenue expenditure in FY2022 appears reasonable, given the cessation of some portions of the fiscal support packages.

Looking ahead, what level of the fiscal deficit should be targeted by the GoI after the pandemic and the recovery are behind us? It may be time to bring back a focus on the revenue deficit target, in our view. The GoI’s revenue deficit ranged from 2.1 percent-2.6 percent of GDP between FY2016 and FY2019, before widening to 3.3 percent of GDP in FY2020 (Rs. 6.7 trillion) according to the provisional data. We expect it to bloat to Rs. 11.2 trillion or 5.8 percent of GDP in FY2021, from the budgeted Rs. 6.1 trillion.

The government could target to curtail the revenue deficit to 3.5 percent of GDP in FY2022 and bring it down by 0.25 percent-0.3 percent of GDP per year till it stabilises at 2 percent of GDP. Simultaneously, the aim should be to maximise capital spending as well as disinvestment proceeds each year. Assuming that capital spending net of disinvestment settles at 2 percent of GDP, this would mean a fiscal deficit of 4 percent of GDP for the government over the medium term.

The author, Aditi Nayar is Principal Economist, ICRA. Views are personal

(Edited by : Aditi Gautam)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | What does a low voter turnout indicate for NDA and I.N.D.I.A Bloc

Apr 29, 2024 5:48 AM

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM