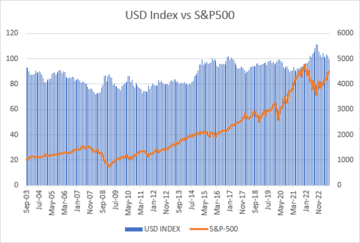

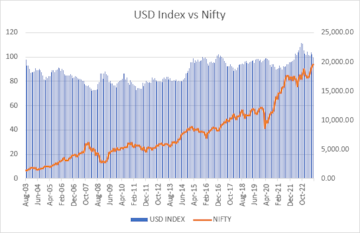

A fall in the dollar should logically boost values of things in dollar terms. The recent run-up in crude oil is thus also partly aided by a soft dollar. But does a dip in the dollar’s value push up stock values? That’s a question we tried to get an answer to. Our study of data over the past 20 years for the US dollar index and the US S&P-500 index and the Indian equity benchmark index, the Nifty, didn’t throw up results that would support this theory.

US $ INDEX AND EQUITIES

Contrary to what some might think, the dollar ($) index and equity indices don’t move in opposite directions. Rather, they have a moderate positive correlation. While this number for the US dollar ($) index and the S&P-500 is 0.71, it is just a tad lower at 0.67 for the Nifty. What this means is, when the US $ index rises, so do stocks.

Take the period from December 2020 to July 2022. While the US dollar ($) index gained from under 90 to 105.5 during the period, the S&P-500 scaled from 3,756 to 4,130. The Nifty too climbed from 13,981 to 17,158.

But then again, there was a period from April 2010 to April 2011, when the US dollar ($) index slipped from near 82 to 73, while the S&P-500 went higher from 1,186 to 1,364. So, there have been occasions of divergence, but in total, the correlation is positive.

INDIAN EQUITIES VS US EQUITIES

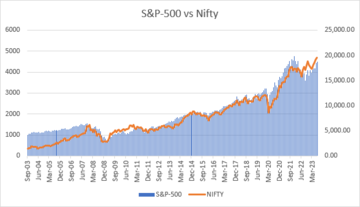

There is another argument that some Emerging Markets, even Indian equities, gaining at a time of dollar depreciation at the cost of US equities. While there can be some truth to this in terms of global fund allocations and weight changes in portfolios, to think that EM equities can rally while US equities sulk is a misperception.

The correlation between the S&P-500 and the Nifty over the past 20 years is as high as 0.97 — that’s as close to a perfect correlation of 1 that you can get. So, while EM equities and Indian stocks could outperform US equities in the extent of gains clocked, they are unlikely to move in different directions.

In other words, equities globally tend to rally on moves towards risk assets and vice versa. While the performances across markets could vary, if the flagship US market doesn’t perform, there is a very high probability that neither will others.

So, don’t get swayed by dollar talk and euphoric emerging market narratives. Focus on your first principles of investing and let the market do the rest for you. Trying to profit from macro shifts isn’t an easy trade and best avoided by most investors.

Don’t try to time the market. Stay focused on businesses and valuations.

Happy investing.