Why do stocks of public sector enterprises perk up at the very mention of the “privatisation” word? The answer is quite simple. Privatisation spells a shift to profitable growth. This doesn’t mean that state-owned enterprises aren’t profitable. Quite to the contrary, many are highly profitable, growing, hefty dividend-paying companies, a lot of which goes to its primary owner, the government, of course. In fact, dividends from state enterprises, besides from RBI, is an important line item in the annual Budget of the Centre.

So, let’s look at why these government-owned entities don’t get their due value from public markets.

THE GREAT CONFLICT

By its very nature, the job of any elected Government is aimed at enhancing public good. That doesn’t quite tie in with the primary objective of business, to earn profit. This is the genesis of the problem. While decisions of a private enterprise are driven by a focus on generating value for its shareholders, that’s not quite the case with state-owned entities, which may act in ways that favour the good of society at large over that of shareholders.

Take the recent case of state-owned oil marketing companies holding back on hiking fuel prices. It is evident that the decision is motivated by a concern for the societal impact of soaring fuel prices, rather than any commercial consideration. While the decision may be apt from a national perspective, it doesn’t do much for shareholders — who have to subsidise the rest of the population by accepting lower profits.

One doesn’t know if it was only global factors or also concerns over the future profitability of oil refining and marketing companies in India that deterred investors from proceeding with bids for Bharat Petroleum Corporation Limited, but any such apprehensions may not have been amiss. Private players like Shell and BP who have entered the fuel marketing business find themselves in a bind when state-owned oil majors decide to hold the price line despite a surge in crude prices.

Such non-market-driven decisions taken in the interest of the public and not shareholders tend to deter investors in highly regulated sectors, or those dominated by state-owned entities.

What’s more, even decisions like capacity expansion and diversification into new areas of business may be driven by a bigger government agenda than just commercial interest. Such decisions may detract from the objectives of shareholders.

GOING PRIVATE

While the government has stated its philosophy of not wanting to be in the business of doing business, there have been challenges in its path to privatise, given public interest and political considerations. However, a move down this path is a great way to unlock value for itself and for shareholders of state-owned enterprises. A transition to a privately run entity, quite like Air India, is a good model to follow.

It is best to identify non-critical sectors and accelerate the pace of privatisation for the good of the economy and the shareholders, as sectors dominated by state-owned entities tend to foster inefficiencies and prolong the terms of archaic and unviable policies. And profitability is the best measure and driver of long-term sustainability.

A WAITING GAME

The significant undervaluation of state-owned enterprises versus the rest of the market does tend to lead to short-term run-ups in these stocks, but most such entities despite robust businesses fail to generate the kind of returns private businesses do.

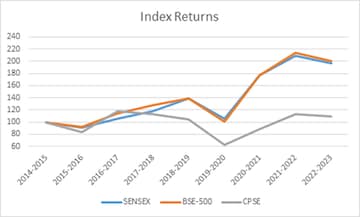

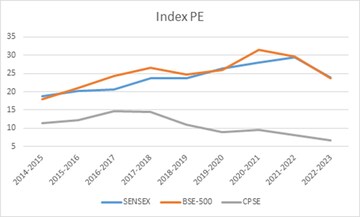

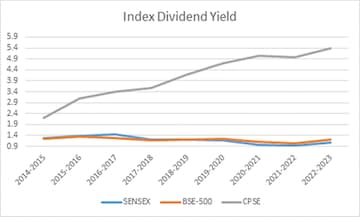

A look at returns delivered by the BSE-Sensex, BSE-500 and BSE-CPSE indices reveals the wide variance. While the Sensex has delivered a CAGR of 8.8 percent since 2015, and the BSE-500 9.1percent, the CPSE index has only returned 1.1 percent. The valuation afforded to private enterprises is also steeper than those to public enterprises. The Sensex has traded in a PE range of 18.7x to 29.5x and the BSE-500 at 18x to 29.6x, but the CPSE index has only traded in the 6.7x to 14.6 band over the past nine years. Even on a dividend yields basis, the state-owned enterprises offer much more value.

From a long-term investor's perspective, though, investment in these enterprises makes sense only if the business itself looks viable and there is a clear path to privatisation. Because privatisation will not only drive the decisions of the companies, but also lead to a PE re-rating. And that can be a big value creation opportunity, especially at the current valuations. But be careful which eggs you put in your basket.

Happy investing.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM