The big fear for equity investors is that interest rates are likely to push higher. That’s not such a bad thing for those looking to put money in fixed income yield instruments.

The US 2-year government bond yield is now trading just below the 5 percent level, a yield last seen in 2006, that’s 17 years ago. The last peak for the 2-year bond was near 3 percent in 2018. So, the current yield is the best the instrument has offered in quite a while. This makes debt very attractive for investors in the US and heightens the risks for investors in risky assets globally.

Equity vs debt today

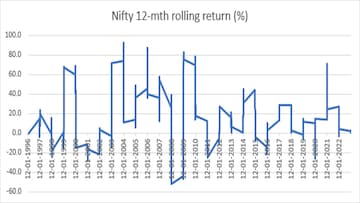

Equity has traditionally been a far better asset class to be in, in India, than debt. We looked at the 12-month rolling returns of the Nifty since 1996 and found that the average return delivered has been a very health 14.5 percent. However, these include months of heady returns 70 percent+ and months of heavy drawdowns 50 percent+, hence returns for investors would vary vastly based on when they got in and got out.

That said, the returns in recent months have been quite disappointing. Trending at rates mostly well below the fixed-income yields. And given the risks to equities posed by further monetary tightening, this may be a good time to start locking-in to some high yield debt, which even for short tenures is offering attractive yields of well over 6 percent.

| NIFTY ROLLING RETURN | |

| Date | 12-month (%) |

| 05-01-2022 | 6.4 |

| 06-01-2022 | 0.4 |

| 07-01-2022 | 8.9 |

| 08-01-2022 | 3.7 |

| 09-01-2022 | -3.0 |

| 10-01-2022 | 1.9 |

| 11-01-2022 | 10.5 |

| 12-01-2022 | 4.3 |

| 01-01-2023 | 1.9 |

| 02-01-2023 | 3.0 |

| 03-01-2023 | 0.7 |

Taking calculated risks

Even in debt, while the returns on the safest instruments like bank deposits and g-secs is not as attractive as what you might get on corporate debt, there’s a case for taking calculated risks on paper of well-heeled corporates.

While top banks offer about 6.6-6.8 percent on a one-year deposit, the rate on a one-year corporate deposit could be a good 40-50 basis points higher.

Also Read: Enabling Education-2: Here is why lifelong learning becomes imperative in a changing world

Should you take the risk for that extra bit? This needs to be approached smartly. Big brands with strong financial underpinnings like HDFC or ICICI are unlikely to default (the biggest risk in high yield debt instruments). In fact, HDFC is an interesting case where ahead of the merger, the housing finance company is offering a significant spread over the banking arm’s rates.

| Company Name | Interest Rate (p.a.) | Tenure range | Additional interest rate for senior citizen (p.a.) | ||

| 1-year tenure | 3-year tenure | 5-year tenure | |||

| Bajaj Finance Limited | 7.15% | 7.60% | 7.60% | 12-60 months | 0.25% |

| HDFC Ltd.* (Regular Deposit up to Rs 2 cr) | 7.10% | 7.40% | 7.40% | 12-120 months | 0.25% |

| ICICI Home Finance | 7.00% | 7.40% | 7.50% | 12-120 months | 0.25% |

| LIC Housing Finance Ltd. | 7.00% | 7.50% | 7.50% | 12-60 months | 0.25% |

| Mahindra Finance | 7.05% | 7.50% | 7.50% | 12-60 months | 0.25% |

| Manipal Housing Finance Syndicate Ltd. | 7.75% | 7.75% | 7.25% | 12-60 months | – |

| Muthoot Capital Services Limited | 6.25% | 6.75% | 7.25% | 12-60 months | 0.25% |

| PNB Housing Finance Ltd. | 7.00% | 7.55% | 7.40% | 12-120 months | 0.25% |

| Shriram Finance Ltd.** | 7.06% | 7.86% | 8.13% | 12-60 months | 0.50% |

| Sundaram Home Finance | 7.20% | 7.50% | 7.65% | 12-60 months | 0.50% |

| Sundaram Finance | 7.20% | 7.50% | – | 12 to 36 months | 0.35% |

(*0.05 percent extra on online deposits | * At monthly rests. Additional 0.25 percent on renewals | Source: PaisaBazaar)

But remember, your decision on the form of fixed income instrument you choose to invest in must also be driven by the taxes applicable to you on these. So, pick what gives you the best post-tax return. But this clearly looks like a good season to be in debt.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi to contest from Varanasi, to file nomination papers on May 14

May 5, 2024 2:49 PM

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM