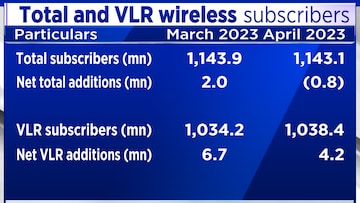

Telecom Regulatory Authority of India (TRAI)’s April 2023 subscriber data indicates industry net additions continue to remain muted with 0.8 million month on month decline and down 24 million since December 2021 tariff hike.

However, the quality of subscriber base continues to improve. Reliance Jio continued to gain wireless subscriber market share, growing 29 bps month on month at Vi’s expense which is down 25 bps in Apr-23. Bharti’s overall and Visitor Location Registry (VLR) net adds were subdued.

Furthermore, the mobile number portability requests remain elevated at nearly 11 million in April despite telcos rationalising retailer’s commissions. This is as high as 11-12 million for past several months indicating intense competition.

With the introduction of JioFiber Backup at Rs199/month, JioFiber continues to lead with 0.32 million broadband net additions, to reach 8.7 million subscribers, whereas Bharti added 0.13 million broadband subscribers to reach 6.3 million subscribers.

Kotak Institutional Equities expects Bharti and Jio’s market share gains to accelerate at Vi’s expense, especially among premium subscribers, driven by pan-India 5G rollouts and Vi’s cash constraints, long-delayed fund-raise and uncertainty on 5G launch. Further, a delay in the tariff hikes could lead the sector to an effective duopoly.

In the fourth quarter of FY23, the performance of telecom companies has been a cause for concern. The top three players in the Indian telecom market, namely Bharti Airtel, Reliance Jio, and Vodafone Idea, experienced a significant decline in revenue, reaching a near two-year low. On a quarter-on-quarter basis, the revenue growth was a modest 1 percent, marking the slowest growth seen in the past seven quarters.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM