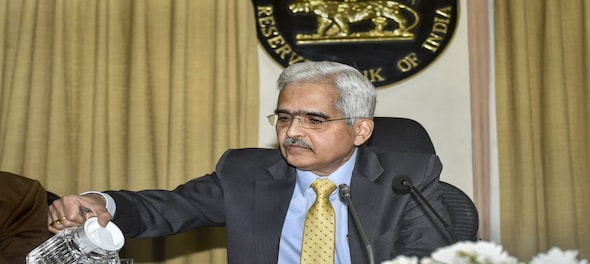

The Reserve Bank of India will hold internal discussions in case there are any issues arising out of the Supreme Court's order on February 14 to telecom companies regarding payments of adjusted gross revenue (AGR) dues to the government, said governor Shaktikanta Das.

Das said he would not comment on a Supreme Court order and its possible consequences on banks in terms of their exposure to the financially-stressed telecom companies.

"This is an order of the apex court. Whatever implication etc, it is an internal matter of the RBI to examine. It will be internally deliberated if at all there's an issue which arises out of that (order)," he told reporters during a briefing after the RBI board meeting.

The top court threatened contempt proceedings against top executives of Bharti Airtel, Vodafone Idea and other telecom firms for failing to comply with its directive to pay an estimated Rs 1.47 lakh crore in AGR dues.

There are apprehensions that the AGR order will lead to uncertainty for the telecom sector which is already reeling under heavy financial stress. Analysts said the court's move could harm the government more broadly, as well as the companies.

Banks in India are owed roughly Rs 30,000 crore by Vodafone Idea, reported Reuters, citing a Macquarie report from 2019. Indian banks are burdened with nearly $140 billion of bad loans and face another huge hit if Vodafone Idea is forced into bankruptcy, the Reuters report noted.

Banks that have the highest exposure to Vodafone Idea include State Bank of India, Punjab National Bank, Canara Bank and Bank of India, among others, according to the Macquarie report.

(With inputs from agencies)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Mark Mobius reveals how markets will react if NDA wins 400+ Lok Sabha seats

May 15, 2024 8:09 PM

Wine shops and bars to remain shut for 4 days in Mumbai in 4 weeks, check details

May 15, 2024 7:52 PM

INDIA bloc will win majority seats in Bihar, says Tejashwi Yadav

May 15, 2024 4:20 PM