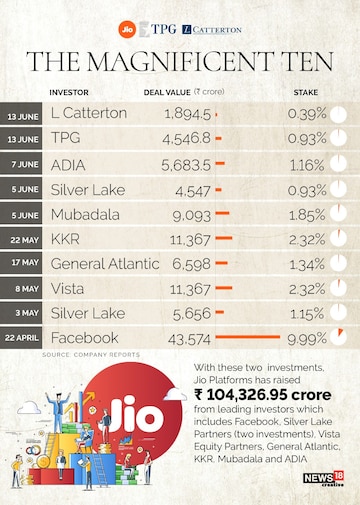

Private equity firm L Catterton will invest Rs 1,894.50 crore in Jio Platforms for a 0.39 percent stake, making it the tenth public investor in the Reliance Industries technology arm in seven weeks.

L Catterton is the largest consumer-focused private equity firm in the world, managing roughly $20 billion of equity investments globally.

With this investment, Jio Platforms has raised Rs 104,326.95 crore from leading technology investors including

Facebook, Silver Lake Partners (two tranches) Vista Equity Partners,

General Atlantic, KKR, Mubadala, ADIA,

TPG and L Catterton This is also the largest continuous fund raising by a company, globally.

Catterton’s investment has been done at a similar valuation as some of the recent private equity investments, giving Jio Platforms an equity valuation of Rs 4.91 lakh crore and an enterprise valuation of Rs 5.16 lakh crore.

L Catterton has invested in and helped build some of the most innovative brands at the forefront of the evolving consumer landscape, including Peloton, Vroom, ClassPass, Owndays, FabIndia, and more.

This series of fund raising by Jio Platforms comes in the midst of a global lockdown, underscoring India’s digital potential and the robustness of Jio’s business strategy.

Mukesh Ambani, Chairman and Managing Director of Reliance Industries, said, “I am delighted to welcome L Catterton as a partner in our journey to unleash the power of digital for India while providing a consumer experience that is among the best in the world. I particularly look forward to gaining from L

Catterton’s invaluable experience in creating consumer-centric businesses because technology and consumer experience need to work together to propel India to achieving digital leadership.”

Michael Chu, Global Co-CEO of L Catterton, said, “We look forward to partnering with Jio, which is uniquely positioned to execute on its vision and mission to transform the country and build a digital society for 1.3 billion Indians through its unmatched digital and technological capabilities."

Facebook was the first to put its finger in the Jio Platforms pie with a Rs 43,574 crore ($5.7 billion) investment for a 9.99 percent stake. The investment made Facebook the largest minority shareholder in Jio Platforms and valued the RIL technology arm at Rs 4.62 lakh crore ($66 billion) pre-money enterprise value.

Subsequently, many other private equity players too grabbed a slice of the digital subsidiary of the Indian conglomerate.

(Disclaimer:

Reliance Industries Ltd., which also owns Jio, is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.)

First Published: Jun 13, 2020 10:26 PM IST