Confirming a previous report by CNBC-TV18, Nazara Technologies Ltd., an online gaming company, is set to allocate an additional 1.4 million equity shares with a face value of Rs 4 each to two entities owned by Zerodha Co-Founder Nikhil Kamath.

These shares, valued at approximately Rs 100 crore, will be granted to M/s Kamath Associates and M/s NKSquared, partnership entities represented by Nikhil and Nithin Kamath as its partners.

In an exclusive interaction with CNBC-TV18 after the announcement, Nikhil Kamath said that he will look to increase his stake in Nazara further. Currently, the combined stake has increased from 1 percent to around 3.5 percent, Kamath said in the interview. Edited excerpts:

Q: What was the rationale behind this investment and is it just done at this point, or do you plan to raise your stake further in the company?

A: Broadly, the thesis for me has been, especially in the younger generation, the feedback loop that interactive content provides is gaining a large amount of traction. This space, which is gaming and eSports, will grow at a pace faster than old-school content. The only real listed player in India is Nazara and they seem to have done an exceptional job under Nitish Mittersain, Joint MD & CEO, Nazara Technologies — kind of alleviating a lot of the issues they have faced in the last many years, and they seem set for growth, and we really like the sector. But very likely, I am looking at this as a really long-term thing and would love to engage with them more in the future, maybe increase and play the eSports gaming theme through them.

Q: How much will your stake be in Nazara Technologies now? How much was it earlier and how much have you raised it to? And, as you talk about the long-term, what would your eventual game plan be?

A: My larger bet is that 10 years from now gaming will be a bigger part of the ecosystem than it is today. The stake was about a percent. I think now it should be up to about 3.5 percent.

Q: You want to take it up, not like an aspirational number or anything, but you would want a meaningful stake here?

A: I would presume so because the rate of growth of gaming, especially in the 20 and below age category is crazy across the world, not just in India. Unlike cricket, Bollywood and other mediums of content, are one way essentially where a user is pulling data but is not interacting with the data. The fact that a user can interact with the data, and he is engaging with it so much more. I think that is a big use case for what the youth of today will want 5-10-15 years from now. The gaming and eSports, the logic I think, seems pretty clear across the world and Nazara being the incumbent behemoth in India seems like a very logical place for me to have increased exposure.

Q: Would you want to be involved in at the board level eventually. They would be happy to have you, I imagine. And are there any possibilities for Zerodha and Nazara to work together, any synergies you see there, I mean, to bring to bear Zerodha’s technological capabilities for Nazara in any way?

A: This has nothing to do with Zerodha. Zerodha will not be investing into this; this is more of a personal investment for me. I don't know about being on the board or being actively engaged because even though I have a thesis on the sector, I don't particularly have an expertise that I presume will be useful to them, but I would love to learn more about the sector and be in it for the long-term because I feel, in a decade from today, the sector will hold a lot more relevance than it does today.

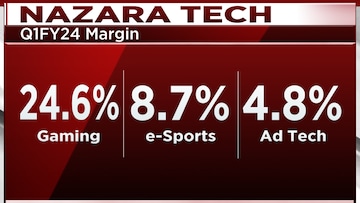

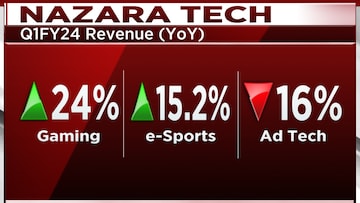

Q: For Nazara, I think almost 50 percent of their revenue comes from the eSports segment and that saw a fabulous growth in the last year. I mean, in FY23, eSports’ revenues were up almost 75 percent. Do you think this pace of growth is something that is sustainable over the next couple of years, or could it even be better than that?

A: I would presume it's likely that it will continue to grow at a quick pace. If you look at other geographies outside India, some of these gaming companies have become ridiculously large. An Indian incumbent, which is doing all these innovative things around eSports and gaming has to be encouraged. And hopefully this Indian company one day will actually compete with larger international players as well.

Q: What is the size of the investment for you, this 3 percent, in terms of money value?

A: It should be about Rs 150 crore if I am not wrong.

Q: Just to get a sense, you are an active investor in many startups and grown up companies. Would you describe this as one of many investments you make across segments, across companies, both listed-unlisted, mostly unlisted? Is that the way to look at this?

A: Yes, that would be the way to look at it. I have a bunch of different themes – gaming and eSports is one, we do a lot around consumption because we have a broader thesis that consumption is set to go up in India. So, in these sectors, we keep investing, mostly private, less so public. But this fits into our portfolio really well.

Q: Which are the other listed investments apart from this?

A: We typically like to take minority stakes and by minority, I mean much lower than 5 percent, but there are a whole host of companies.

Q: You are also interested in a lot of fintech companies and you are doing a lot in senior living, but one final question on Nazara since you have had several talks with them and their management, you are convinced on that front. Nazara has been investing recently in some game developers abroad as well. There was an Israel-based game developer snacks games that they invested in. What else are they doing in the overseas market where you see high growth potential?

A: I really should not comment on that, but they have a bunch of interesting things in the pipeline in that specific domain, but I think the onus would be on them to announce it when they are done with the deal.

(Edited by : C H Unnikrishnan)

First Published: Sept 4, 2023 4:40 PM IST