Google India Digital Services and NPCI International Payments (NIPL), a wholly-owned subsidiary of the National Payments Corporation of India (NPCI), have signed a Memorandum of Understanding (MoU) to expand the impact of Unified Payments Interface (UPI) to countries beyond India.

The MoU has three key objectives. First, it seeks to broaden the use of UPI payments for travellers outside of India, enabling them to conveniently make transactions abroad.

Second, the MoU intends to assist in establishing UPI-like digital payment systems in other countries, providing a model for seamless financial transactions.

Lastly, it focuses on easing the process of remittances between countries by utilising the UPI infrastructure, thereby simplifying cross-border financial exchanges, NPCI said in a statement.

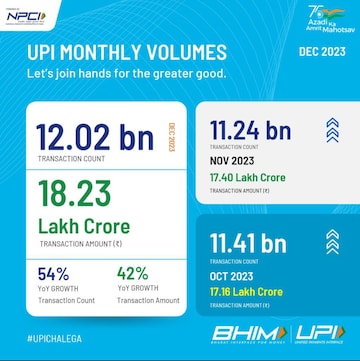

UPI platform has recently crossed the 100 billion mark in 2023, totalling around 118 billion transactions throughout the year. This marks a 60% growth compared to the 74 billion transactions recorded in 2022.

The total value of UPI transactions in 2023 stood at approximately ₹182 lakh crore, a 44% increase compared to ₹126 lakh crore in 2022.

If we look at the monthly transaction amount, the same touched ₹18.23 lakh crore in December, showcasing a 54% increase compared to the corresponding data for 2022.

Last month, NPCI announced the launch of an Application Supported by Blocked Amount or ASBA-like facility in the secondary market after getting the go-ahead from SEBI.

The UPI for the secondary market will start its beta phase next week for the equity cash segment. It will be supported by key stakeholders, including clearing corporations, stock exchanges, depositories, stockbrokers, banks, and UPI app providers.

NPCI stated that in the initial phase, this functionality will be available for a limited set of pilot customers.

(Edited by : Amrita)

First Published: Jan 17, 2024 12:15 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Telangana CM violated poll code, defer Rythu Bharosa payment, says Election Commission

May 7, 2024 9:01 PM

Lok Sabha Election 2024: How Indian political parties are leveraging AI

May 7, 2024 6:59 PM