When Zomato announced Blinkit's acquisition in June 2022, it was seen as a rescue act to save the sinking startup.

For one, Blinkit and Zomato co-founders Albinder Dhindsa and Deepinder Goyal, respectively, were known to be close friends from their younger days. Some even questioned whether Zomato should have explicitly disclosed to investors that Dhindsa’s wife was a top executive at the food delivery company.

Meanwhile, both the companies found themselves in different spots of bother.

Zomato’s multiple efforts at grocery delivery had failed, while its archrival Swiggy was doing well in quick commerce. Its stock was taking a beating as pre-IPO investors were selling shares like there was no tomorrow. The core food delivery business was showing early signs of sputtering growth. And, the public market was demanding a quick path to profitability.

At the same time, Blinkit (previously Grofers) was cash-strapped and feeling the heat in the intensely competitive quick commerce space. It had laid off employees, shuttered dark stores, and even delayed vendor payments. The acquisition came months after Zomato extended a $150 million loan to keep Blinkit on life support. While the share swap deal's value was earlier estimated to be upwards of $700 million, the drop in Zomato’s stock price had reduced it to $568 million.

For Zomato, Blinkit was a last-ditch effort to enter into the grocery space after it retreated twice from the segment – in 2020 and 2021.

Things change

Nearly two years later, Goyal and Dhindsa appear to have proved their sceptics wrong.

Take for instance, Jefferies, after meeting with Zomato’s Deepinder Goyal and CFO Akshant Goyal around September 2022, asked if quick commerce was for real considering that “...scepticism is high on quick commerce, given no proof of concept yet in any large market in the world.”

The note to clients added that a lot of investors expressed a fundamental question on Blinkit’s existence, with people asking ‘why someone wants grocery delivery in 10-min?’

Cut to February 2024, the same brokerage house said Q3FY24 “...was another strong quarter with exceptional performance in quick commerce (Q/C)...” which in a way underscored Blinkit’s turnaround.

From being an albatross around Zomato's neck, Blinkit has transformed into a thriving player in the express delivery space, taking on rivals such as Swiggy's Instamart, Tata group's BB Now, Zepto, Amazon and Flipkart among others. From delivering groceries and vegetables, Blinkit has expanded to deliver just about anything - iPhones, condoms, personal massagers, sundry items for local festivals, and even running printing services.

Management gurus who value focus in a business might baulk at Blinkit's approach, but the numbers tell a different story.

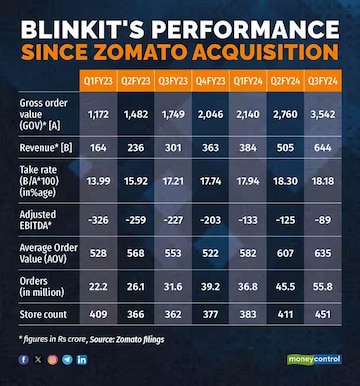

Blinkit incurred a net loss of Rs 1,440 crore in FY22 but its adjusted EBITDA (earnings before interest, taxes, depreciation and amortisation) loss reduced to Rs 89 crore as of Q3FY24 and is months away from profitability.

The company said it is on track to meet its guidance of adjusted EBITDA break-even on or before Q1FY25.

Blinkit's performance after Zomato acquisition.

Blinkit's performance after Zomato acquisition.What gives?

Blinkit’s execution, working capital discipline, and cataloguing give the Gurugram-based company an edge over its peers.

For instance, Blinkit is the only quick-commerce company that generates a purchase order (PO) daily whereas Swiggy Instamart and Zepto do it every week, as per Sreejith Moolayil, founder of True Elements, a functional foods brand, that sells across the quick grocery platforms.

“Blinkit does daily POs because of which their working capital requirement is the lowest. They don't keep too much inventory. They’re probably losing some opportunities which I don't think they mind, seeing their bottom line and growth,” Moolayil explained.

While shipping supplies to warehouses across the country on a daily basis can be a pain for brands, it helps Blinkit be nimble in stocking up inventory in lockstep with demand patterns and have better control over its finances which is crucial as quick commerce companies work on take rates from each consumer order.

Take rate is the commission paid to an e-commerce player for facilitating a transaction on its platform.

Quick commerce platforms earn take rates between 15 and 35 percent depending on the pull of a consumer brand and the category it operates in. The take rate could include a listing fee, advertising revenue and shipping charges that brands pay. Companies in the sector also earn from advertisements, which in Blinkit’s case is growing faster than order value as of Q3FY24.

That’s an arrangement different from what other e-commerce companies follow. Amazon and Flipkart for instance run a marketplace model where sellers list their products on the platform and ship to buyers.

While some items are stocked in company warehouses, most sellers merely list products on these apps/websites and dispatch them once an order is placed. In contrast, quick commerce companies stock up the products that are listed on the apps in neighbourhood 'dark stores' which helps in more localised forecasting, cataloguing and minutes-long delivery timelines.

Quick commerce companies, especially Blinkit, are however expanding stock keeping units (SKUs) to graduate from selling daily essentials to selling reading glasses, electronics, and several other products which helps them compete with established e-commerce players.

For quick commerce companies, having a wider assortment essentially means the firm has more products to offer consumers, which bulks up the cart's value in each purchase.

Experts say that more SKUs also translate to a higher ordering frequency for an app, which is vital for them to grow their user base. Thereon, an expanding user pool builds a habit and trust which leads to a better brand recall.

Along with efforts to widen its assortment, Blinkit has also cracked the code on establishing a rapport with its top sellers which is giving the company an edge over others, say industry executives.

“What we know for sure is that Blinkit always took a wider assortment approach when compared to Swiggy Instamart or Zepto and now everyone is following this approach as it seems to have worked in Blinkit’s favour,” said Sachin Dixit, lead analyst, internet, at JM Financial.

However, Dixit is quick to add a disclaimer, saying: “See, it’s also a cause and effect thing— because Blinkit is doing well now, in retrospect people are saying this worked for the company and this did not. In reality, we do not know for certain what clicked.”

Deploying the charm offensive

A founder, who is a top seller on Amazon and Blinkit, said there is a remarkable difference in the way the two companies treat their sellers. He said that the engagement with the Amazon account management team is purely formal where the two parties mostly meet when something needs to be addressed and the meeting ends after.

“But Blinkit has broken that in its typical flamboyant Delhi style of doing things. Blinkit has already called its sellers twice for a dinner party with Mr Dhindsa (referring to Blinkit CEO Albinder Dhindsa) in the past year. At the party in Delhi, Mr Dhindsa asked his sellers what the problems were and how Blinkit could solve them. Overall, they’re more accessible to us sellers,” the founder said, requesting anonymity as he does not want to burn bridges with other companies.

While Blinkit has been doing this since at least January or February 2023, competitors like Swiggy Instamart hosted a similar gathering only around November or December last year. The founder said he can’t recall a similar arrangement from Zepto’s side, at least for him.

Another differentiator that has helped Blinkit is the company’s practice of providing sellers with early intelligence on what things will sell better on certain festive days.

“Last month, during Sankranti/Lohri, Blinkit had informed us much earlier that sesame-based products would go through the roof so we were able to manage inventory and demand very well. Not that others aren't planning engagement well, but as of now, in our category, Blinkit has an edge and probably the first-mover advantage,” a founder of a snacks company said while underlining Blinkit’s control over hyperlocal events.

The founder added that the company will do the same for Holi, slated for the second half of March.

The Z factor

Zomato’s acquisition of Blinkit is also a key reason why the company has been able to steady the ship.

"After Zomato bought a 10 percent stake in Blinkit in March 2022, Deepinder Goyal spent six months diving deep into the inner workings of the company to understand if it could be turned around. Only when he was convinced did Zomato move to acquire the company," said an industry executive in the know.

"What makes Deepinder different from other founders is that he is a lot quicker in making decisions. He is very focussed," the executive said. CEO Goyal is also known to be aggressive when it comes to controlling costs, as witnessed by the surprise turnaround in Zomato, which has been profitable for three consecutive quarters.

If not for Zomato, Blinkit’s fortunes could have turned out to be very different.

“In quick commerce, it’s all about razor sharp delivery execution capability and inventory management, which I am sure the Zomato leadership has instilled into Blinkit,” said Sreedhar Prasad, Internet business expert and former partner with KPMG & Kalaari Capital while adding that with Hyperpure, Zomato’s wholesale arm, also being a strong node in the ecosystem, the inventory layer gets a strong back end platform.

“Further, the ‘data’ focus of Zomato would be helping the Blinkit team in being sharp in being predictive on inventory management which will result in lesser stockouts,” Prasad said.

Zomato's shares traded at Rs 66 apiece around the beginning of June 2022, and later dropped to a low of Rs 42 a month later when Blinkit's acquisition deal was met with scepticism. The company's shares have however rallied over 280 percent, comfortably outperforming the Nifty, from its low to change hands at around Rs 160 apiece now.

Also, the Blinkit app being housed separately from that of the parent brand also helps the company as it draws a more loyal quick-commerce shopper base, according to Rahul Jain, vice president, Dolat Capital, which tracks internet companies.

Jain added that Zomato, and Blinkit, being in better financial health than Swiggy allows the Gurugram-based company to take risks and be more competitive.

For comparison, Swiggy had a revenue of Rs 8,625 crore and incurred a loss of Rs 4,179 crore in FY23. Arch rival Zomato on the other hand registered a revenue of Rs 7,761 crore and recorded a net loss of Rs 971 crore in the same year. Zomato has been profitable so far in FY24.

However, another industry executive also pointed out that Zomato and Blinkit are yet to find operational synergies on the ground.

For instance, they have kept their delivery fleets separate as food and quick commerce deliveries are different in terms of distance covered. In food delivery, a rider may need to cover a distance of 5-8 kilometres in 15-20 minutes. In quick commerce, the expectation is to cover 2 kilometres in 5 minutes.

Moreover, given the smaller radius of a quick commerce rider, they tend to develop more familiarity with particular neighbourhoods or housing societies which increases their efficiency in reaching the customer's doorstep quicker and without calling up the consumer for directions.

Future tense

Where does Blinkit go from here?

Zomato thinks the quick commerce app can become bigger than the food delivery app in the future. Deepinder Goyal said last year that Blinkit will deliver more value to shareholders than the core business of food delivery in the next 10 years.

"I can proudly say that Blinkit's GOV (gross order value) is very close to Zomato's GOV in some of the large cities where we have an overlapping presence. This is just the start, and I believe that 10 years from now, Blinkit will drive more value for our shareholders than Zomato," Goyal wrote in a letter to shareholders in August 2023.

This was right after Blinkit recorded its highest-ever GOV and transacting customers in the months of June and July, after recovering from the business disruption caused by a delivery workers' strike in its biggest market, Delhi-NCR.

However, one thing that might constrain Blinkit’s rise is the country’s macroeconomic fundamentals.

Sure, Blinkit and its quick commerce peers have demonstrated growth in the top eight cities. But, can they go beyond?

If we go by the trajectory of food delivery, around 50 percent of Zomato’s sales still come from around 5 percent of its users, who expected. The case will not be very different for Swiggy. And this after the two have poured billions of dollars to grow the market.

To be sure, experts are of the opinion that the days of heady growth for food delivery are over as it has almost fully penetrated the top layer of India’s tech-savvy and prosperous urban population. Swiggy boss Sriharsha Majety and Zomato CEO have both concurred with that view.

Quick commerce is not a very different value proposition in the consumer’s mind, compared to food delivery. Will the Indian consumer in Tier 2 and 3 cities pay up a bit extra for quick doorstep deliveries of fruits, vegetables, cereals, packaged snacks and the like? Or, will they be prosperous enough to do so?

As Blinkit grows bigger, it will need to find answers to such questions. For now, it can take heart from a job well done in staging a turnaround that many believed was not possible.