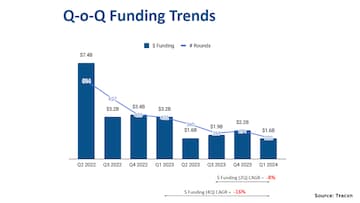

Indian startups saw venture capital investments slip in Q1 2024 (until March 15), with $1.6 billion raised in funding after continuous growth in the previous three quarters of 2023, as per data from Tracxn.

The funding slowdown comes at a time when the Indian startup ecosystem was witnessing some signs of spring.

VC investments had inched up from $1.6 billion in Q2 2023 to $1.9 billion in Q3 2023 and $2.2 billion in Q4 2023. To be noted, these figures were much lower compared to the same period in 2021 and 2022.

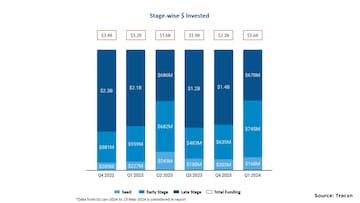

Despite the slump, the quarter witnessed a silver lining as early-stage funding witnessed a notable increase of 28% while late-stage funding experienced a significant drop of over 46% from $1.4 billion in Q4 2023 to $670 million in Q1 2024.

The report highlighted that India ranked fourth globally despite funding slowdown, with Retail, FinTech, and Enterprise Applications being the top-performing sectors in Q1 (until March 15) 2024.

The retail sector received funding of $494 million, which was a decline of 34% compared to the previous quarter. Enterprise Applications garnered $448 million, showing a growth of 48% while Fintech received $429 million in funding, marking a 48% growth from the last quarter's $289 million.

Shadowfax and Credit Saison received the highest funding of over $100 million, with Capillary, Rentomojo, and Captain Fresh also being among the top-funded companies. The quarter saw the emergence of two new unicorns—Perfios and Ola Krutrim.

Venture Catalysts, We Founder Circle, and Titan Capital led the seed investments in Q1 2024 while Peak XV Partners, Saama Capital, and RTP Global were prominent in early-stage investments. Elev8, Epiq Capital Advisors and UC-RNT Fund took the lead in the late-stage category in the previous quarter.

On the exit front for investors, eight tech companies went public, including MediaAssist, WTI, Exicom, and LawSikho. Overall, there were 20 acquisitions during the quarter, a 33% decrease from last quarter and a 55% drop compared to 45 acquisitions in Q1 2023.

Notable acquisitions included Pingsafe (a cloud security platform acquired by SentinelOne) and Difenz (a fraud risk management platform acquired by Signzy).