“The day we started PolicyBazaar, I knew we would succeed!”

That was not some crazy conviction of an entrepreneur, explained Yashish Dahiya, co-founder and group CEO, PolicyBazaar in an earlier interview with CNBC-TV18. “We were very clear on what we were doing and why,” he had said.

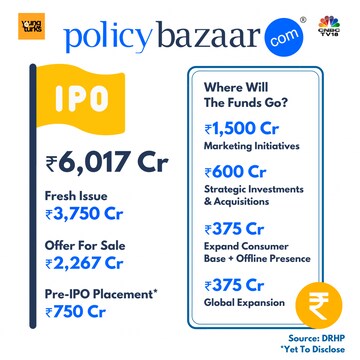

Running on that conviction for 13 years, the insurance aggregator PolicyBazaar has now reached the gates of Dalal Street. PB Fintech, which runs PolicyBazaar and PaisaBazaar, has filed the paperwork for an initial public offering (IPO) to raise a little over Rs 6,000 crore. The IPO is likely to happen towards the end of this year.

This has added more zest to the frenzy around ‘tech IPOs’ following the bumper listing of food-delivery platform Zomato in July. The list of startups preparing for public life is only going to get longer as the year rolls on with PolicyBazaar and Nykaa becoming the latest alongside Paytm, MobiKwik and CarTrade filing for an IPO.

Interestingly, founders of IPO-bound startups are downplaying the gloriole of listing on the stock exchanges, calling it ‘the logical next step and nothing more’. However, it is a big deal for the Indian startup ecosystem. Especially so, when the startup - PolicyBazaar - faced an existential crisis within three years of starting.

“A lot of people thought that was the end for us,” said Dahiya. Today, PolicyBazaar is one of India’s largest online insurance selling platforms.

The First Click

In 2001, a group of people working with Yashish Dahiya at the European travel comparison portal called EBookers ruminated if such a model would work for a product as complex yet much-needed as insurance.

“We thought why not make insurance the hero of the new venture that we are planning to start,” said Jerry Bhutia, co-founder and director of sales, PolicyBazaar.

In 2008, PolicyBazaar.com went online led by Yashish Dahiya, Alok Bansal and Avaneesh Nirjar. “There were about 12 to 15 general insurance companies and another 15 life insurance companies. There were about 150 to 200 insurance products for a consumer to choose from. How do you choose the right product? All we did was create a comparison or a chart,” said Bhutia.

Info Edge’s Sanjeev Bikhchandani, who seeded the PolicyBazaar venture, was intrigued after Dahiya claimed that the founder of Naukri.com was paying at least 60 percent more for his car insurance.

In a testimonial for PolicyBazaar, Bikhchandani wrote, “He (Dahiya) gave me a demo using the prototype they had built, which substantiated his claim. There were cheaper policies available with similar features that I wasn't aware about.”

The first big hurdle was breaking the ice with the insurance firms, which viewed PolicyBazaar suspiciously. At the time, insurance agents ran the show by earning large commissions on each policy sold, which had created an environment of mistrust and mis-selling. Dahiya’s father was a victim too.

Eventually, some insurance providers came around, others started to follow. As the listings increased, the clicks went up. Then came the existential crisis.

In 2011, the industry watchdog Insurance Regulatory and Development Authority of India (IRDAI) made a clear distinction between an insurance broker and an insurance aggregator. This restricted the money PolicyBazaar earned on leads generated and commissions. The regulator also barred such platforms from displaying ads and rating products.

“This regulation basically said you can earn a certain amount and that amount made the business unviable,” said Dahiya. Some investors even said PolicyBazaar does not have a business anymore.

In order to survive, PolicyBazaar made a big pivot. It took on the burden of converting leads to sales so that it would earn revenue. That was done by building a back-end support team, which chased the customer and closed the deal. It worked.

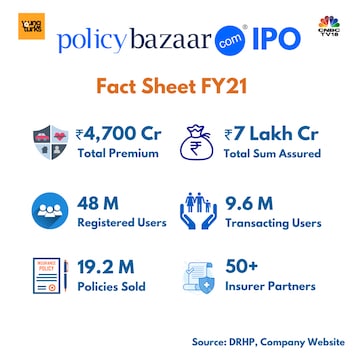

In the FY12-FY16 period, the number of policies sold on the platform went up from 40,000 to 6 lakh. Now, it sells over 10 lakh policies each month.

According to Frost & Sullivan, Policybazaar was India’s largest digital insurance marketplace in 2020 with a 93.4 percent market share based on the number of policies sold.

The Burden Of ‘Cash Burn’

While internet penetration lent a helping hand, achieving this kind of scale in a country that’s historically averse to insurance does not come cheap.

Over two decades, insurance penetration in India has grown at a paltry 1 percent from 2.71 percent in 2001 to 3.76 percent in 2019, according to the Economic Survey for 2020-2021. That’s much lower than the global average of 7.23 percent.

So, over its 13-year existence, PolicyBazaar has turned evangelical about getting India insured. It has run feature shows on TV, conducted explainers, and even turned its website into a schoolroom for customers.

“We realized no one is going to create this business, it’s in the consumers’ interest to make sure they buy these products. For us the most important thing was to make the consumer aware that he needs protection,” said Dahiya.

As Indians learned to do everything online - order food, book movie tickets, pay, shop and much more, insurance as a product itself was less appealing. That meant spending money on awareness-cum-marketing campaigns.

“We have spent Rs 1,000 crore, just communicating death, disease and disability,” said Dahiya.

As a result, like many IPO-bound startups, PolicyBazaar is loss-making too. The only profitable name on the list is Nykaa.

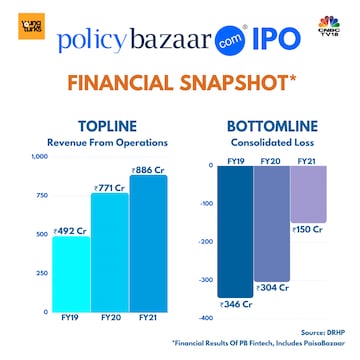

For parent company PB Fintech, the overall revenue has doubled during the pandemic period, losses have narrowed as the company clawed back advertising and marketing expenses from 70 percent of revenue in FY19 to 41 percent in FY21.

As a result of the COVID-19 pandemic, government-mandated lockdowns, and Reserve Bank of India’s moratorium on loan interest payments, sister-concern Paisabazaar’s revenues shrunk in FY21. Historically, PB Fintech has derived most of the revenue from its oldest business PolicyBazaar.

As the company plans to step into unchartered territories in the near future, it has issued a warning in the draft red herring prospectus (DRHP) saying, “We have a history of losses and we anticipate increased expenses in the future.”

Securing the Future

However, change is afoot at the insurtech firm after it surrendered its insurance aggregator license in exchange for that of an insurance broker, which allows it to set up physical outlets for sales and customer service.

“We have already set up 15 physical offices as of July 15, 2021, and seek to develop up to 200 physical retail outlets by the end of fiscal 2024,” the company said in its prospectus. At least Rs 150 crore from the IPO proceeds will also be used for this purpose.

Expenses may also go up as the platform seeks to replicate and adapt its business model and pursue opportunities in regions such as the Middle East and Southeast Asia. At least Rs 375 crore will be used from the IPO fundraise for global expansion, as per the DRHP.

The Big Bank Of Investors

PolicyBazaar is the second IPO from the Info Edge stable. The oldest investor in the company Sanjeev Bikhchandani still professes the long-term prospect of a business such as PolicyBazaar just as he did when he invested in the startup 13 years ago.

“For the life of me if we were identifying sectors we would never have identified non-existent sectors such as restaurant listing and insurance comparison. Pioneering entrepreneurs deliver outlier results over a decade or more,” he said.

For Dahiya, this kind of investor backing has been crucial, given the ups and downs of working in a closely regulated sector with consumers who possess little knowledge about the product. “It was brave of our investors. We knew what we were doing. They didn't know what we were doing. And, they were still backing us. That was really brave and I would commend Info Edge on that, who were our investors then,” said Dahiya.

After overcoming the initial ‘existential crisis’, PolicyBazaar added to its roster notable global investors, from the American Tiger Global to the Chinese Tencent.

While investors approach startups with great growth potential, startup founders have the final say as they seek alignment in the vision for the company. However, there was one investor whom Dahiya chased: SoftBank.

“Let’s look at Silicon Valley and how much investment the entire VC community has made in the last 25 years – roughly upto $75-80 billion. Softbank alone had $100 billion and they were deploying it very fast,” said Dahiya.

He said that having somebody with that kind of financial power on one’s side is very critical when trying to transform an industry. “Having that same capital against you is a bit of a disaster,” he added.

After being rejected once for not being ‘crazy enough’, PolicyBazaar welcomed a $200 million funding round led by SoftBank in 2018.

That catapulted PolicyBazaar into the elite league of unicorns - startups valued over $1 billion. Since its inception, the company has raised over $700 million in funding and now holds a valuation of $2.4 billion ahead of its IPO.

The Man Who Can’t Be Moved With Valuation

While the unicorn status is a badge of pride for several startups, it is not so for Dahiya. “I don’t feel proud being part of the club,” he said.

On the Indian startup ecosystem now flush with cash, he says, “People are being known by how much money they raised, what valuation somebody invested at. This is all paper valuation.” India has seen the creation of 20 unicorns in just seven months this year.

However, valuation is a parameter, a big enough indicator of the power to raise funds if you are a first-mover or an industry leader fending off new, well-funded rivals.

The Virat Kohli and Anushka Sharma-backed Digit became the first unicorn of 2021. Recently, it raised $200 million in funding led by Sequoia Capital in what is claimed to be the largest single-round of investment in the insurance industry. With a new valuation of $3.5 billion, it ranks above PolicyBazaar. Another rival Acko is expected to enter the unicorn club following a large fundraise soon.

What’s more, the pandemic pushed insurtech funding to an all-time high, not only in India but globally too, according to consulting firm BCG.

The Future Pathway

Among the key risks identified by the company in its prospectus is competition. A fight not on paper, but on the ground. While the IPO-bound Paytm, Plum and Coverfox offer a fight in the broking space, Digit and Acko will challenge with tech-led insurance products.

“The online independent fintech industries in India that Policybazaar and Paisabazaar operate in are intensely competitive, enabled by growing digitization of India, shifting governance structures from paper dependent to cloud based, better credit evaluation due to digital consolidation of information and India’s millennials driving digital adoption,” says the DRHP.

Winning this battle will matter more as PolicyBazaar enters a bigger stage - the stock market. As the IPO comes up Dahiya sums up PolicyBazaar’s intent in one line, “The adventures will not go away soon.”

(Edited by : Kanishka Sarkar)

First Published: Aug 6, 2021 3:03 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP spent more than ₹103 crore on Google Ads since May 2018, maximum expenditure on videos

Apr 27, 2024 11:39 AM

Lok Sabha Election Phase 2: Experts decode the key trends and issues in key battleground states

Apr 26, 2024 11:53 PM

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM