DLF, a commercial real estate developer, reported good earnings for the December quarter. The company has clocked in its highest-ever quarterly rental revenue and bookings also look strong with nearly 90 percent from new projects.

Speaking to CNBC-TV18 after the earnings report and 2023 Union Budget announcements, whole-time director Ashok Tyagi said that the new cap on capital gains deduction of Rs 10 crore will not have much impact on DLF sales. However, he acknowledged that the cap may affect sales of super luxury apartments in markets such as Mumbai.

“It could have some bearing, especially on markets, like downtown Mumbai, where a lot of apartments do cost significantly more than Rs 10 crore,” Tyagi said.

This would not be an immediate worry for DLF as the firm does not have any major super luxury projects in the near future. As a result, Tyagi is confident that DLF will be able to comfortably breach their fiscal year 2023 bookings guidance of Rs 8,000 crore.

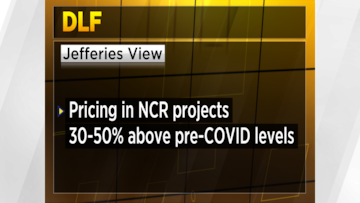

In the last 2-2.5 years, there has been a sharp increase in real estate prices. Despite this trend, Tyagi remains optimistic about DLF's future sales and growth. The company's lack of reliance on super luxury projects and its ability to adapt to changes in the market make it well-positioned for continued success.

“If you are a credible developer, have a good location, have a product which is appealing. You can ask for fairly comfortable pricing levels,” he said.

For more details, watch the accompanying video