1 / 6

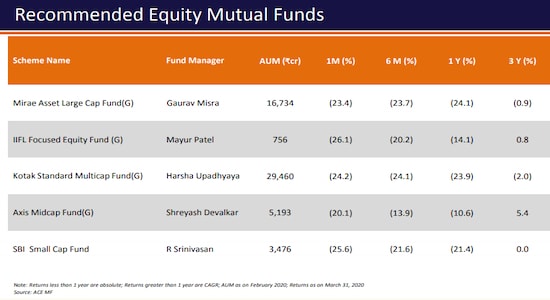

1 / 6Equity Mutual Funds: IIFL recommends Mirae Asset Large Cap Fund, IIFL-focused equity fund, Kotak Standard Multicap Fund, Axis Midcap Fund, and SBI Small Cap Fund in this category.

2 / 6

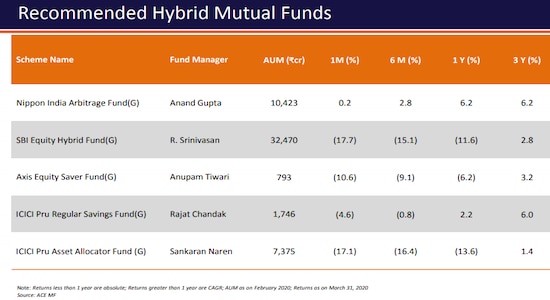

2 / 6Hybrid Mutual Funds: Nippon India Arbitrage Fund, SBI Equity Hybrid Fund, Axis Equity Saver Fund, ICICI Pru Regular Savings Fund, and ICICI Pru Asset Allocator Fund are its top picks.

3 / 6

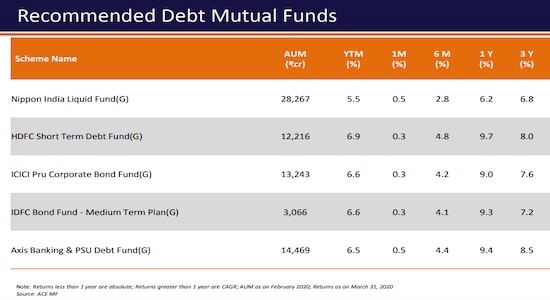

3 / 6Debt Mutual Funds: IIFL suggests that debt investors may consider short to medium duration funds with quality papers. It recommends Nippon India Liquid Fund, HDFC Short Term Debt Fund, ICICI Pru Corporate Bond Fund, IDFC Bond Fund - Medium Term Plan, and IDFC Bond Fund - Medium Term Plan.

4 / 6

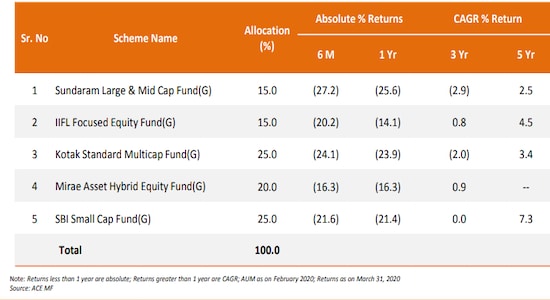

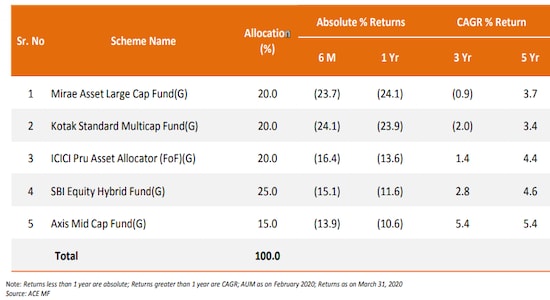

4 / 6Aggressive Model Portfolio: The objective of the strategy is to generate substantial wealth in the long run for investors from a portfolio of aggressive equity-oriented mutual funds. The strategy takes a concentrated position in mutual funds across different market-cap and sectors and endeavors to strategically change allocation between different market-cap and sectors depending on change in the business cycles.

5 / 6

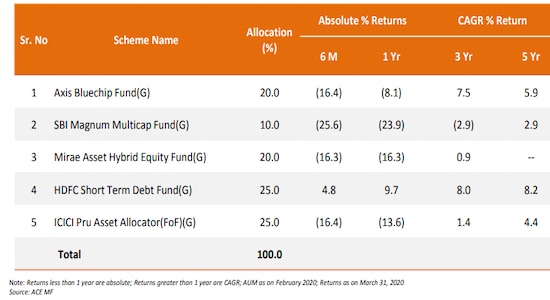

5 / 6Moderate Model Portfolio: The objective of the strategy is to generate long term capital appreciation for investors from a portfolio of equity-oriented mutual funds with moderate risk appetite, primarily to beat inflation without having too much volatility, IIFL noted.

6 / 6

6 / 6Conservative Model Portfolio: The objective of the strategy is to generate long term capital appreciation for investors from a portfolio of equity and debt-oriented mutual funds primarily to avoid any potential loss and preserve capital.