1 / 5

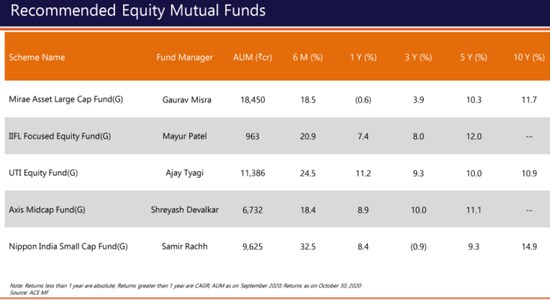

1 / 5Equity Mutual Funds: In this category, IIFL recommends Mirae Asset Large Cap Fund, IIFL-Focused Equity Fund, UTI Equity Fund, Axis Midcap Fund, and Nippon India Small Cap Fund. These funds have given a 5-year return of between 9-12 percent and a six-month return of 18-32.5 percent.

2 / 5

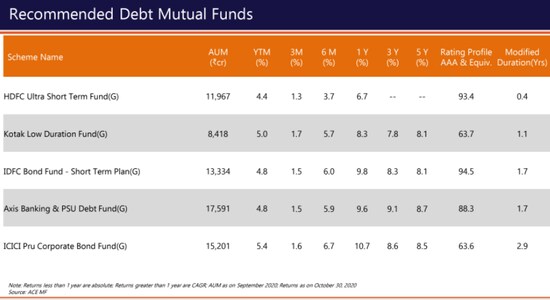

2 / 5Debt Mutual Funds: IIFL recommends HDFC Ultra Short Term Fund, Kotak Low Duration Fund. IDFC Bond Fund- Short Term, Axis Banking & PSU Debt Fund, and ICICI Pru Corporate Bond Fund. All these funds have delivered returns between 6-11 percent in the last one year and have been positive on a 6-month as well as a 3-month basis.

3 / 5

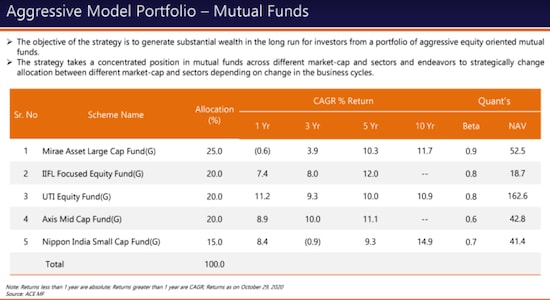

3 / 5Aggressive Model Portfolio: The objective of the strategy is to generate substantial wealth in the long run for investors from a portfolio of aggressive equity-oriented mutual funds. The strategy takes a concentrated position in mutual funds across different market-cap and sectors and endeavors to strategically change allocation between different market-cap and sectors depending on change in the business cycles.

4 / 5

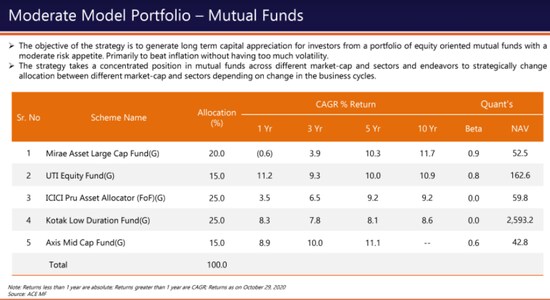

4 / 5Moderate Model Portfolio: The objective of the strategy is to generate long term capital appreciation for investors from a portfolio of equity-oriented mutual funds with moderate risk appetite, primarily to beat inflation without having too much volatility, IIFL noted.

5 / 5

5 / 5Conservative Model Portfolio: The objective of the strategy is to generate long term capital appreciation for investors from a portfolio of equity and debt-oriented mutual funds primarily to avoid any potential loss and preserve capital.