1 / 5

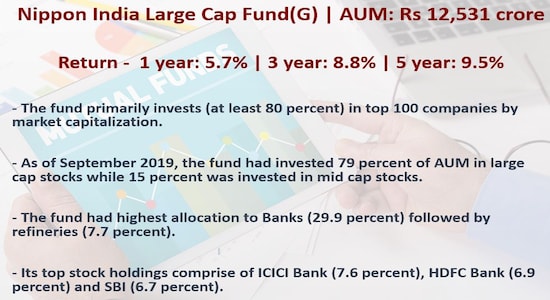

1 / 5Nippon India Large Cap Fund(G): The key objective of this scheme is to generate long term capital appreciation by investing predominantly into equity and equity-related instruments of large-cap companies. The scheme also aims to generate consistent returns by investing in debt, money market securities, REITs and InvITs. As per IIFL, this open-ended fund is suitable for investors who have moderately high-risk appetite with an investment horizon of at least 3 years.

2 / 5

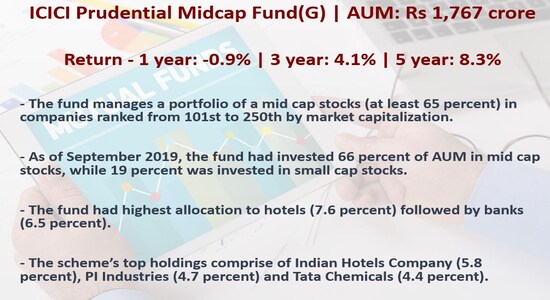

2 / 5ICICI Prudential Midcap Fund(G): The fund looks to identify and invest in growing companies that have significant room for value unlocking. Management integrity is also a key criterion while screening stocks for investing. As per IIFL, this fund is suitable for investors who have moderately high-risk appetite with an investment horizon of at least 5 years.

3 / 5

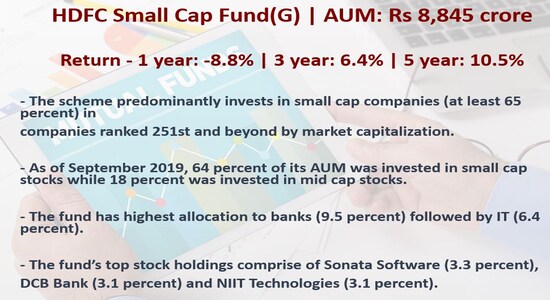

3 / 5HDFC Small Cap Fund(G): It focuses on the companies which have reasonable growth

prospects, sound financials, sustainable business model and acceptable valuations that offer scope for capital appreciation. This scheme is relevant for investors who have high-risk appetite with an investment horizon of at least 7 years, said IIFL.

4 / 5

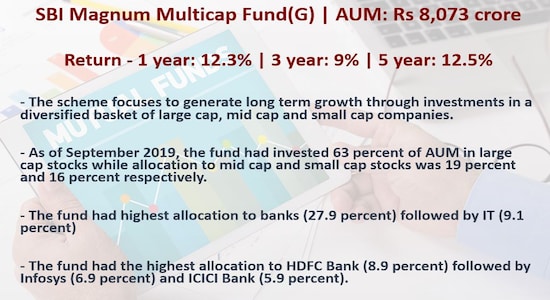

4 / 5SBI Magnum Multicap Fund(G): This fund invests at least 65 percent of its AUM in equity and equity-related instruments across the market capitalization and rest

in debt and money market instruments. It follows a bottom-up approach to stock picking and selects companies across sectors and styles. Investors with moderately high-risk appetite with a time horizon of at least 5 years, can look to invest in this open-ended scheme, said IIFL.

5 / 5

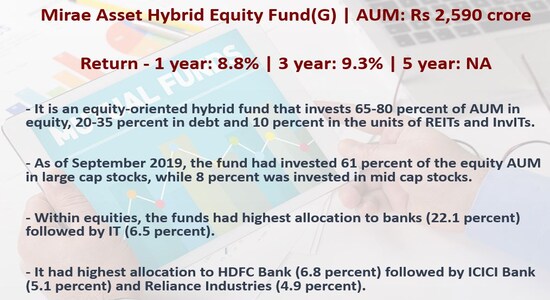

5 / 5Mirae Asset Hybrid Equity Fund(G): For equities, it focuses to identify high growth companies available at a reasonable valuation while for debts the key focus is on

Government securities and highly rated PSUs and corporates. This (aggressive) Hybrid category fund is suitable for investors with moderately high-risk appetite with at least 3 years of investment horizon, said IIFL.