1 / 6

1 / 6Fine Organic Industries: The initial public offering (IPO) of Fine Organic Industries opened for subscription on June 20, 2018, with a price band of Rs 780-783 per share. The issue closed on June 22, 2018, and was subscribed nearly 9 times. From the issue price of Rs 783, the stock has risen 89 percent as of Tuesday's close. The chemicals firm eyed 25 percent stake sale or 7,664,994 equity shares of face value of Rs 5 each.

2 / 6

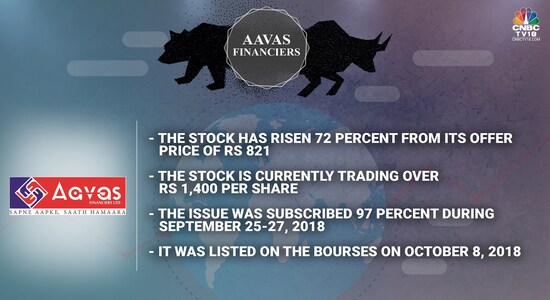

2 / 6AAVAS Financiers: The Rs 1,734-crore IPO of AAVAS Financiers was subscribed 97 percent during September 25-27, 2018, amid challenging stock market conditions for the entire non-banking finance companies (NBFC) sector post the IL&FS crisis. The price band for the offer was fixed at Rs 818-821 per share. From the issue price of Rs 821, the stock has risen 72 percent as of Tuesday's close.

3 / 6

3 / 6HDFC AMC: The IPO of HDFC Asset Management (HDFC AMC) opened on July 25, 2018, and closed on July 27, 2018. HDFC AMC IPO offered up to 2.54 crore equity shares and raised Rs 2,800 crore through the offering. The offer was subscribed 83 times and was listed on August 6, 2018. The fund house’s two biggest shareholders — mortgage lender Housing Development Finance Corp Ltd and Standard Life — sold 12 percent stake in the IPO. From the issue price of Rs 1,100, the stock has risen 67.3 percent as of Tuesday's close.

4 / 6

4 / 6RITES: The company’s Rs 466-crore IPO, which ran between June 20, 2018, and June 22, 2018, was subscribed 67 times with a price band of Rs 180-185 apiece. It was the first state-owned company to hit the IPO market in FY19. It was listed on July 3, 2018. From the issue price of Rs 185, the stock has risen 48.7 percent as of Tuesday's close.

5 / 6

5 / 6Neogen Chemicals: Specialty chemical maker Neogen Chemicals opened its initial public offer for subscription on April 24, 2019, and closed on April 26, 2019. The Rs 132-crore public offer was subscribed 41.18 times. It received bids for 17.82 crore equity shares against the total IPO size of 43.29 lakh shares. The price range for the offer, which listed on May 7, 2019, was fixed at Rs 212-215 per share. From the issue price of Rs 215, the stock has risen 43 percent as of Tuesday's close.

6 / 6

6 / 6Rail Vikas Nigam: The IPO of Rail Vikas Nigam — a project executing agency of Ministry of Railways — was launched for subscription on March 29, 2019. The issue raised about Rs 481 crore with a price band of Rs 17-19 per share. Post the issue, the government cut its stake in the company by 12.2 percent. The issue was subscribed 1.78 times and closed on April 3, 2019. From the issue price of Rs 19, the stock has risen 37.8 percent as of Tuesday's close.