1 / 5

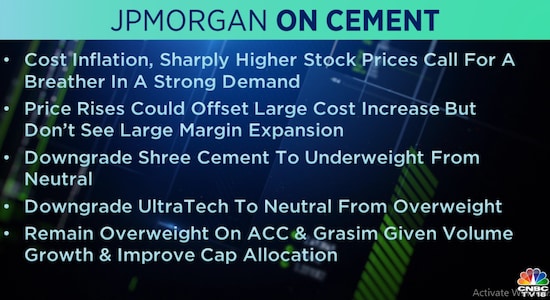

1 / 5JPMorgan on Cement: As per the brokerage, cost inflation, sharply higher stock prices call for a breather in a strong demand cycle. It downgraded Shree Cement and UltraTech Cement but remains 'overweight' on ACC and Grasim.

2 / 5

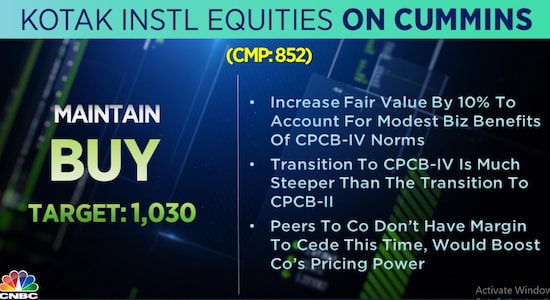

2 / 5Kotak on Cummins: The brokerage maintains a 'buy' call on the stock with the target at Rs 1,030 per share. It added that the peers of the firm don't have the margin to cede this time which would boost the company's pricing power.

3 / 5

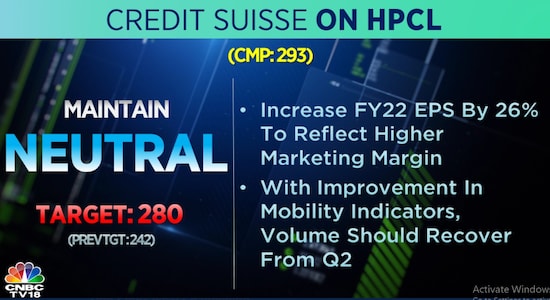

3 / 5Credit Suisse on HPCL: The brokerage is 'neutral' on the stock but raised the target to Rs 280 per share from Rs 242 earlier. It also increased FY22 EPS for HPCL by 26 percent to reflect a higher marketing margin.

4 / 5

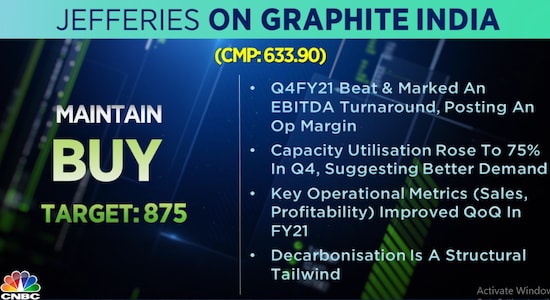

4 / 5Jefferies on Graphite India: The brokerage has a 'buy' call on the stock with the target at Rs 875 per share. It is bullish after a strong Q4 performance; says decarbonisation is a structural tailwind.

5 / 5

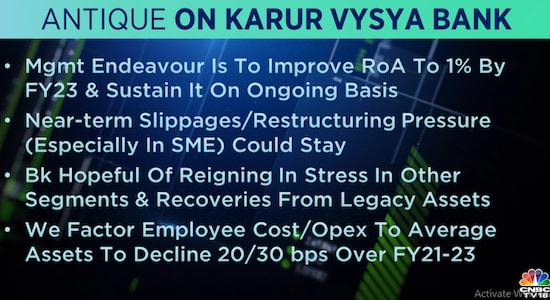

5 / 5Antique on Karur Vysya Bank: Antique interacted with Karur Vysya Bank's MD & CEO Ramesh Babu along with other senior management. As per the brokerage, the management endeavor is to improve RoA to 1 percent by FY23 and sustain it on an ongoing basis.