1 / 8

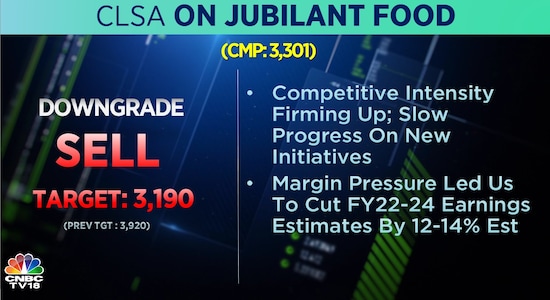

1 / 8CLSA on Jubilant FoodWorks | The brokerage downgraded the stock to 'sell' and reduced its target price to Rs 3,190 from Rs 3,920. CLSA also lowered its FY22-FY24 earnings estimates for Jubilant FoodWorks by 12-14 percent citing margin pressure.

2 / 8

2 / 8Citi on HDFC | The brokerage maintained its 'buy' rating on the stock with a target price of Rs 3,300. Citi lowered its FY22 estimate for HDFC by two percent and raised the FY23 estimate by one percent.

3 / 8

3 / 8Morgan Stanley on Tata Consumer | The brokerage retained its 'overweight' rating on Tata Consumer Products with a target price of Rs 886. The company's Q3 results marginally missed consensus estimates, but its volume growth as innovations in the Sampann portfolio are encouraging, according to Morgan Stanley.

4 / 8

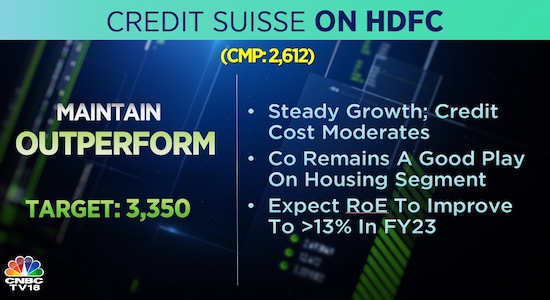

4 / 8Credit Suisse on HDFC | The brokerage has maintained an 'outperform' call on HDFC with a target price of Rs 3,350. Credit Suisse believes HDFC remains a good play on the housing segment, and expects its return on equity (RoE) to improve to more than 13 percent in FY23.

5 / 8

5 / 8Citi on Jubilant FoodWorks | The brokerage has continued with a 'buy' call on the stock but reduced its target price to Rs 4,350 from Rs 4,750. The company's margin is health despite COVID restrictions impacting its revenue, according to Citi.

6 / 8

6 / 8CLSA on Zee Entertainment Enterprises | The brokerage has maintained a 'buy' call on Zee with a target price of Rs 427. The media company's Q3 revenue, led by ad revenue, is in line with estimates and its merger with Sony is seeing steady progress, according to CLSA.

7 / 8

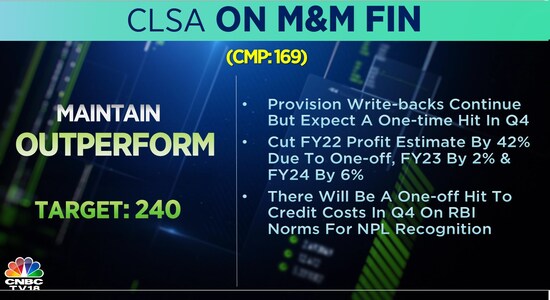

7 / 8CLSA on M&M Finance | The brokerage has retained an 'outperform' rating on M&M Finance with a target price of Rs 240. CLSA has, however, lowered its FY22-FY24 estimates for the company by 2-42 percent. There will be a one-off hit in the form of credit costs in Q4 on account of the RBI's norms for the recognition of NPLs.

8 / 8

8 / 8CLSA on BPCL | The brokerage has maintained a 'buy' rating on BPCL but brought down its target price to Rs 480 from Rs 510. The company's falling market share in diesel is a concern and the timeline for privatisation unclear, according to CLSA.