1 / 9

1 / 9JPMorgan on BPCL: The brokerage is 'overweight' on the stock with a target at Rs 550 per share. Large 0ne-time dividend main highlight of a strong quarter, it added.

2 / 9

2 / 9Jefferies on BPCL: The brokerage has a 'buy' call on the stock with the target raised to Rs 520 per share. It added that the core EBITDA was in line with estimates, with inventory gains driving a large beat. IT further said that marketing profitability will be restored as retail price hikes continue.

3 / 9

3 / 9Morgan Stanley on BPCL: The brokerage is 'overweight' on the stock with a target at Rs 480 per share. It said that retail fuel hikes and dividend drives positive stance for the OMC.

4 / 9

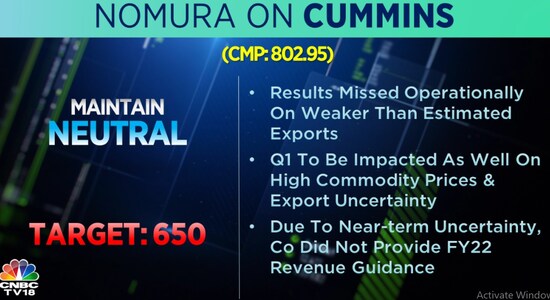

4 / 9Nomura on Cummins: The brokerage is 'neutral' on the stock with a target at Rs 650 per share. It added that March quarter results missed estimates operationally on weaker than estimated exports.

5 / 9

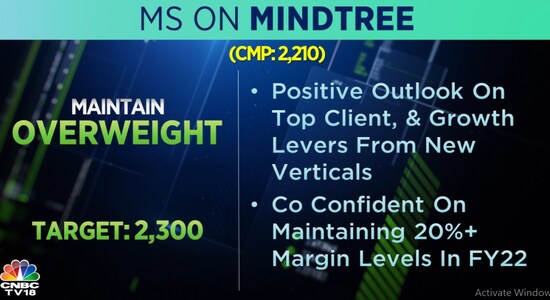

5 / 9Morgan Stanley on Mindtree: The brokerage is 'overweight' on the stock with a target at Rs 2,300 per share. It has a positive outlook on the back of top client and growth levers from new verticals.

6 / 9

6 / 9Macquarie on Mindtree: The brokerage is 'neutral' on the stock with a target at Rs 2,000 per share. It said that calibrated approach on geo expansion, vertical addition continues.

7 / 9

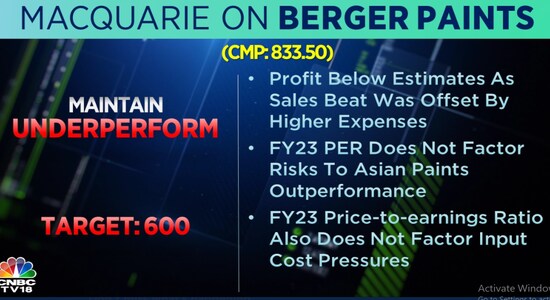

7 / 9Macquarie on Berger Paints: The brokerage has an 'underperform' call on the stock with a target at Rs 600 per share. Profit was below estimates as sales beat was offset by higher expenses, added the brokerage.

8 / 9

8 / 9CLSA on Tata Motors: The brokerage has a 'buy' call on the stock with a target at Rs 450 per share. It notes that JLR is beginning to outperform its peer and estimates JLR's overall April retail sales grew 150 percent YoY.

9 / 9

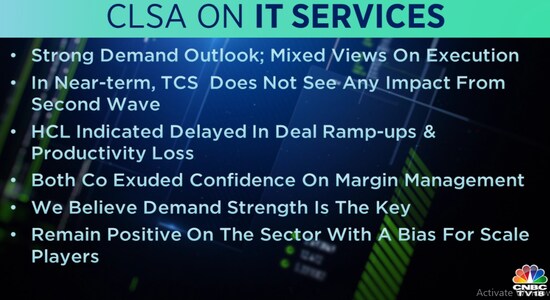

9 / 9CLSA on IT services: The brokerage noted that the strong demand outlook for IT services space, has mixed views on execution. It is positive on the IT services sector with a bias for scale players.