1 / 11

1 / 11CLSA on Bharti Airtel: The brokerage has raised its target price on Bharti Airtel from Rs 630 to Rs 680 per share.

2 / 11

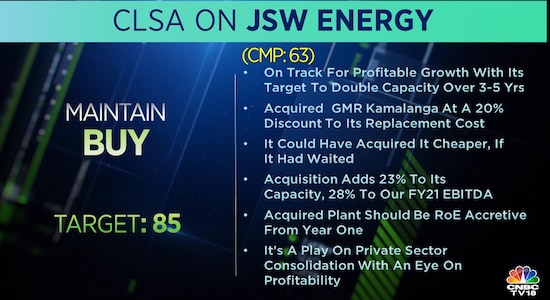

2 / 11CLSA on JSW Energy: The brokerage maintains 'buy' call on JSW Energy at a target price of Rs 85 per share. CLSA says the company is on track for profitable growth with its target to double its capacity over 3-5 years.

3 / 11

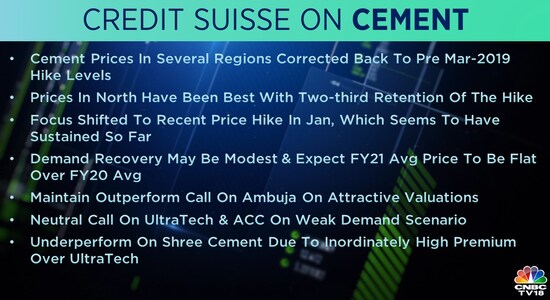

3 / 11Credit Suisse on Cement: Global brokerage notes that cement prices in several regions corrected back to pre-March 2019 hike levels and that prices in the North have been best with 2/3rd retention of the hike. Credit Suisse has maintained 'outperform' call on Ambuja, 'neutral' on UltraTech and ACC and 'underperform' on Shree Cement.

4 / 11

4 / 11Credit Suisse on JSW Steel: The brokerage maintains 'outperform' call on JSW Steel, sets a target price at Rs 320 per share.

5 / 11

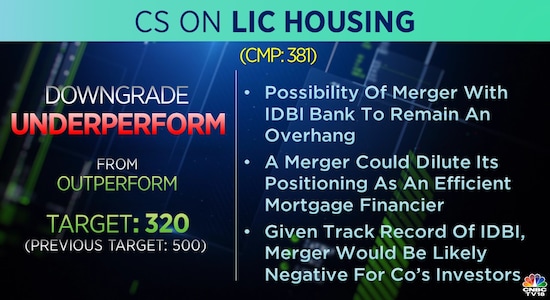

5 / 11Credit Suisse on LIC Housing: The global brokerage has downgraded LIC Housing Finance to 'underperform' from 'outperform'. Credit Suisse says the possibility of a merger with IDBI Bank will remain an overhang on the stock.

6 / 11

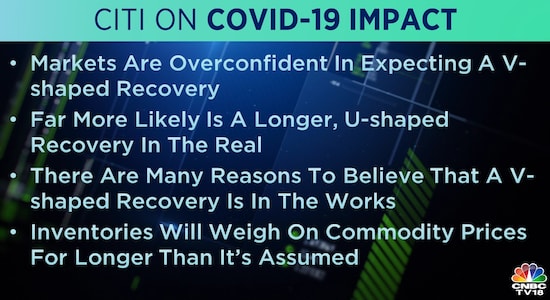

6 / 11Citi on COVID-19 Impact: The brokerage says a longer, U-shaped recovery is more likely than a V-shaped recovery as inventories will weigh on commodity prices for longer than it is assumed.

7 / 11

7 / 11Credit Suisse Market Strategy: The global brokerage prefers ICICI Bank, SBI amongst banks, Power Grid in utilities, Tech Mahindra in IT and Bharti Airtel in Telecom.

8 / 11

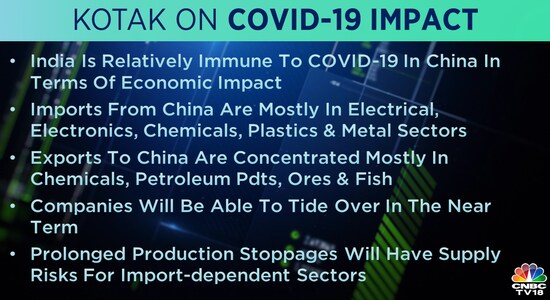

8 / 11Kotak Institutional Equities on COVID-19 Impact: The brokerage says prolonged production stoppages because of coronavirus will have supply risks for import-dependent sectors.

9 / 11

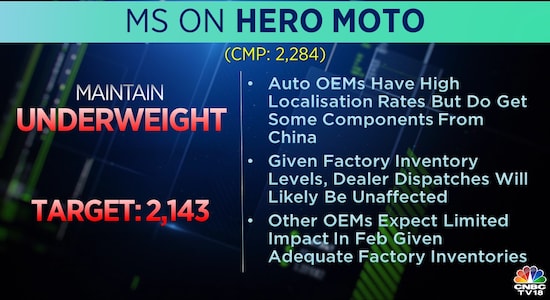

9 / 11Morgan Stanley on Hero MotoCorp: The global brokerage maintains 'underweight' call on Hero MotoCorp at a target price of Rs 2,143 per share.

10 / 11

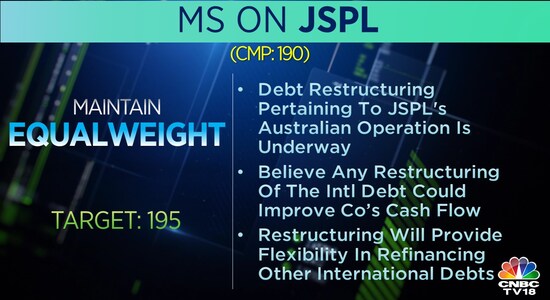

10 / 11Morgan Stanley on JSPL: The global brokerage believes any restructuring of the international debt could improve the company's cash flow. Morgan Stanley maintains 'equal-weight' stance on JSPL at a target price of Rs 195 per share.

11 / 11

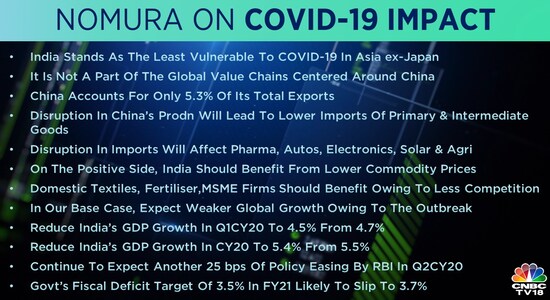

11 / 11Nomura on COVID-19 Impact: The global brokerage says India stands as the least vulnerable to coronavirus (COVID-19) in Asia ex-Japan. Nomura says disruption in imports will affect pharma, autos, electronics, solar and agri sectors. But India could benefit from lower commodity prices.