1 / 8

1 / 8Maruti Suzuki India: The stock has made trend line breakouts with supportive volumes. Technical indicators MACD and the demand and the average directional indices look positive. Buying is recommended around Rs 7,485 for targets of Rs 10,000, Rs 12,000 and Rs 14,000 with a stop loss at Rs 6,740. (Analyst: Bharat Gala, Ventura Securities)

2 / 8

2 / 8Solar Industries: The price appears to be in strong bullish momentum for the past 10 days and has given a fresh close above the major supply area of Rs 2,740-2,790. If it takes out the Rs 2,880 level on the intraday chart with enough volumes, a strong upmove can be expected in the coming days. One can buy Solar Industries shares at Rs 2,880 for a target price of Rs 2,970 with a stop loss at Rs 2,800. (Analyst: Vijay Dhanotiya, CapitalVia Global Research)

3 / 8

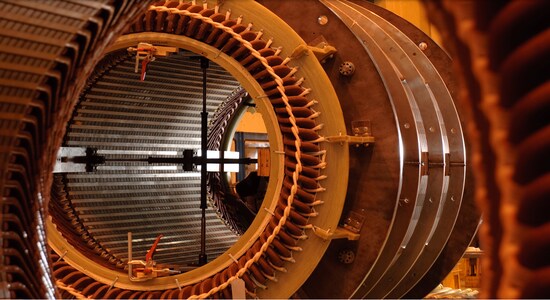

3 / 8TD Power Systems: The stock has continuously taken support of its averages with a super trend positive since September 2020. It has since traded in a narrow weekly range, making a high of Rs 414 with supportive volumes. Technical indicators MACD, vortex and the demand index appear to be positive. One can buy the TD Power Systems stock around Rs 339 for a target of Rs 650 with a stop loss at Rs 290. (Analyst: Bharat Gala, Ventura Securities)

4 / 8

4 / 8Zee Entertainment: The stock has broken out of a resistance patch of Rs 178-179 along with good volumes. There could be a selling patch around Rs 193-194 but the short-term trend remains positive. Buying is recommended for a target price of Rs 200 with a stop loss at Rs 175. (Analyst: Manish Hathiramani, Deen Dayal Investments)

5 / 8

5 / 8Elecon Engineering Company: A technical correction has followed a significant run from May to September, with the stock hitting a low of Rs 142 in October. Value buying since has pushed the stock above the averages. The 200-day moving average is continuously in a rising mode. Buying is advised around Rs 166 for a target price of Rs 275-300 with a stop loss at Rs 140. (Analyst: Bharat Gala, Ventura Securities)

6 / 8

6 / 8Rajesh Exports: The stock has given a strong breakout on the daily chart with strong volumes. If the price sustains the Rs 743 level, a good upmove can be expected in the stock. One can buy Rajesh Exports shares at Rs 743 for a target price of Rs 785 with a stop loss at Rs 712. (Analyst: Vijay Dhanotiya, CapitalVia Global Research)

7 / 8

7 / 8Hero MotoCorp: The stock has formed a good base at Rs 2,600-2,650 levels, and taken out resistance at Rs 2,750 with active volumes. One can buy the Hero MotoCorp stock for target price of Rs 2,905 with a stop loss at Rs 2,700. (Analyst: Manish Hathiramani, Deen Dayal Investments)

8 / 8

8 / 8 Birlasoft: The stock has traded above the averages between March 2020 and September 2021 with a positive super trend. It has given a weekly candle breakout with supportive volumes. Technical indicators such as ROC, vortex and the demand index suggest a possible upmove. Buying is recommended around Rs 453 for a target of Rs 600-800 with a stop loss at Rs 380. (Analyst: Bharat Gala, Ventura Securities)

Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.