1 / 11

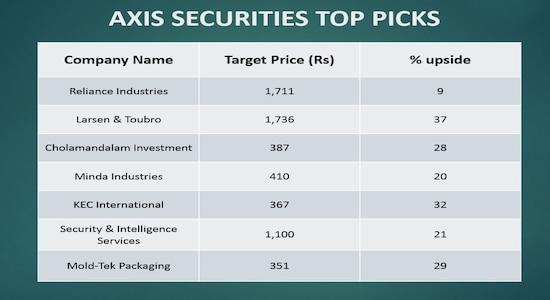

1 / 11Axis Securities: The brokerage expects the coming year to be good for equity investments especially the midcaps following the aggressive roadmap of reforms undertaken by the government.

2 / 11

2 / 11ICICI Direct: The brokerage expects Nifty earnings to stage a smart recovery, growing at a CAGR of 18 percent over FY19-21E. Outperformance in forward earnings (FY19-21E) is expected to be driven by the BFSI space. It values the Nifty at 13,150 and its corresponding target for the Sensex is at 43,000.

3 / 11

3 / 11HDFC Securites: As per the brokerage, Indian stock markets look more polarised as the incremental inflows are mostly chasing less than a dozen stocks. The reason for this ‘passive flight to safety’ mainly includes a decline in macro growth as core indicators are mostly struggling, it said.

4 / 11

4 / 11Religare Broking: The brokerage believes that 2020 could see strong outperformance from mid and small-cap stocks. However, it does not expect the rally to be broad-based as seen in 2017 and recommend investors to remain selective in this space and stick with quality names with strong corporate governance and sound fundamental track record.

5 / 11

5 / 11SMC Global: For 2020, the brokerage advises investors to keep on booking profits and remain invested in the market. Its yop picks include ICICI Bank, Bajaj Auto, Bank of Baroda, Gujarat Gas, KEC International, Inox Leisure, JB Chemicals & Pharma.

6 / 11

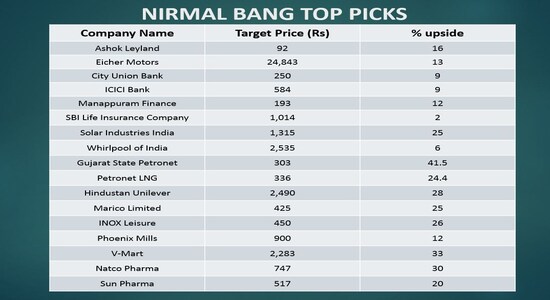

6 / 11Nirmal Bang: The brokerage is bullish on Ashok Leyland and Eicher Motors from the auto sectors. In the banking and financial space, it likes City Union Bank, ICICI Bank, Manappuram Finance, and SBI Life. From the FMCG sector, the brokerage's top picks are Marico and HUL, and Natco Pharma, Sun Pharma from the pharma index.

7 / 11

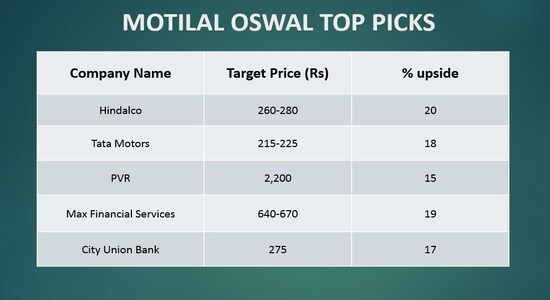

7 / 11Motilal Oswal: The brokerage is positive on Hindalco, Tata Motors, PVR, Max Financial Services, and City Union Bank for next year.

8 / 11

8 / 11Citi Largecap: The brokerage expects the macro recovery to be protracted and see the earnings expectations as high. Valuations remain expensive in the historical context, hence upsides will be limited, it said.

9 / 11

9 / 11Citi Midcap: According to the broekrage, returns have been concentrated in multiple major markets – not only India. However, several midcaps have also done well and the primary theme has been earnings visibility – Citi expects that to continue in the near-term.

10 / 11

10 / 11India Nivesh: The brokerage is positive on 10 stocks from both the largecap and midcap space including SBI, Dr Reddy's, RBL Bank, V-Mart, UltraTech Cement, and ICICI Bank. The brokerage, however, is negative on Eicher Motors, InterGlobe Aviation, Maruti Suzuki, and VA Tech Wabag in 2020.

11 / 11

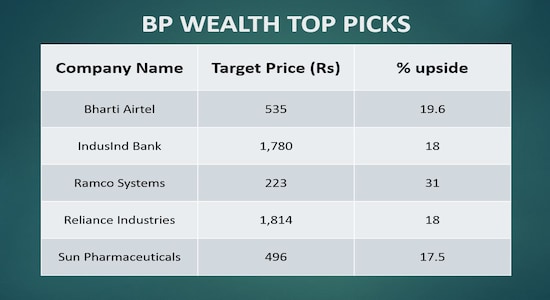

11 / 11BP Wealth: The brokerage is bullish on Bharti Airtel, IndusInd Bank, Ramco Systems, Reliance Industries, and Sun Pharma.