1 / 6

1 / 6Credit Suisse on Asian Paints: The brokerage has an 'outperform' call on the stock and raised its target price to Rs 3,000 per share from Rs 2,425 earlier. It also increased FY21-23 EPS estimates by 4-14 percent and target multiple to 62x.

2 / 6

2 / 6Morgan Stanley on Asian Paints: The brokerage is 'overweight' on the stock with a target at Rs 3,000 per share. A new pandemic-fueled renovation cycle seems to be setting in for Asian Paints, said MS, adding that strong management commentary supports its overweight thesis.

3 / 6

3 / 6CLSA on Asian Paints: The brokerage is 'overweight' on the stock with a target at Rs 2,950 per share. It has had a strong start in the home decor segment and continues to see significant value creation optionality, said CLSA, and lifted FY21-22 estimates by 4-10 percent.

4 / 6

4 / 6CLSA on Bandhan Bank: The brokerage downgraded the stock to 'outperform' from 'buy' and cut its target to Rs 390 per share from Rs 430 earlier. It said profit missed estimate by 20 percent primarily due to a higher-than-expected credit cost.

5 / 6

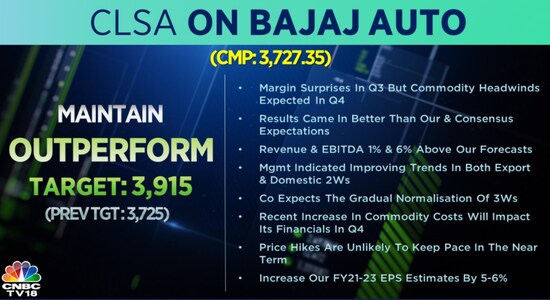

5 / 6CLSA on Bajaj Auto: The brokerage maintains an 'outperform' rating on the stock and raised its target to Rs 3,915 per share from Rs 3,725 earlier. Bajaj Auto’s Q3 margin surprised CLSA but commodity headwinds are expected in Q4. It says results came in better than expectations and increased its FY21-23 EPS estimates by 5-6 percent.

6 / 6

6 / 6CLSA on Westlife: The brokerage has a 'buy' call on the stock and raised its target to Rs 555 from Rs 525 earlier. With a recovery, Westlife Development’s vision 2022 margin targets can be achieved ahead of time, noted CLSA, adding that convenience channels have seen an accelerated recovery.