1 / 13

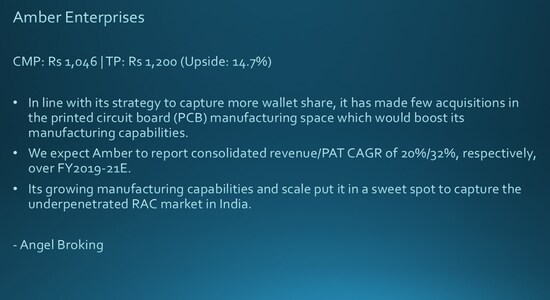

1 / 13Amber Enterprises India is the market leader in the room air conditioners outsourced manufacturing space in India. It is a one-stop solutions provider for the major brands in the RAC industry and currently serves eight out of the ten top RAC brands in India.

2 / 13

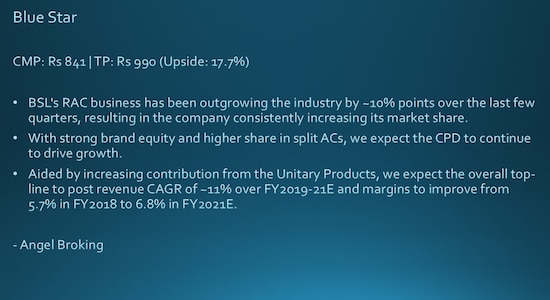

2 / 13Blue Star is one of the largest air-conditioning companies in India. With a mere 3% penetration level of ACs vs 25% in China, the overall outlook for the room air-conditioner market in India is favourable.

3 / 13

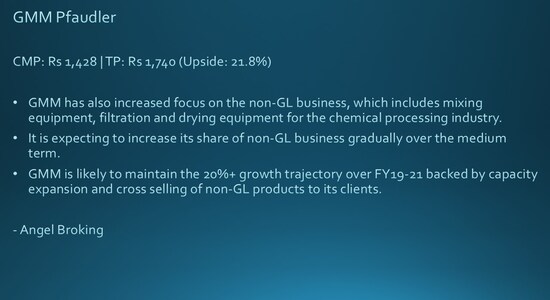

3 / 13GMM Pfaudler (GMM) is the Indian market leader in glass-lined (GL) steel equipment used in corrosive chemical processes of agrochemicals, specialty chemical and pharma sector. The company is seeing strong order inflow from the user industries which is likely to provide 20%+ growth outlook for the next couple of years.

4 / 13

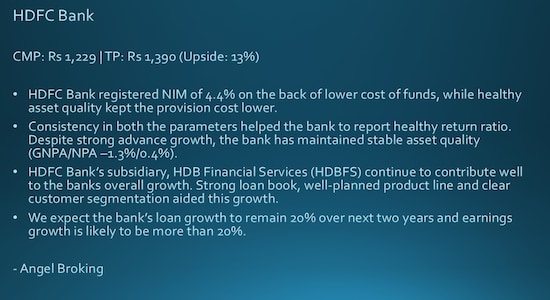

4 / 13HDFC Bank has planned to improve business with digital platforms and is engaging with mid-market clients. Its next leg of growth road map includes (1) increasing branch opening number from 300 current to 600 annually in non-urban area, (2) increase point of sale (POS) 4x to 4mn by FY2021 and double the virtual relationship manager clients in 3 years.

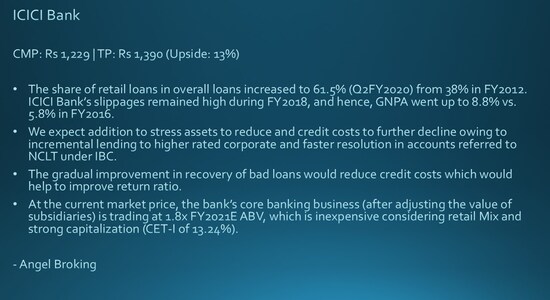

5 / 13

5 / 13ICICI Bank has taken a slew of steps to strengthen its balance sheet viz measures like incremental lending to higher-rated corporate, reducing concentration in few stressed sectors and building up the retail loan book.

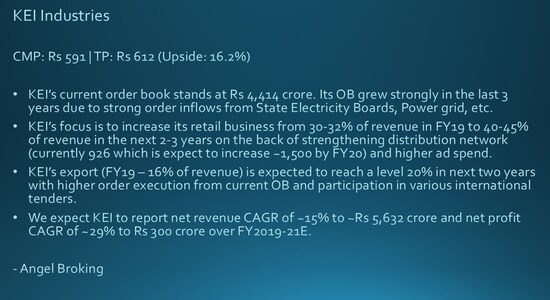

6 / 13

6 / 13KEI Industries

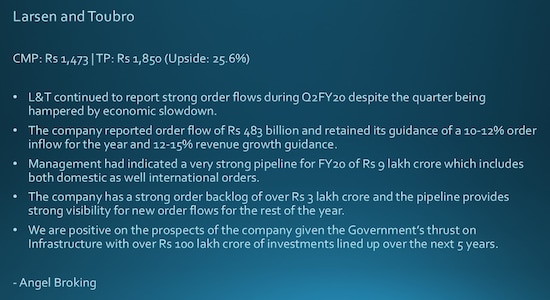

7 / 13

7 / 13L&T is India’s largest EPC company with strong presence across various verticals including Infra, Hydrocarbon and services segment. The company also has a very strong presence in the IT services and NBFC space through its various subsidiary companies which are also growth drivers for the company.

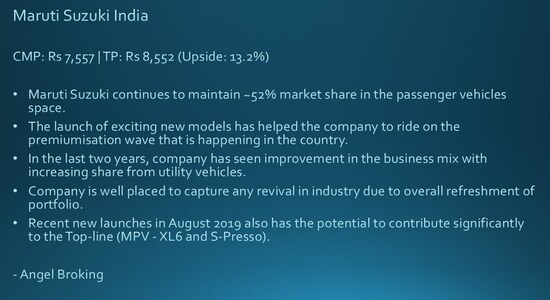

8 / 13

8 / 13Maruti Suzuki continues to maintain a 52% market share in the passenger vehicles space. The launch of exciting new models has helped the company to ride on the premiumization wave that is happening in the country. In the last two years, the company has seen improvement in the business mix with increasing share from utility vehicles.

9 / 13

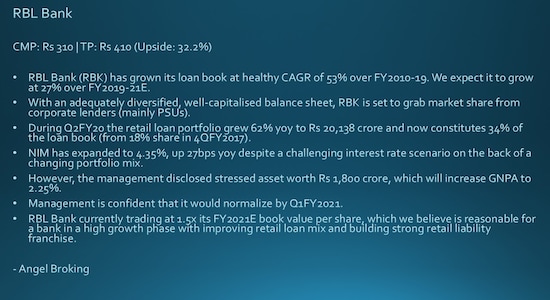

9 / 13RBL Bank (RBK) has grown its loan book at healthy CAGR of 53% over FY2010-19. We expect it to grow at 27% over FY2019-21E. With an adequately diversified, well-capitalised balance sheet, RBK is set to grab market share from corporate lenders (mainly PSUs).

10 / 13

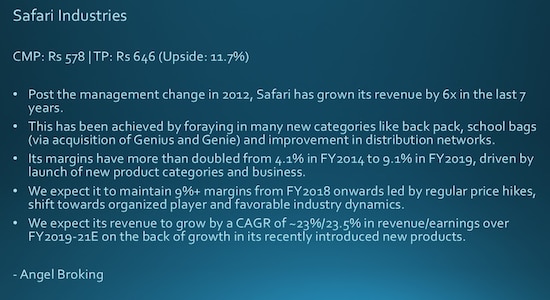

10 / 13Safari Industries is the third-largest branded player in the Indian luggage industry. Post the management change in 2012, Safari has grown its revenue by 6x in the last 7 years.

11 / 13

11 / 13SHTF's primary focus is on financing pre-owned commercial vehicles. We expect AUM growth to improve going ahead led by (1) good monsoon, (2) pick-up in infra/construction, (3) ramping up in rural distribution.

12 / 13

12 / 13TTK Prestige (TTK) is the leading brands in kitchen appliances with 40%+ market share in the organised market.

13 / 13

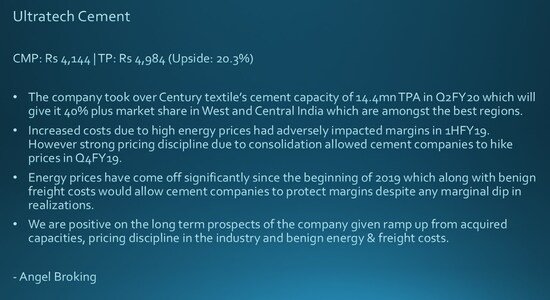

13 / 13Ultratech Cement is India’s largest cement manufacturer with ~100mn TPA of capacity spread across the country with a strong presence in Central, North, and West India.