1 / 10

1 / 101. Asia: Stocks in Asia Pacific rose in Friday morning trade as the coronavirus situation stateside continues to be monitored by investors amid concerns with cases continuing to surge. In Japan, the Nikkei 225 rose 0.88 percent as shares of conglomerate Softbank Group jumped more than 1 percent while the Topix index shed 0.71 percent. South Korea’s Kospi also added 0.91 percent. Meanwhile, shares in Australia traded higher, with the S&P/ASX 200 up 0.52 percent. Overall, the MSCI Asia ex-Japan index traded 0.34 percent higher. Markets in China are closed on Friday for a holiday. (Image: AP)

2 / 10

2 / 102. US: U.S. stock futures slipped on Thursday night following the release of the Federal Reserve’s latest bank stress-test results and disappointing quarterly numbers out of Nike. Dow Jones Industrial Average futures dipped 89 points, or 0.4 percent. S&P 500 fell marginally and Nasdaq-100 futures were flat. The Fed’s annual stress test of the major banks shows some banks could get close to minimum capital levels in scenarios related to the coronavirus pandemic. Because of this, banks must suspend share repurchase programs and keep dividend payments at current levels for the third quarter. (Image:AP)

3 / 10

3 / 103. Market At Close On Thursday: Indian stocks swung between gains and losses on Thursday after the International Monetary Fund (IMF) slashed its growth outlook for the country and forecast a deeper global recession. However, gains in consumer and financial stocks offset the losses. The Sensex ended 27 points lower at 34,842 while the Nifty ended 16 points lower to settle at 10,289. Meanwhile, the Nifty Midcap and Nifty Smallcap indices also rose 0.9 percent and 0.6 percent, respectively. (Image: Reuters)

4 / 10

4 / 104. Crude Oil: Oil prices rose in early trade on Friday, extending gains from the previous day on optimism about recovering fuel demand worldwide, despite surges in coronavirus infections in some U.S. states and indications of a revival in U.S. crude production. U.S. West Texas Intermediate (WTI) crude futures gained 15 cents, or 0.4 percent, to $38.87 at 0009 GMT but were on track for a slight drop for the week. Brent crude futures rose 22 cents, or 0.5 percent, to $41.27, but were also heading towards a decline for the week. (image: Reuters)

5 / 10

5 / 105. Rupee Close: The rupee erased its initial losses to close 7 paise higher at 75.65 against the US dollar on Thursday tracking positive domestic equities, lower crude prices and foreign fund inflows. Forex traders said the rupee traded in a narrow range as gains in domestic equities, easing crude oil prices and foreign fund inflows supported the market, while strong US dollar and rising coronavirus cases weighed on investor sentiments. (Image: Reuters)

6 / 10

6 / 106. Indian Railways Cancels All Regular Trains Till August 12: All regular mail, express and passenger services as well as suburban trains have been cancelled till August 12, the Railway Board said on Thursday. Sources said that the decision was taken keeping in mind the increasing number of coronavirus cases in the country. However, all special trains -- 12 pairs running on the Rajdhani routes since May 12 and 100 pairs operating since June 1 -- will continue, they said. The limited special suburban services which began recently in Mumbai to ferry essential services personnel identified by the local authorities will also continue to run, officials said. (Image: PTI)

7 / 10

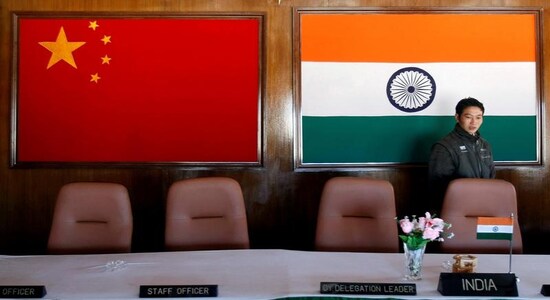

7 / 107. India-China Border Tense As Both Countries Send Additional Troops: India and China on Wednesday agreed to ensure expeditious implementation of the understanding on disengagement of troops from eastern Ladakh as decided in a meeting of senior military commanders on June 6, the Ministry of External Affairs said. The two sides held diplomatic talks through video conference on the border standoff in midst of fresh details emerging that China has strengthened its position in several areas in eastern Ladakh including Galwan Valley. People aware of the development said China has significantly ramped up its military presence in several other key sectors along the Line of Actual Control in Arunachal Pradesh, Sikkim and Uttarakhand. (Image: Reuters)

8 / 10

8 / 108. Piyush Goyal To Meet Top Trump Administration: India and the US will restart high level negotiations on a trade pact in the coming days, Commerce Minister Piyush Goyal said on June 25. He will engage with industry captains from both countries in mid-July, and will hold discussions with US Commerce Secretary Wilbur Ross. Both countries have been negotiating a limited trade pact to enhance market access for over a year now. The minister said that he is in regular dialogue with US Trade Representative (USTR) and US Commerce Secretary Wilbur Ross. (Image: PTI)

9 / 10

9 / 109. IMF Flags Risks As Disconnect Between Markets, Economy Widens: The disconnect between the real economy and financial markets has become more apparent in the recent months since the spread of the COVID-19 pandemic. After a sharp decline immediately after the spread of the pandemic, equity markets have rallied back, not just in India, but around the world. In its latest Global Financial Stability report, the International Monetary Fund (IMF) explains this tug of war between the real economy and financial markets. “Investors seem to be betting that lasting strong support from central banks will sustain a quick recovery even as economic data point to a deeper-than-expected downturn,” IMF said in its blog accompanying the report. (Image: Reuters)

10 / 10

10 / 1010. Customs Duty On Solar Equipment To Boost Manufacturing: Even as the decision to impose basic custom duty on solar equipment is likely to boost domestic manufacturing, the move can be counter productive for manufacturers who have set up facilities in SEZs unless they are treated at par with units in the domestic tariff areas, industry players say. Power and New & Renewable Energy Minister R K Singh on Thursday said his ministry has proposed to impose basic custom duty (BCD) from August 1, this year on solar equipment, including cells, modules and inverters, in the range of 15-20 percent in the first year, which would eventually increase up to 40 per cent. (Image Source: Chief Executive Officer KSPDCL)