1 / 8

1 / 8Nearly two-thirds of the 20 fund managers and market experts polled by CNBC-TV18 continue to maintain that equities is the best asset class to invest in for Samvat 2080 as well. The poll also highlights where will the Nifty 50 be at the end of the new Samvat. Nearly 60% of those polled see the index to be anywhere between 21,000 to 22,000. Here's a look at the questions we asked the fund managers and market experts:

2 / 8

2 / 8As we highlighted earlier, while most of the fund managers believe that equities still is the best asset class, some have also chosen to prefer bonds, fixed income and even Gold. The yellow metal had gained 18% suring Samvat 2079.

3 / 8

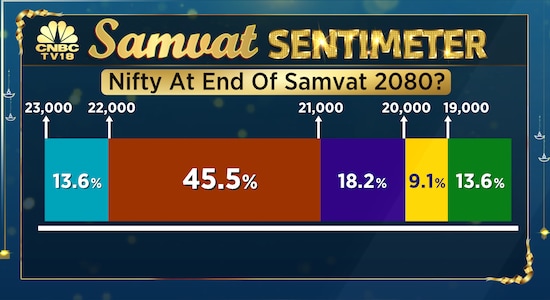

3 / 8Nearly half of the fund managers polled by CNBC-TV18 are expecting the Nifty 50 to be in the 21,000 - 22,000 range by the end of the new Samvat. Nearly 14% of the respondents even believe that the 50-stock index has the potential to cross the 22,000 mark over the next 12 months. Brokerage firm ICICI Direct had also highlighted their Nifty 50 target for the new Samvat to be 21,500.

4 / 8

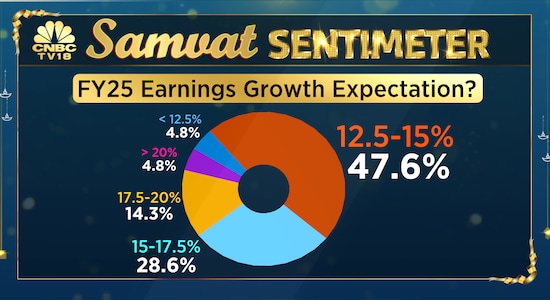

4 / 8Most of the analysts polled by CNBC-TV18 are expecting earnings growth for the next financial year to be between 12.5% and 15%. The next bunch with a higher percentage are projecting the earnings growth to be between 15% and 17.5%.

5 / 8

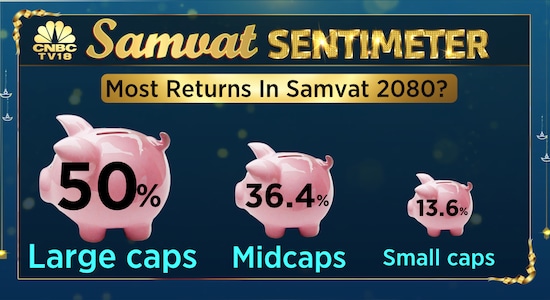

5 / 8With the kind of rally seen by midcap and smallcap stocks in Samvat 2079, many analysts have turned cautious on the space with some even advising investors to book profits that they have been sitting on. Therefore, it comes as no surprise that half of the fund managers in this poll are expecting largecaps to be the best performing category in the new Samvat as they find their valuations to be at more comfortable levels compared to the broader market.

6 / 8

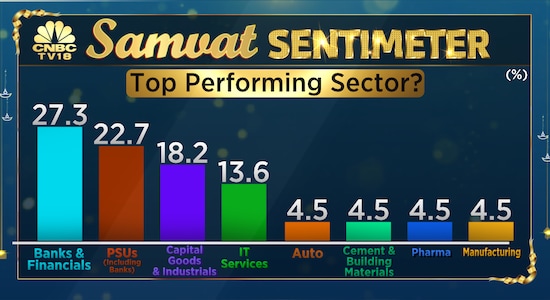

6 / 8The Nifty Bank has been an underperformer this year with the exception of certain PSU Banks. But fund managers and market participants are expecting this sector to be the top performer in the new Samvat. The PSU theme, including the state-run lenders is likely to continue getting top billing as per the poll. Auto, Cement, Pharma are lower down in this pecking order.

7 / 8

7 / 8India will vote in 2024 to elect a new government at the center. Many fund managers and market participants have explained what may happen with the markets if Prime Minister Narendra Modi is not voted back to power. However, they mentioned that the chances of that happening are low. Yet, elections remains the key risk for majority of the market participants, followed by interest rates.

8 / 8

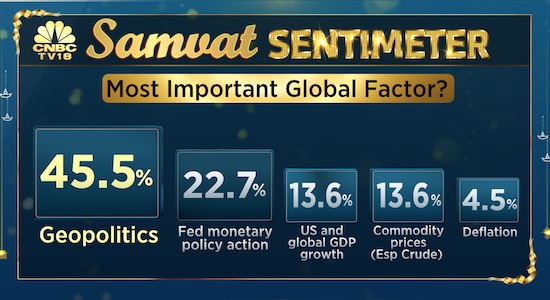

8 / 8Lastly, geopolitics continues to be the most important global factor among market participants during the new Samvat. The Fed policy takes second spot, while Commodity, especially crude prices are among the other factors on the list.