1 / 9

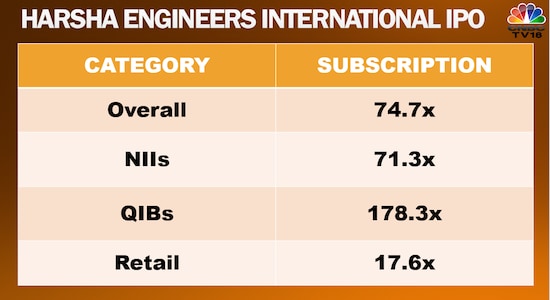

1 / 9Ahmedabad-based Harsha Engineers' shares listed at a premium of 35-36 percent over the upper end of the company's issue price.

A number of analysts recommended bidding for the IPO, which concluded on September 16, 2022, with an overall subscription of 74.7 times the shares on offer.

According to Angel One, the IPO demanded a price-to-earnings multiple of 32.7 times its earnings per share for the year ended March 2022.

2 / 9

2 / 9Even the company's debut on bourses drew strong investor interest.

Harsha Engineers commanded the fifth best premium among the new listings during the course of the year.

3 / 9

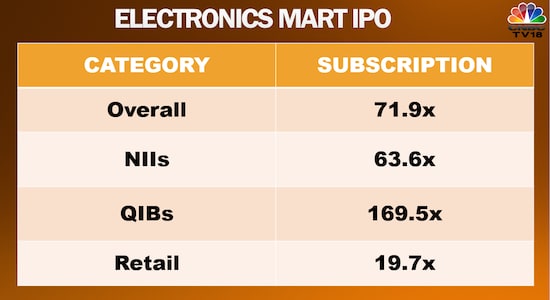

3 / 9The IPO of consumer durable and electronics retailer Electronics Mart concluded on October 7 with a subscription of almost 72 times the shares on offer.

One of the country's largest electronics retailers, Electronics Mart attracted a strong response from qualified institutional buyers — with the category seeing a booking of nearly 170 times the portion reserved.

4 / 9

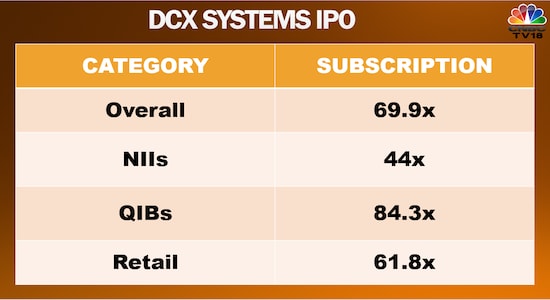

4 / 9DCX Systems — a Bengaluru-based maker of electronic sub-systems and cable harnesses — secured a subscription of nearly 62 times the shares on offer in an IPO that was open for three trading days till November 2, 2022.

DCX shares debuted on BSE and NSE at a premium of up to 39 percent.

5 / 9

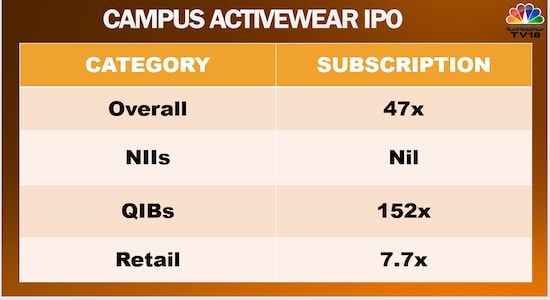

5 / 9New Delhi-based Campus Activewear's IPO concluded on April 28, 2022, with a strong response from institutional investors though the portion reserved for non-institutional investors — or the super rich — failed to attract any bid.

The stock of the sports and athleisure footwear brand debuted on Dalal Street at a premium of up to 23 percent over the issue price.

6 / 9

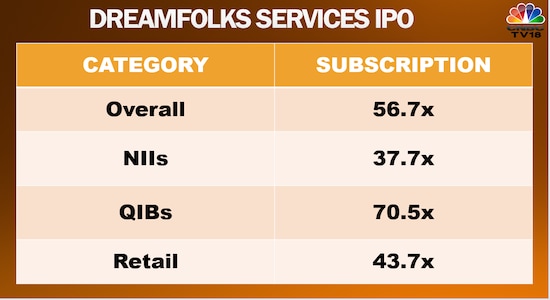

6 / 9Gurugram-based DreamFolks Services — which operates an airport service aggregator platform — saw the best listing of the year, with shares debuting at a premium of 56 percent over the upper end of its IPO price band.

DreamFolks saw a strong response across categories. emerging the fourth most chased IPO of the year, after Harsha, Electronics Mart and DCX.

7 / 9

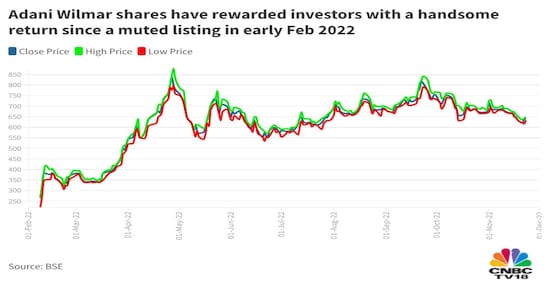

7 / 9During the course of the year so far, two IPOs failed to win full subscription: Adani Wilmar (30 percent overall subscription) and Five Star Business Finance (70 percent).

However, shares in Ahmedabad-based Adani Wilmar — the seventh company of the Adani group to tap Dalal Street for capital — made a comeback, gaining momentum after a lacklustre IPO and a weak listing.

The stock of the edible oil maker made it to the premium zone soon after debuting at a discount of up to four percent to the issue price.

8 / 9

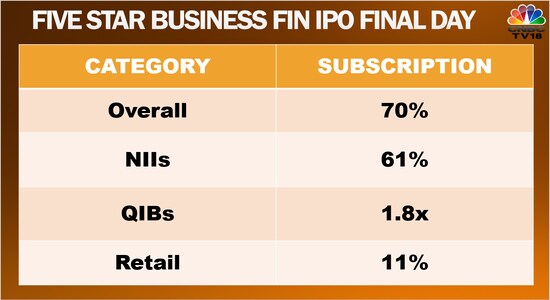

8 / 9Chennai-based financier Five Star Business Finance's IPO failed to secure a full subscription in November 2022.

The stock debuted in the secondary market at a discount as high as five percent.

9 / 9

9 / 9Though fully subscribed, the IPO of state-run life insurance giant LIC fell short of the expectations of many.

The IPO saw a similar response across bidder categories, securing bids for 2-6 times the shares reserved.

The country's largest ever IPO was followed by a sluggish listing on bourses, with shares beginning their journey at a discount of 8-9 percent to the issue price.