1 / 5

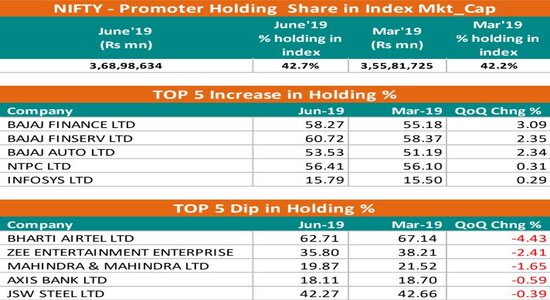

1 / 5Promoter Holdings: While Bajaj twins have seen a rise in promoter holding for the June-quarter, Bharti Airtel, Zee, and M&M witnessed the maximum decline in promoter holdings for this period. Total percentage of the promoter holding in the Nifty companies have risen from 42.2 percent in March 2019 to 42.7 percent in June 2019.

2 / 5

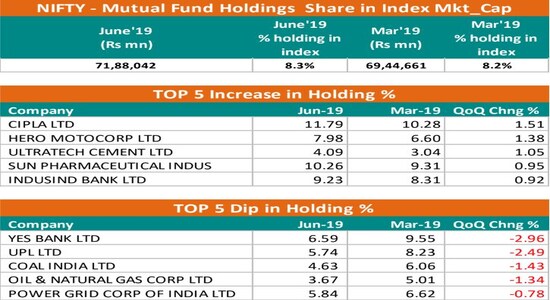

2 / 5Mutual Funds: Mutual Funds mildly increased their holdings in the Nifty50 companies from 8.2 percent to 8.3 percent (QoQ). MFs increased their holdings in Cipla by 1.5 percent followed by Hero MotoCorp (up 1.38 percent). Meanwhile, MFs sold the most in stocks in YES Bank, UPL, Coal India, ONGC, and PowerGrid.

3 / 5

3 / 5FIIs: The shareholding pattern of FIIs saw major changes in the June quarter. FIIs bought the most in Bharti Airtel, M&M, PowerGrid, HDFC, and Zee, while sold the most in YES Bank, Indiabulls, Hero MotoCorp, IndusInd Bank, and Grasim. The FIIs have been on a selling spree since the beginning of July after the Finance Minister announced surcharge on foreign investors, Continuing with their selling spree, foreign investors pulled out a net amount of Rs 9,197 crore in just seven trading sessions in August.

4 / 5

4 / 5Insurance Companies: Insurance companies have decreased their holding in L&T by 1.8 percent, PowerGrid by 1.57 percent and Asian Paints by 1.13 percent. Meanwhile, their promoter holdings have risen in Grasim, Hindalco, M&M, Hero Moto, and Tata Steel by 0.73-1.53 percent.

5 / 5

5 / 5DIIs: Domestic investors have reduced their shareholding in Nifty50 companies to 16.1 percent in June 2019 from 18.7 percent in March 2019. Hero MotoCorp, Grasim, and Hindalco witnessed over 2 percent rise in the shareholding by DIIs in the June quarter. However, according to the IDBI report, HUL saw the biggest fall in their domestic investor shareholding, down 57.8 percent. Shareholding in YES Bank and PowerGrid also decreased 3.8 percent and 2.45 percent, respectively.