1 / 7

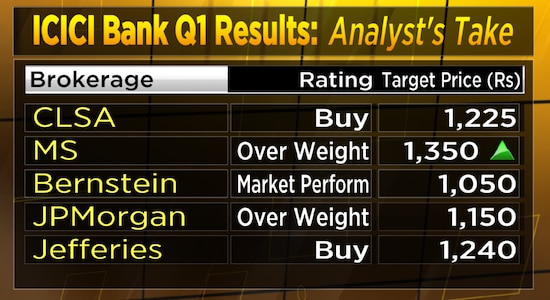

1 / 7A look at brokerage ratings and target prices

2 / 7

2 / 7CLSA: The brokerage expects highest earnings certainty over the next three years for the bank, which remains its top pick. It sees the bank’s growth as strong and commentary confident. It noted that the lender would invest in growth in FY24. ICICI Bank’s return on risk-weighted assets (RORWA) of 3.1 -3.2 percent is best in class and its earnings multiple of 15.5/13.5x FY24/25CL is still reasonable, the brokerage said.

3 / 7

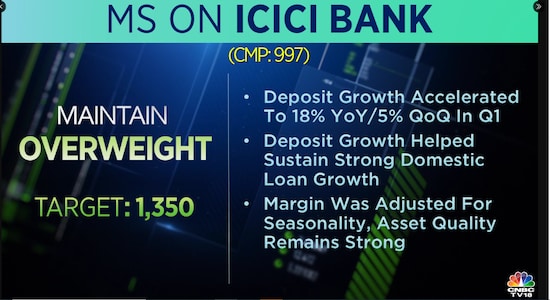

3 / 7Morgan Stanley: The brokerage points out that the lender’s deposit growth accelerated to 18 percent YoY and five percent QoQ in the April to June 2023 quarter. The margin was adjusted for seasonality while the asset quality remains strong, it said.

4 / 7

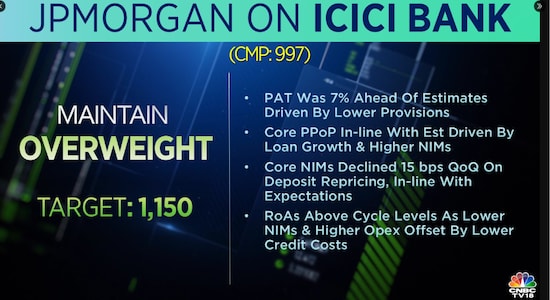

4 / 7JPMorgan: The brokerage has given the stock an overweight rating, saying core pre-provision operating profit (PPoP) was in-line with estimates, driven by loan growth and higher NIMs.

5 / 7

5 / 7Bernstein: The brokerage has a market perform rating for the banking firm, which its says delivered a “perfect quarter.” The bank maintained its Return on assets (RoA) and return on equity (RoE) at 2.4 percent and 18.9 percent respectively (unchanged QoQ) with NIM seeing only a marginal decline (-12 bps QoQ) to remain at 4.78 percent. The deposit growth too picked up to narrow the gap with HDFC Bank.

6 / 7

6 / 7Jefferies: The brokerage pointed out the credit cost during the quarter was low at 0.5 percent, but was only for stress loans versus past few quarters when it was mostly for contingencies. With lower recoveries/upgrades, even with stable slippages, this trend may stay, it expects. It added that the pickup in deposit growth to 18 percent should aid loan growth. Jefferies expects a 16 percent compound annual growth rate (CAGR) in profit over FY23-26.

7 / 7

7 / 7ICICI Bank shares were trading marginally lower in early trade on July 24. However, in 2023 so far (year-to-date), the stock has risen over 10 percent.