1 / 10

1 / 10Sell crude oil futures: Traders may sell the November crude oil futures contract on MCX at Rs 6,340 with a target of Rs 6,250 at a stop loss of Rs 6,400. (Analyst: Ravindra Rao, Kotak Securities)

2 / 10

2 / 10Buy castor seed futures: The near-term futures contract on NCDEX is likely to continue its uptrend, after remaining strong above key averages on the daily chart. The price is expected to cross the Rs 6,600 level, and continue its journey towards the Rs 7,000 mark. Buying the November contract is recommended in the range of Rs 6,400-6,450 for a target of Rs 6,800-7,000 with a stop loss below Rs 6,200. (Analyst: NS Ramaswamy, Ventura Securities)

3 / 10

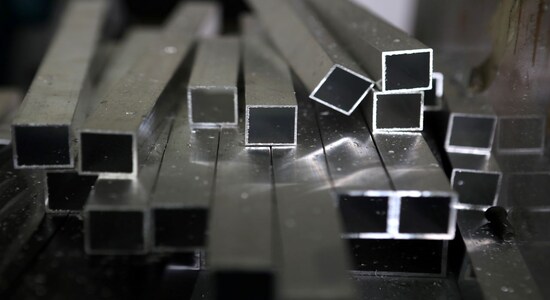

3 / 10Sell aluminium: The light metal appears to be overbought after surging to the highest levels recorded since late 2008. Aluminium could see sustained profit booking at higher levels. Premiums in the physical market have retraced from the highs, which could keep the forward prices in check in the short term. Selling MCX aluminium November futures is advised at Rs 232 for a target of Rs 215 with a stop loss at Rs 240. (Analyst: Amit Sajeja, Motilal Oswal Financial Services)

4 / 10

4 / 10Buy nickel futures on dips: Traders may buy the nickel futures (November) on MCX on dips to around Rs 1,570 for a target of Rs 1,594 with a stop loss at Rs 1,555. (Analyst: Manoj Kumar Jain, Prithvi Finmart)

5 / 10

5 / 10Buy gold futures: There appears to be an opportunity in the near-month MCX gold futures. One can look at buying the December contract at Rs 47,950 for a target of Rs 48,500 with a stop loss at Rs 47,700. (Analyst: Ravindra Rao, Kotak Securities)

6 / 10

6 / 10Buy coriander futures: The commodity is likely to rise going forward on improving demand. One can buy the near-month futures contract near Rs 7,900 for a target of Rs 9,300 with a stop loss at Rs 7,400. (Analyst: Ajay Kedia, Kedia Advisory)

7 / 10

7 / 10Buy crude oil futures on dips: Crude oil appears to be in a strong uptrend for the past few weeks. Technical indicator RSI looks positive on the daily and weekly charts. Any dip in MCX crude oil can be used as an opportunity to go long in the commodity. Buying is recommended in crude oil November futures in the range of Rs 6,200-6,250 for a target of Rs 6,600-6,800 with a stop loss below Rs 6,000. (Analyst: NS Ramaswamy, Ventura Securities)

8 / 10

8 / 10Buy lead futures: The commodity is expected to extend gains in line with the overall commodity basket. Traders can initiate long positions in the November contract on MCX around Rs 184 for a target of Rs 195 with a stop loss at Rs 179. (Analyst: Ajay Kedia, Kedia Advisory)

9 / 10

9 / 10Buy natural gas futures: The price is likely to continue the primary trend on the upside after the recent consolidation from highs. Strong support is seen at Rs 370 on a closing basis. Any dip can be used to go long in natural gas. One can initiate longs in the November natural gas futures on MCX in the range of Rs 395-400 for a target of Rs 430/450 with a stop loss below Rs 380. (Analyst: NS Ramaswamy, Ventura Securities)

10 / 10

10 / 10 Buy silver futures: The price has managed to close above key moving averages on the daily chart after a long consolidation phase. Silver is now above the 100-day exponential moving average placed at Rs 64,300 on the daily timeframe, which is expected to act as immediate support. One can look to buy the December futures on MCX in the range of Rs 65,000-65,500 for a target of Rs 66,500-68,000 with a stop loss below Rs 64,000. (Analyst: NS Ramaswamy, Ventura Securities)

Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.