1 / 7

1 / 7Buy gold: The prices of the yellow metal have shown a remarkable rally to test the Rs 55,500/10 gms mark, followed by a corrective move. Trend-wise, the counter is still maintaining a positive stance, trading above the crucial 200-day simple moving average on higher timeframes. Momentum indicators are hovering in an oversold zone, indicating the resumption of an uptrend. Level-wise, strong support remains at Rs 51,200-51,400/10 gms, corresponding to its 20-day exponential moving average. One can initiate a long position in the April contract on MCX around Rs 51,400-51,200 per 10 gms for a target of around Rs 53,200 per 10 gms with a stop loss at Rs 50,300/10 gms. (Analyst: Sugandha Sachdeva, Religare Broking)

2 / 7

2 / 7Sell soy oil on rise: The price has hit close to the 79 cents per pound level as expected. If the May contract on CBOT stays below 76 cents, it could gradually edge lower to 70.15 cents, followed by 68.15 cents. From a medium-term perspective, The big picture has started to suggest that a possible top is in place already. (Analyst: Gnanasekar Thiagarajan, Commtrendz Research)

3 / 7

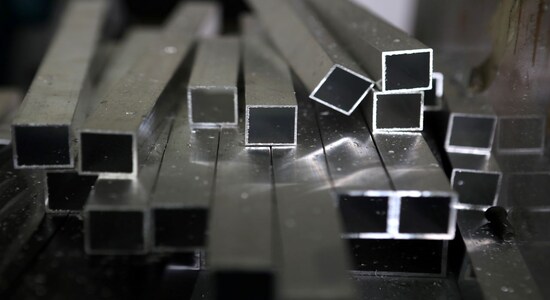

3 / 7Buy aluminum: One can buy the March contract on MCX at Rs 266 for a target of Rs 300SL with a stop loss at Rs 248. Concerns related to the Russia-Ukraine situation, lower LME stocks and higher energy prices support aluminium. (Analyst: Manoj Kumar Jain, Prithvi Finmart)

4 / 7

4 / 7Buy natural gas: Natural gas has edged higher after forming a near-term base at Rs 330/MMBtu. A dip towards its 20-day exponential moving average is likely to provide a buying opportunity to ride the uptrend. Rising volumes on the up days and low volumes on selling days confirm that traders want to remain on the buy side in the near term. A reading above 50 of momentum indicator RSI on the daily chart provides another technical trigger for a long-side entry. One can buy the March contract on MCX around Rs 346-348/MMBtu for a target of Rs 385/MMBtu with stop loss at Rs 330/MMBtu.(Analyst: Sugandha Sachdeva, Religare Broking)

5 / 7

5 / 7Buy natural gas: The commodity is attempting to grind sideways and find its footing possibly in preparation for a short-term bounce. Natural gas has formed a strong base and a rounding bottom pattern. One can purchase the March contract on MCX at Rs 354.8 for a target of Rs 370 with a stop loss at Rs 349. (Analyst: Kshitij Purohit, CapitalVia Global Research)

6 / 7

6 / 7Buy copper: After a dip from the recent highs, copper prices have retested the previous swing high of Rs 790/kg, which is likely to act as key support going ahead. An inside candle at this juncture suggests a pause, which may again entice buying interest in the red metal, taking its prices on the higher incline. One can buy the March contract on MCX at Rs 795-800/kg zone for a target of around Rs 840-845/kg with a stop loss at Rs 778/kg.(Analyst: Sugandha Sachdeva, Religare Broking)

7 / 7

7 / 7Sell silver: The white metal has begun a fall after reaching a high of Rs 73,000, a critical resistance level where a lot of supply is likely. After a one-sided rally, some profit taking may be seen at these levels. Technically, it formed a bear flag pattern on the hourly chart, and a break below Rs 69,800 will increase selling pressure towards previous support levels. One can sell the May contract on MCX at Rs 70,100 for a target of Rs 69,500 with a stop loss at Rs 70,470. (Analyst: Kshitij Purohit, CapitalVia Global Research)

Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.