1 / 8

1 / 8Airbnb IPO: The home booking platform had announced its decision to go public last year but no dates have been released yet. Media reports also suggest that the IPO may be shifted to 2021 due to the pandemic. The company, which was founded in 2008, has raised a total of $4.4 billion across 15 venture capital funding rounds so far. (Pic: Reuters)

2 / 8

2 / 8Ant Financials IPO: Alibaba owned Ant Financial is another awaited IPO of 2020, looking to go public in Hong Kong and China. The company is the highest valued fintech company in the world and is also the world’s most valuable unicorn company. As per reports, the company is seeking to raise at least $35 billion in its initial public offering. Ant generated 72.5 billion yuan in revenue in the first half of 2020, after full-year sales of 120.6 billion yuan in 2019. The firm posted a 21.1 billion yuan profit in the first half of this year. (Pic: Reuters)

3 / 8

3 / 8Didi Chuxing IPO: The Chinese ride-hailing giant plans to go public were first reported on July 20 and is considering a listing in Hong Kong by the end of the year on a likely valuation of more than $80 billion. Uber took an 18.8 percent stake in Didi, but has since diluted to 15.9 percent when it sold its Chinese business to Didi in 2016. Outside China, Didi currently operates in Australia, Japan, Brazil, Mexico, Costa Rica, Chile, Colombia and Panama. (Pic: Reuters)

4 / 8

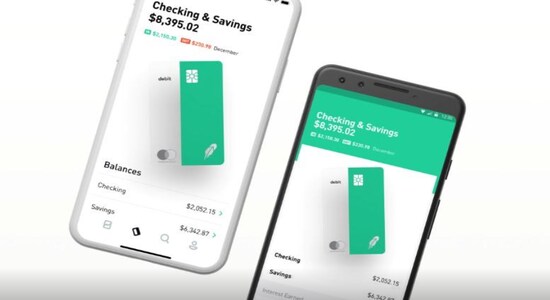

4 / 8Robinhood IPO: Robinhood is another most awaited IPO of 2020. The trading app disrupted the online trading industry offering zero-fee trades. It has a young user base with over half first-time investors. Robinhood management has said an IPO is coming at some point, and the company raised $200 million at an $11.2 billion valuation in August. The stock trading app reportedly added 3 million new users in the first four months of 2020 and now has more than 13 million users. (Pic: Reuters)

5 / 8

5 / 8DoorDash IPO: The food delivery company DoorDash plans is likely to file for an IPO in the fourth quarter of 2020. It is the leading US food delivery service with 44% market share. Its latest $400 million fundraising round in June valued the company at $16 billion. (Pic: Reuters)

6 / 8

6 / 8Instacart IPO: Instacart is a grocery pickup and delivery service with more than 25,000 retail partners. The company raised $225 million capital in June and is valued at a $13.7 billion. It's service coverage now exceeds 85 percent of U.S. households. It added that in 2020, the order volume has jumped 500 percent year over year, and app downloads in March were up 218 percent. (Pic: Reuters)

7 / 8

7 / 8WeDoctor IPO: The online medical service provider is expected to file a prospectus for a Hong Kong IPO by October. The company, backed by Tencent Holdings, hopes to raise between $700-900 million through the IPO, as per media reports. The company's businesses range from insurance policies and medical supplies to online appointment-booking. (Pic: Reuters)

8 / 8

8 / 8Palantir IPO: The company officially filed to go public August 25 through a direct listing. In its prospectus, the data analytics firm reported 2019 revenue of $742.6 million, up 25 percent from 2018. The firm said in April that it expects to reach $1 billion in revenue this year. In mid-2019, Palantir reportedly planned to target a $26 billion IPO valuation. (Pic: Reuters)