1 / 7

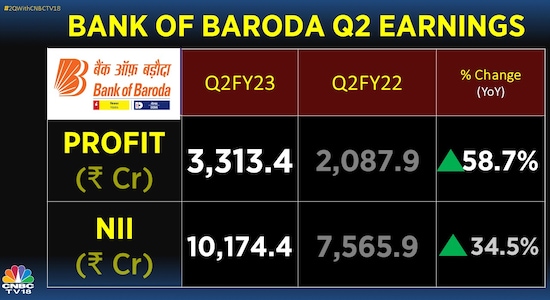

1 / 7State-owned Bank of Baroda on Saturday reported a jump of 59 percent in its net profit to Rs 3,313 crore for the second quarter ended September on the back of a decline in bad loans and a rise in interest income. Its total income rose to Rs 23,080.03 crore for the second quarter of 2022-23 and net interest income grew by 34.5 percent to Rs 10,714 crore.

2 / 7

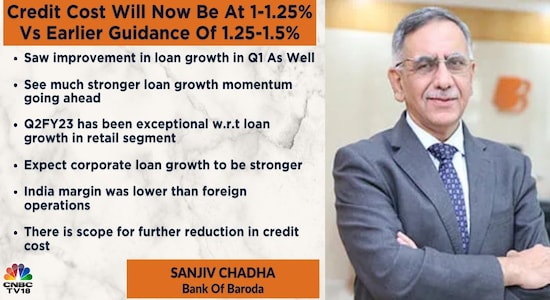

2 / 7The credit cost will now be at 1-1.25 percent versus earlier guidance of 1.25-1.5 percent, Sanjiv Chadha, Managing Director and Chief Executive Officer of Bank of Baroda, told CNBC-TV18 on Monday. He sees much stronger loan growth momentum going ahead.

3 / 7

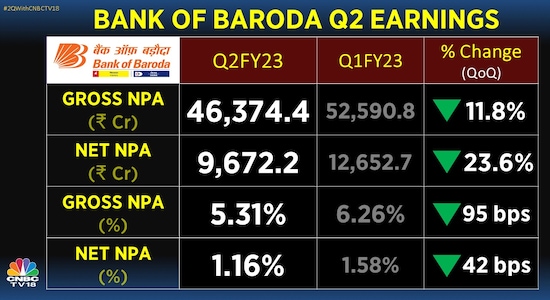

3 / 7As the lender beat estimates, several brokerages have raised their ratings on BoB shares on the back of a reducing net non-performing assets (NPA) levels, which have already come off to 1.2 percent.

4 / 7

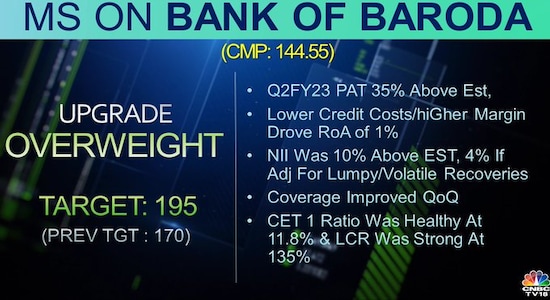

4 / 7Morgan Stanley has raised the target price on BoB’s stock to Rs 195 from Rs 170 per share. It said lower credit costs and higher margins drove a return on assets of 1 percent.

5 / 7

5 / 7Nomura On BoB has a buy call on the stock with a target price of Rs 170 as acknowledged further improvement in asset quality. It expects re-rating to continue. The banking firm is likely to report 13- 13.5 percent, it said.

6 / 7

6 / 7JPMorgan too has an overweight stance and has raised the target price to Rs 200 from Rs 140 earlier, noting that Q2 net interest income was 15 percent ahead of the estimate. The brokerage has raised FY23 and FY24 earnings per share (EPS) by 35 percent and 21 percent respectively.

7 / 7

7 / 7Investec has given a buy rating to BoB and it too has raised the target price on the lender’s stock to Rs 200. It pointed to a strong Q2 with RoA of 1 percent led by NIMs improving QoQ and lower credit costs. It expects RoA of 0.9 percent for FY23e and a further expansion to a percent during FY24. According to the brokerage, it is key for the bank to ensure asset quality remains stable while other aspects of P&L are in a much better position. It has upgraded the FY24 estimated book value per share (BVPS) by 4 percent.