1 / 11

1 / 11The HT Parekh Legacy Centre is located at the Ramon House in Mumbai, which is the headquarters of HDFC. HDFC Chairman Deepak Parekh says the idea is to ensure people remember HDFC even after its merger with HDFC Bank.

2 / 11

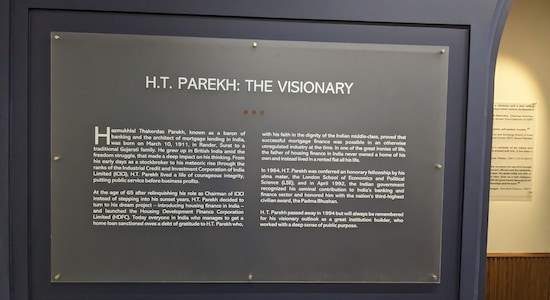

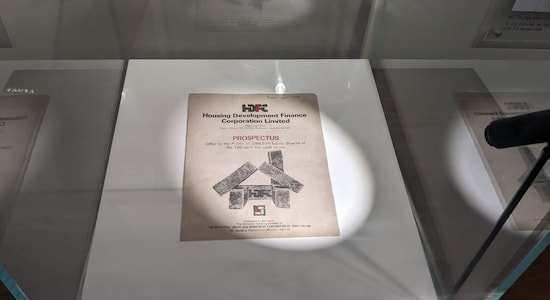

2 / 11The legacy centre pays tribute the life of HDFC’s founder Hasmukh Thakordas Parekh. At a time when Housing Finance was an alien concept in India, and Indians were averse to the idea of debt, HT Parekh wanted to start India’s first private housing finance company that would help India’s middle class avail home loans and thus own their own homes.

3 / 11

3 / 11An idea first came to him when he was studying at the London School of Economics when he saw how building societies in England allowed people to own homes through mortgage finance. He wanted to bring this concept to India.

4 / 11

4 / 11At the age of 66, when most people hang up their boots, HT Parekh started HDFC post his retirement as the Chairman of ICICI with an initial personal contribution of Rs 10,000 and Rs 10 crore he borrowed from industrialist and banker friends.

5 / 11

5 / 11This is what HT Parekh’s cabin looked like.

6 / 11

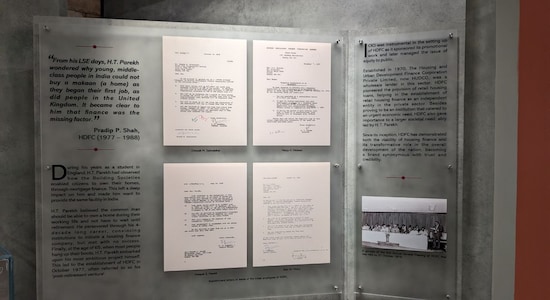

6 / 11Apart from HT Parekh’s life, the legacy Centre showcases several snippets of HDFC’s growth through the years.

7 / 11

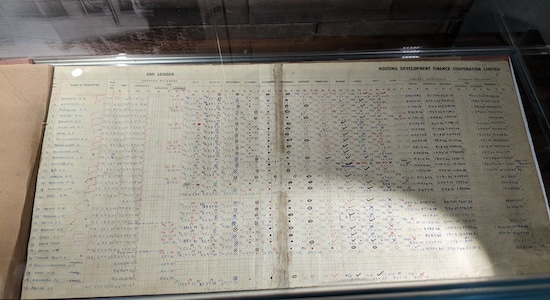

7 / 11This handwritten EMI ledger is the first one used when HDFC began its business and it has the names of the first Indians who took a formal home loan.

8 / 11

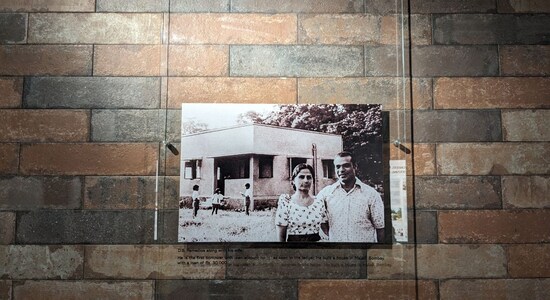

8 / 11This is DB Remedios and his wife. Remedios was the first borrower who took out a home loan of Rs 30,000 to build his own house in Mumbai's suburb of Malad.

9 / 11

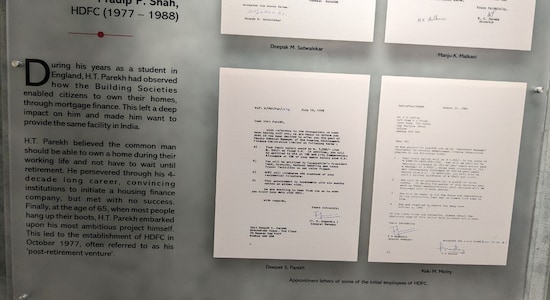

9 / 11These are the appointment letters handed out to Deepak Parekh and Keki Mistry, also documenting their first salaries. Deepak Parekh’s first basic salary back in 1978 was Rs 3,500 plus Rs 500 fixed D.A, while Keki Mistry was offered a basic salary of Rs 1,450 in 1981.

10 / 11

10 / 11HDFC went from financing 299 houses in 1978, 9.2 lakh homes in 1994 to over 10.2 million homes by 2023.

11 / 11

11 / 11The legacy Centre also showcases HDFC’s contribution to India’s retail housing finance industry. For Instance, HDFC was the first to link repayment of loans to the borrower’s repayment ability based on income, it also was the first to draft the retail lending policy for housing loans in India at a time when there was no legislation in place for recoveries.