Zerodha Mutual Fund, one of India's newest fund houses, has launched its inaugural new fund offers (NFOs). These new investment opportunities, named the Zerodha ELSS Tax Saver Nifty LargeMidcap 250 Index Fund and the Zerodha Nifty LargeMidcap 250 Index Fund, aim to provide investors with diverse options for their financial portfolios.

Live TV

Loading...

The NFO subscription period for both funds commenced on Friday, October 20, 2023, and will continue until November 3, 2023.

Zerodha ELSS Tax Saver Nifty LargeMidcap 250 Index Fund

This is an open-ended passive equity-linked savings scheme with a statutory lock-in period of 3 years. It replicates/tracks the Nifty LargeMidcap 250 Index. It falls under the category of Index ELSS, as per SEBI circulars and directives. The benchmark for this fund is the Nifty LargeMidcap 250 Index TR.

The primary objective of this scheme is to invest in stocks that constitute the Nifty LargeMidcap 250 Index in the same proportion as the index, aiming to achieve returns equivalent to the Total Return Index of the Nifty LargeMidcap 250 Index. Additionally, it offers deductions under Section 80C of the Income-tax Act, 1961, the fund house said.

Investors in this scheme are eligible for deductions under Section 80C of the Income Tax Act, 1961, subject to the statutory limits and conditions.

Redemption of units can be made after the three-year lock-in period, with NAV-based pricing on all business days. The fund will dispatch redemption proceeds within three working days, Zerodha Mutual Fund said.

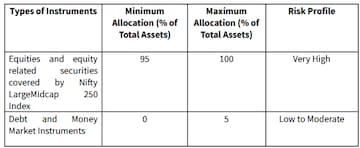

Under normal circumstances, the fund's asset allocation will include equities and equity-related securities (95-100% of total assets) and debt and money market instruments (0-5% of total assets).

(Source: Zerodha Mutual Fund)

This scheme adopts a passive investment strategy, aiming to closely mirror the Nifty LargeMidcap 250 Index by rebalancing the portfolio as needed. It may also invest in debt and money market instruments for liquidity.

Zerodha Nifty LargeMidcap 250 Index Fund

This fund aims to replicate the Nifty LargeMidcap 250 Index and achieve returns equivalent to its Total Return Index, subject to tracking error. This scheme allows subscription and redemption at NAV-based prices on all business days, with redemption proceeds dispatched within three working days.

The benchmark for this fund is the Nifty LargeMidcap 250 Index TR.

Similar to the ELSS fund, Zerodha Nifty LargeMidcap 250 Index Fund allocates the majority of its assets to equities and equity-related securities (95-100% of total assets) and a smaller portion to debt and money market instruments (0-5% of total assets).

(Source: Zerodha Mutual Fund)

This is also a passively managed index fund that strives to replicate the Nifty LargeMidcap 250 Index while minimizing tracking error through regular rebalancing.

Investment considerations

Both funds offer investors a chance to participate in the performance of the Nifty LargeMidcap 250 Index with different tax-saving benefits in the case of the ELSS fund. However, it's crucial for investors to carefully assess their investment goals, risk tolerance, and time horizon before deciding to invest in these NFOs.

Experts say that NFO could make sense only when the fund offers something unique that is not available in the market. Additionally, investors can look at the objective and the motive behind the new fund offer. Also, returns of other funds in that category should be checked. As with any investment, it's advisable to consult with a financial advisor to make informed decisions that align with one's financial objectives, experts opine.

First Published: Oct 20, 2023 3:07 PM IST

Note To Readers

The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections 2024: Kadapa to Visakhapatnam, a look at key battles

May 8, 2024 5:31 PM

NCP's likely merger with Congress — why Sharad Pawar want to settle the future of his party sooner

May 8, 2024 5:04 PM

Andhra Pradesh Lok Sabha elections: All about Congress candidates

May 8, 2024 2:11 PM