UTI Mutual Fund has launched two index funds- UTI Nifty50 Equal Weight Index Fund, and UTI S&P BSE Housing Index Fund. The new fund offers (NFOs) opened for subscription today, May 22, 2023, and will close on June 5, 2023. The investment objective of the schemes is to provide returns that, before expenses, correspond to the total return of the securities as represented by the underlying index.

Live TV

Loading...

However, there is no guarantee or assurance that the investment objective of the scheme will be achieved, the mutual fund house said.

UTI Nifty50 Equal Weight Index Fund

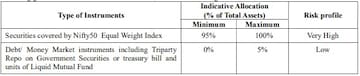

This is an open-ended scheme replicating/tracking Nifty50 Equal Weight TRI. The investment policies of the scheme will be as per SEBI (Mutual Funds) Regulations, 1996 and within the following guideline. Under normal circumstances, the investment range would be as follows:

The minimum application amount is Rs 5,000 and in multiples of Re 1 thereafter.

The net assets of the scheme will be invested in stocks constituting the underlying index. This would be done by investing in the stocks comprising the index. The scheme shall endeavour to maintain the same weightage they represent in the index or investing in derivatives on the said index. The scheme may take an exposure to equity derivatives of constituents of the underlying index for short duration when securities of the index are unavailable, insufficient or for rebalancing at the time of change in index or in case of corporate actions or for hedging purposes, as permitted subject to rebalancing within 7 days, the fund house said.

It will also invest in money market instruments rated not below investment grade and derivatives traded on recognized stock exchanges. It can also invest in units of liquid mutual fund. Pending deployment of funds, in short term deposits with scheduled commercial banks are also allowed.

Sharwan Kumar Goyal is the dedicated Fund Manager of UTI Nifty50 Equal Weight Index Fund.

UTI S&P BSE Housing Index Fund

This is an open-ended scheme replicating/tracking S&P BSE Housing TRI. The scheme offers following regular and direct plans. Both the plans offer only growth option. Ordinarily no IDCW will be made under this option. All income generated and profits booked will be ploughed back and returns will be reflected through the NAV in growth option, the fund house said.

Direct Plan is only for investors who purchase/subscribe units directly with the fund and is not available for investors who route their investments through a distributor. The direct plan will be a separate plan under the scheme and shall have a lower expense ratio excluding distribution expenses, commission etc. and will have a separate NAV, the fund house added.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Exclusive | NDA will cross 400 mark before 12:30 pm on June 4, can win all 80 seats in UP, says Amit Shah

May 2, 2024 12:47 PM

View | Congress manifesto vs BJP's wealth redistribution narrative — is it something out of nothing

May 2, 2024 9:10 AM

Two days left for filing nomination, Congress undecided on candidates for Amethi and Rae Bareli seats

May 2, 2024 7:32 AM

Lok Sabha polls: Polling time in Telangana increased by an hour, here's why

May 2, 2024 6:55 AM