The Unified Payments Interface (UPI) platform has crossed the 100 billion-mark in 2023, totalling around 118 billion transactions throughout the year. This marks a 60% growth compared to the 74 billion transactions recorded in 2022, data shared by the National Payments Corporation of India (NPCI) showed.

Live TV

Loading...

The total value of UPI transactions in 2023 stood at approximately ₹182 lakh crore, a 44% increase compared to ₹126 lakh crore in 2022.

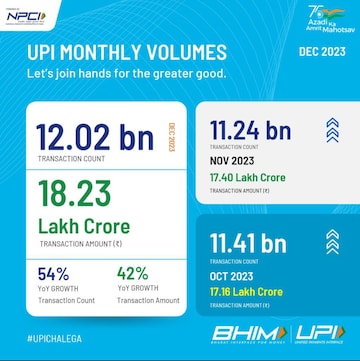

If we look at the monthly transaction amount, the same touched ₹18.23 lakh crore in December, showcasing a 54% increase compared to the corresponding data for 2022.

In terms of transaction volume, December recorded a figure of 12.02 billion transactions, marking a 42% rise from the previous year, as per NPCI data.

The surge in UPI transactions has been steady, reflecting its rising popularity among users.

From 92 crore transactions in FY 2017-18, UPI transactions soared to 8,375 crore transactions in FY 2022-23, showcasing a compound annual growth rate (CAGR) of 147% in terms of volume.

This rise can be attributed to several factors, notably UPI's user-friendly interface and its uninterrupted availability around the clock.

The Reserve Bank of India (RBI) has played a proactive role in introducing a series of measures aimed at fortifying the security and fairness of the UPI ecosystem.

Last month, NPCI announced the launch of an Application Supported by Blocked Amount or ASBA-like facility in the secondary market after getting the go-ahead from SEBI.

The UPI for the secondary market will start its beta phase next week for the equity cash segment. It will be supported by key stakeholders, including clearing corporations, stock exchanges, depositories, stockbrokers, banks, and UPI app providers.

NPCI stated that in the initial phase, this functionality will be available for a limited set of pilot customers.

While UPI has been the standout star, Immediate Payment Service (IMPS) transactions have also witnessed growth. December witnessed a 6% increase in IMPS transactions, totalling 499 million compared to November's 472 million.

In value terms, the December figure surged by 7% to ₹5.7 trillion.

(Edited by : Amrita)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court refuses plea seeking 6-year poll ban on PM

May 14, 2024 7:14 PM

Punjab Lok Sabha elections 2024: A look at BJP candidates

May 14, 2024 7:06 PM

Lok Sabha polls: EC disposes of 90% complaints related to MCC violations

May 14, 2024 4:45 PM

Jharkhand Lok Sabha elections 2024: All about INDIA bloc candidates

May 14, 2024 2:52 PM