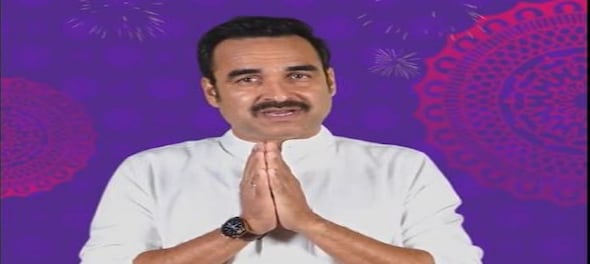

In an effort to strengthen safety awareness on digital payment platforms, the National Payments Corporation of India (NPCI) has announced the appointment of actor Pankaj Tripathi as its 'UPI Safety Ambassador.' This move comes in the wake of ongoing discussions regarding the safety and security of digital payment platforms, particularly United Payments Interface (UPI).

Live TV

Loading...

In a communication on X, formerly known as Twitter, NPCI announced its collaboration with Tripathi. The actor emphasised the far-reaching impact of NPCI's initiatives such as UPI, RuPay, and IMPS, stating that they have made digital payments easy and secure, reaching the farthest corners of India, including cities, towns, and villages. He also highlighted the importance of safety when using these platforms, urging users not to fear but to ensure they use the right app for the right person.

Acclaimed Indian actor Pankaj Tripathi is now our 'UPI Safety Ambassador' and he has a special message for all of us this Diwali. Watch on to know more about staying safe while making digital payments.#NPCI #UPI #UPISafetyShield #PankajTripathi #Diwali @dilipasbe @upichalega pic.twitter.com/WKNJxylfks

— NPCI (@NPCI_NPCI) November 7, 2023

The rapid growth in digital transactions using UPI has become an integral part of daily life for Indian consumers. While the convenience and speed of digital payments have been embraced, NPCI aims to emphasise the importance of safety measures when conducting online transactions.

Here are key UPI safety tips one should follow:

-Enter UPI PIN ONLY to deduct money from the account. UPI PIN is NOT required for receiving money.

-Check the receiver's name when verifying the UPI ID. Do NOT make payments without verification.

-Enter UPI PIN ONLY on the app's UPI PIN page. Do NOT share the UPI PIN with anyone.

-Scan QR codes ONLY for making payments, not for receiving money.

-Do not download screen sharing or SMS forwarding apps when requested by unknown individuals without understanding their utility.

In addition to these tips, it is essential to verify the UPI ID before initiating payments. The app itself will verify the beneficiary's UPI ID when scanning a QR code or entering a phone number. Users should never share their UPI PIN, as it is only required for debiting money. After a successful transaction, users should check their SMS to confirm the deduction of the amount.

Furthermore, for any transaction-related issues, users are encouraged to utilize the help section within the UPI app. NPCI has a team of experts available 24x7 to assist users with any concerns or issues related to UPI transactions.

In recent times, several cases of UPI QR code scams have even come to light, each characterised by its unique modus operandi, placing consumers at risk of financial loss. To mitigate these risks, users are strongly advised to remain vigilant and adopt the following protective measures:

Exercise caution with QR code sharing

: Never share your OTP or PIN in response to QR code requests. Legitimate senders will not request such information.

Avoid public QR code scanning: Refrain from scanning QR codes in public places to safeguard personal information and e-wallet/UPI PINs.

Validate QR codes received via email: Before scanning QR codes received via email, ensure their authenticity by cross-verifying with the respective company or organization's representative. Validate the presence of "https://" in the website address and look for contact information, email IDs, as well as clear cancellation and refund policies.

QR codes are for transactions, not receipts: Always remember that QR codes are intended for facilitating transactions, not receiving funds. Never disclose the OTP or PIN.

Carefully review transaction deductions: Scrutinise transaction deductions meticulously, and exercise caution when lending phone to others for payment-related activities.

It's worth noting that this isn't Pankaj Tripathi's first association with a national cause. Last year, he was honored as the 'National Icon' of the Election Commission of India (ECI) for his commitment to the cause and wide appeal across the country, particularly in creating awareness amongst voters.

First Published: Nov 7, 2023 3:42 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!