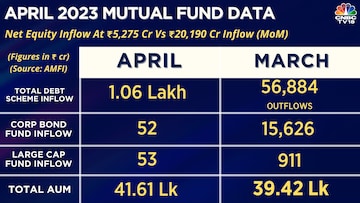

The April 2023 mutual fund industry data released by Association of Mutual Funds in India (AMFI) highlighted some key insights. While the equity mutual funds witnessed a net inflow at Rs 5,275 crore in April 2023, the total debt scheme saw an inflow at Rs 1,06,677 crore. Here are key trends that AMFI data showed:

Live TV

Loading...

Equity inflows decline to lowest in four months

Equity mutual funds have witnessed net inflow at Rs 5,275 crore in April 2023 as against Rs 20,190 crore in March 2023. While all equity mutual fund schemes recorded net inflows in April, small-cap schemes saw the highest investments. Large-cap funds received the lowest inflows, the data showed.

According to Akhil Chaturvedi, Chief Business Officer, Motilal Oswal AMC, the gross flows have reduced in April over March basis recent rally in the markets thereby reflecting cautious stance by investors.

"Having said so, broadly we see the investor interest in equity and equity oriented mutual funds on the rise and medium to long term trend would be positive for the asset class. Also, inflows in the small cap category remained strong in continuation of recent trend. Small caps look reasonably attractive at these levels post the price correction they went through during FY22-23," he said.

Mayank Bhatnagar, Chief Operating Officer at FinEdge attributed the decline to “profit booking” actions stemming from the lack of patience due to the extended lull in the market, and not having a goal-backed long term return expectation in mind while investing.

"Once again, we are witnessing a repeat cycle of high retail participation at the point of maximum financial risk, and low participation at points of maximum financial opportunity such as the one we are sitting on today. Interestingly, high retail outflows have traditionally signalled trend reversals, so we may well be close to the bottom of the time correction that we have been in since October 2021," he said.

Debt funds see sharp turnaround

Debt mutual funds witnessed a sharp turnaround in April as they received a huge net inflow of Rs 1,06,677 crore. Except for credit risk and banking and PSU fund categories, all the other categories witnessed net inflows. This came after the category received a massive outflow of Rs 56,884 crore last month,

Liquid funds receive highest net inflows

Categories having shorter maturity profile were the biggest beneficiaries. Liquid funds received the highest net inflows during the month followed by money market fund and ultrashort duration fund category.

While liquid funds saw an inflow of Rs 63,219 crore, money market fund witnessed Rs 13,961 crore inflow in April. The ultrashort duration fund saw inflow of Rs 10,661 crore.

Gold ETFs see inflows

Gold ETFs saw net inflows to the tune of Rs 124 crore in the month of April 2023 after witnessing net outflows in the previous quarter.

"Over the past few months, we have witnessed gold prices rising. While gold prices rose, some investors would have chosen to book profits or take on risk on approach with a view that central banks would pause further rate hikes. That said, pertinent risks still engulf developed economies and therefore over the course of the month, investors again flocked to gold ETFs which is considered as a safe haven during uncertain times," said Himanshu Srivastava, Associate Director - Manager Research, Morningstar India,

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM