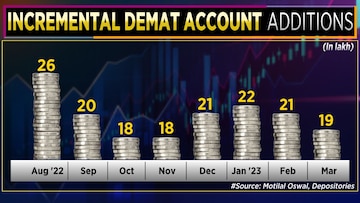

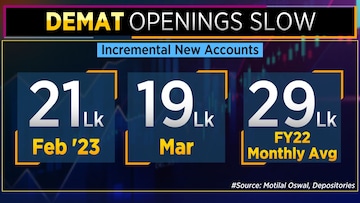

The trend of new demat account openings is slowing down. March data from the exchanges and depositories show some interesting investor behaviour trends. Though the total number of demat accounts continue to rise, the incremental new account addition is seeing a drop. March saw 19 lakh new demat accounts being opened as opposed to 21 lakh new accounts additions in February.

The March number is also well below the monthly average of 29 lakh new demat account openings that was seen throughout FY22.

Lackluster markets are probably the key reason behind this drop in fresh demat openings and that could also be a factor behind the steady decline seen in NSE's total active client base, which has been falling for 9 consecutive months, according to Motilal Oswal, and it has come down to 326 lakh accounts in March.

Even though number of NSE active clients is down almost 9.5 percent in March 2023 versus March 2022, discount brokers aren't complaining. Their dominance has been growing steadily throughout the last one year with the top 5 that is Zerodha, Upstox, Angel One, Groww and 5paisa Capital making up for 60 percent of the market share now.

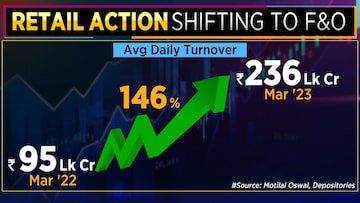

Another interesting trend is retail investors or retail traders increasing interest in the futures and options (F&O) market.

ALSO READ |

Despite the market remaining flat over the last 18 months, average turnover has been healthy. Infact the daily average turnover in March is up 146 percent over the same period last year, courtesy the rise in F&O volumes.

Average daily turnover in the F&O segment in March is up 148 percent over last year and over 13 percent compared to February.

And it's not just seasoned traders, but retail has decided that it doesn't miss out on the F&O opportunity. Motilal Oswal points out that retail segment average daily turnover has grown about 12.5 percent in March over February.

Daily average turnover in the retail F&O segment is up from Rs 40 lakh crore in March 2022 to Rs 87 lakh crore in March 23.

The cash market retail volumes have dropped in the same time period by a little over 28 percent to Rs 237 lakh crore.

Retail investors are clearly experimenting with newer ways of making money and heading from the cash to the F&O market.

Sandeep Bhardwaj, COO and CDO at HDFC Securities believes that the market has seen a significant decline in retail participation in the cash market.

“It is a tactical shift from direct equities to mutual fund way of investing and as far as ownership is concerned, I think from 2001 to 2019, it was a constant decline in terms of ownership of NSE listed companies. But during COVID, when we saw close to 2 percent of the ownership high, which again we are noticing that it is already down by 0.6 basis points (bps),” he told CNBC-TV18.

As per A Balasubramanian, the MD & CEO of Aditya Birla Sun Life AMC, one of the significant changes that the investment industry has experienced is the post-pandemic demat account growth, which was significant.

Speaking to CNBC-TV18 he added, “However, increased volatility has led to many investors withdrawing from the market recently. The market has been experiencing significant fluctuations, leading to many investors pulling out of the market.”

For more details, watch the accompanying video

(Edited by : Anshul)

First Published: Apr 19, 2023 1:17 PM IST