If you have ₹ 10 lakh to invest what are your best options? Well, it is difficult to find one investment avenue that can provide adequate returns in a short period. In today's complex financial landscape, the quest for the optimal investment strategy demands meticulous consideration. So, with a substantial corpus of ₹ 10 lakh, astute decision-making becomes imperative to maximise returns while mitigating risks.

Live TV

Loading...

In this article, we delve into the insights of financial experts to provide you with a comprehensive guide on the best approach for investing ₹10 lakh.

Nikhil Aggarwal, Founder & CEO at Grip, a digital investment platform, thinks that a judicious allocation across a spectrum of investment avenues yields is required for the same.

"Diversifying between equities, fixed income instruments, and avenues like bonds, commercial real estate (CRE), an astute investor can target an average annualised return of around 8-10% over the long term and can harness market potential while minimising exposure to volatility. The backdrop of economic dynamism underscores the significance of staying attuned to emerging sectors. Investing a small part of the money in growing sectors like technology or sustainable energies can potentially yield exponential gains," Aggarwal told CNBC-TV18.com.

A look at key investment strategies

Diversify across sectors in equities

Experts consider equity as one of the most rewarding asset classes to bet on. Investing for the long term allows one to ride out market fluctuations and recover from losses. However, it's crucial to understand that equities come with higher risks compared to other asset classes like debt.

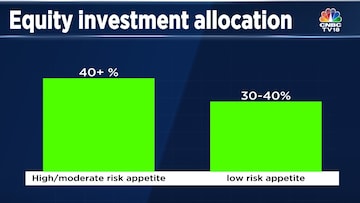

Investors with moderate/high-risk appetite can allocate a higher portion to equities, while those with lower risk tolerance should maintain a balance with debt, allocating 30-40 percent towards equities, experts say.

Choose quality mutual funds

Investors can also consider investing in quality equity mutual funds to diversify unsystematic risks. It's vital to determine the investment time horizon before selecting funds.

For those needing funds in a few months or less than a year, ultra short-term debt products are recommended. For those investing for more than 5 years, equity mutual fund schemes are a suitable choice. Many experts endorse index funds as a low-cost option for long-term investments. These funds provide a well-diversified portfolio that passively tracks an index. Young investors can have a portfolio biased towards equity due to their ability to take on more risk.

Satyen Kothari, Founder & CEO, Cube Wealth thinks age also plays a crucial factor here. He thinks that a 35-year old who already has emergency fund and insurance in place can invest ₹ 6-₹ 8 lakh in 3-4 quality equity mutual funds recommended by a reliable mutual fund advisory specialist who has a 10-year-plus track record of beating the markets.

Here's a look at key equity mutual funds and their returns:

| Scheme Name | 1-year | 3-year | 5-year | 10-year |

| DSP Natural Resources and New Energy Fund - Direct Plan - Growth Sectoral/Thematic | 32.62% | 34.02% | 17.25% | 20.09% |

| Invesco India Infrastructure Fund - Direct Plan - Growth Sectoral/Thematic | 35.54% | 38.26% | 23.99% | 22.43% |

| Nippon India Multicap Fund - Direct Plan - Growth Multi Cap Fund | 31.03% | 39.50% | 20.52% | 19.02% |

| Bank of India Manufacturing & Infrastructure Fund - Direct Plan - Growth Sectoral/Thematic | 33.73% | 35.73% | 22.97% | 19.92% |

| Sundaram Consumption Fund - Direct Plan - Growth Sectoral/Thematic | 21.97% | 24.64% | 15.90% | 18.10% |

| Nippon India Small Cap Fund - Direct Plan - Growth Small Cap Fund | 38.92% | 46.30% | 27.36% | 30.50% |

(Source: Moneycontrol)

Consider gold investments

Gold has a historical track record of consistent appreciation and serves as a valuable diversification tool within an investment portfolio. However, it's advisable to invest in gold as an asset class rather than in the form of jewelry. Gold ETFs, mutual funds, and Sovereign Gold Bonds (SGBs) are available investment options. SGBs, in particular, are a decent option as they provide liquidity, don't involve storage costs, and are easy to redeem.

Alternative investments for short-term gains

For those with short-term financial goals (up to 3 years) and wishing to earn returns greater than those offered by savings accounts or fixed deposits, Kothari suggests allocating ₹ 2 to ₹ 4 lakh to alternative assets such as Peer-to-Peer (P2P) lending and lease finance.

"These options can potentially yield returns of 10% or more," he told CNBC-TV18.com.

(Edited by : Amri)

First Published: Oct 18, 2023 1:24 PM IST

Note To Readers

Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Exclusive interview: 'Southern states will be a big surprise,' says PM Modi

May 13, 2024 9:05 PM

PM Modi's Patna visit: From serving langar to historic roadshow

May 13, 2024 5:13 PM